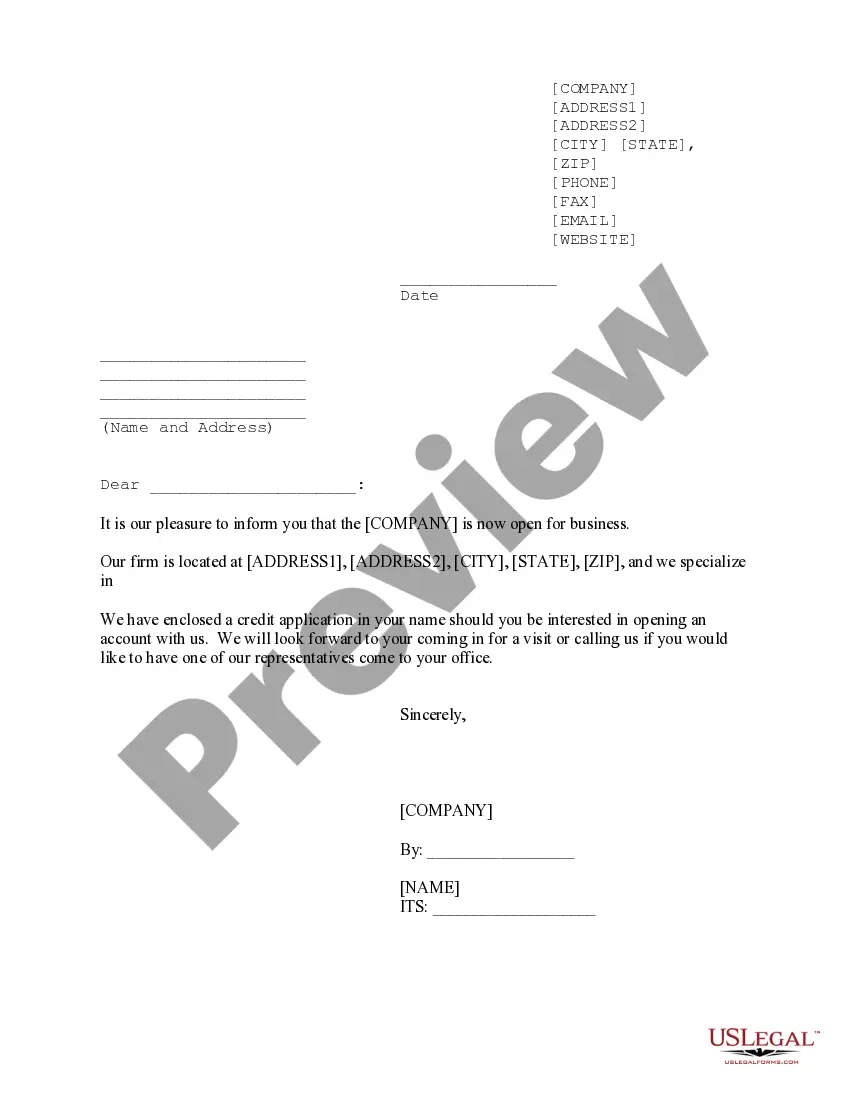

Kentucky Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal form templates that you can download or print.

Using the website, you can access countless forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Kentucky Sample Letter for New Business with Credit Application within moments.

If you already hold a subscription, Log In and download the Kentucky Sample Letter for New Business with Credit Application from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Select the format and download the form to your device.

Make changes. Fill out, modify, and print and sign the saved Kentucky Sample Letter for New Business with Credit Application. Each template you have added to your account does not have an expiration date and remains your property indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Kentucky Sample Letter for New Business with Credit Application with US Legal Forms, the most extensive library of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form summary to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find the one that does.

- Once satisfied with the form, validate your choice by clicking on the Purchase now button.

- Next, select the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Form popularity

FAQ

If you are submitting your Kentucky state tax return online, there is no need to mail a paper copy. The online filing system takes care of submission for you, allowing you to track your return status easily. Incorporating a Kentucky Sample Letter for New Business with Credit Application during this process can provide additional documentation that bolsters your application's credibility and supports your financial activities.

Yes, KY Form 725 can be filed electronically, reflecting Kentucky's commitment to making tax processes easier for businesses. E-filing reduces paperwork and speeds up processing times. To enhance your electronic filing experience, consider preparing a Kentucky Sample Letter for New Business with Credit Application. This gives a professional touch and showcases your preparedness to creditors and banks.

You should mail form 725, which is the Kentucky Corporate License Tax, to the Department of Revenue in Frankfort, Kentucky. Ensure you send it to the correct address specified on the form to avoid delays. Preparing a Kentucky Sample Letter for New Business with Credit Application could complement your filing by demonstrating your business's financial responsibility.

To file for an LLC in Kentucky, you must complete the Articles of Organization and submit them to the Secretary of State. This process requires careful attention to detail to ensure compliance with state laws. A strategic approach includes preparing a Kentucky Sample Letter for New Business with Credit Application, which can be essential for establishing banking relationships and securing initial funding.

The small business tax credit program in Kentucky supports businesses by providing tax incentives for creating and maintaining jobs. This program aims to stimulate economic growth and help new entrepreneurs thrive. Utilizing a Kentucky Sample Letter for New Business with Credit Application can facilitate funding opportunities, aligning your business with available tax credits effectively.

Yes, you can efile Kentucky state taxes through the Kentucky Department of Revenue's website. Efiling streamlines the process, making it easier to submit returns accurately and quickly. If you're a new business, consider integrating a Kentucky Sample Letter for New Business with Credit Application as part of your documentation. This helps ensure you meet all regulations and deadlines efficiently.

KY Form 725 must be filed by corporations and limited liability companies that are doing business in Kentucky. This form is also necessary for partnerships and limited partnerships that meet certain criteria. Filing this form is crucial for compliance, and having a Kentucky Sample Letter for New Business with Credit Application can assist in maintaining good standing with credit sources as you manage your obligations.

To start a business in Kentucky, begin by selecting a suitable business structure, like an LLC or corporation. After that, register your business name with the state. Additionally, you will want to prepare a Kentucky Sample Letter for New Business with Credit Application to facilitate credit arrangements and partnerships, ensuring smooth operations from the outset.

Starting a small business involves several key steps. First, you should conduct market research to identify your target audience and niche. Next, create a business plan that outlines your goals, strategies, and finances. Don’t forget to draft a Kentucky Sample Letter for New Business with Credit Application to establish solid relationships with suppliers and vendors.

To check if a name is taken for a business in Kentucky, you should conduct a name search through the Secretary of State’s online database. This resource enables you to quickly verify the availability of your chosen name. Additionally, researching local business registries can provide further clarity. If you're preparing your business documents, consider using our 'Kentucky Sample Letter for New Business with Credit Application' to present your findings and intentions effectively.