The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

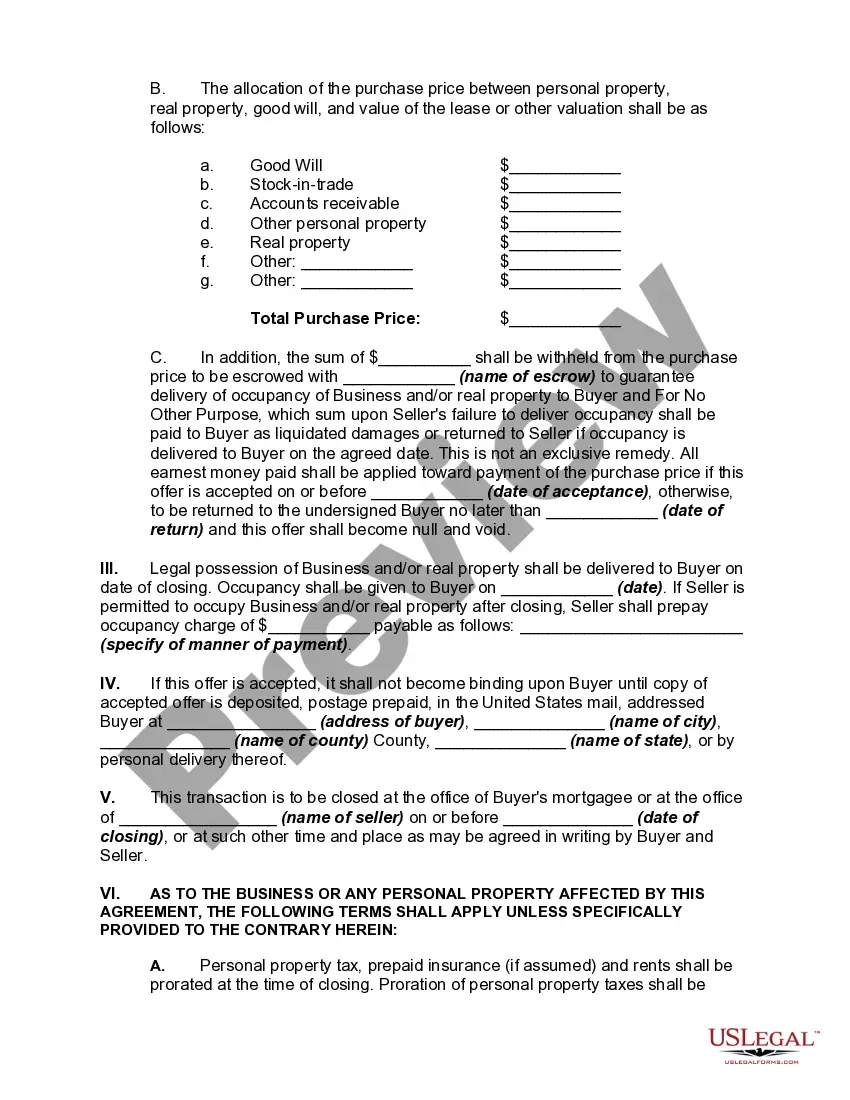

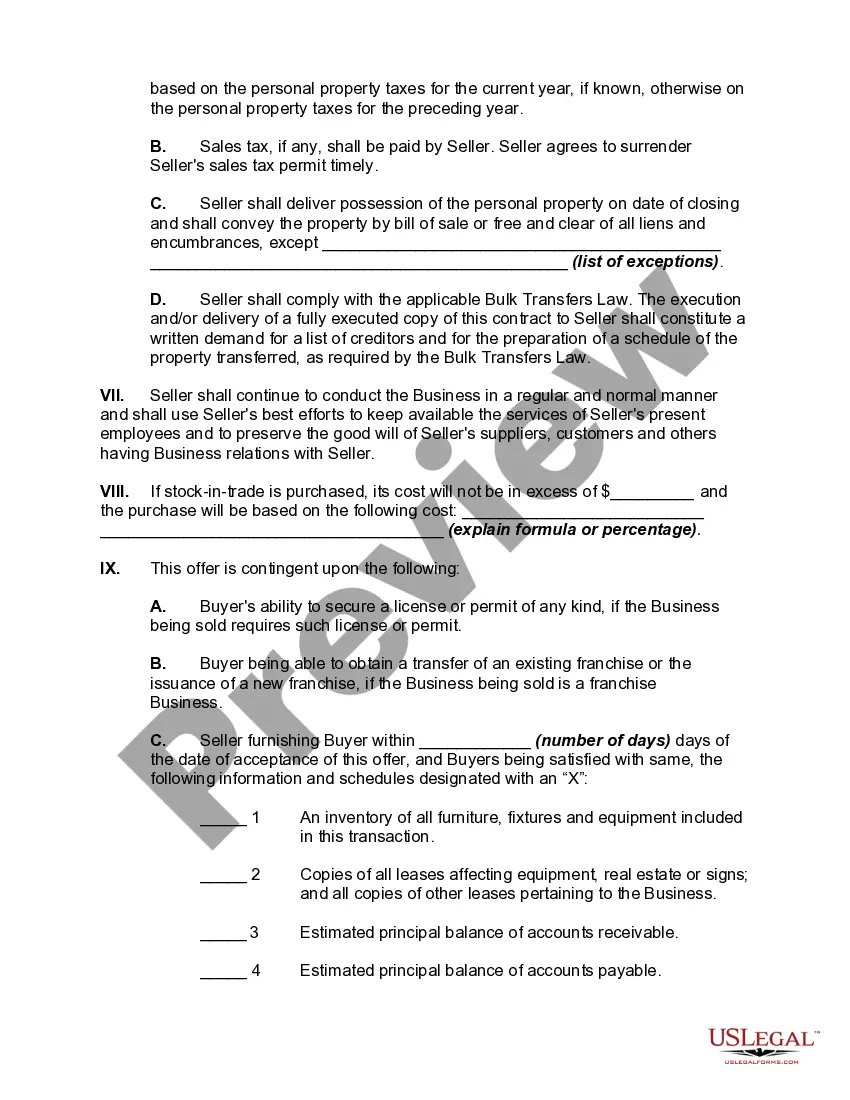

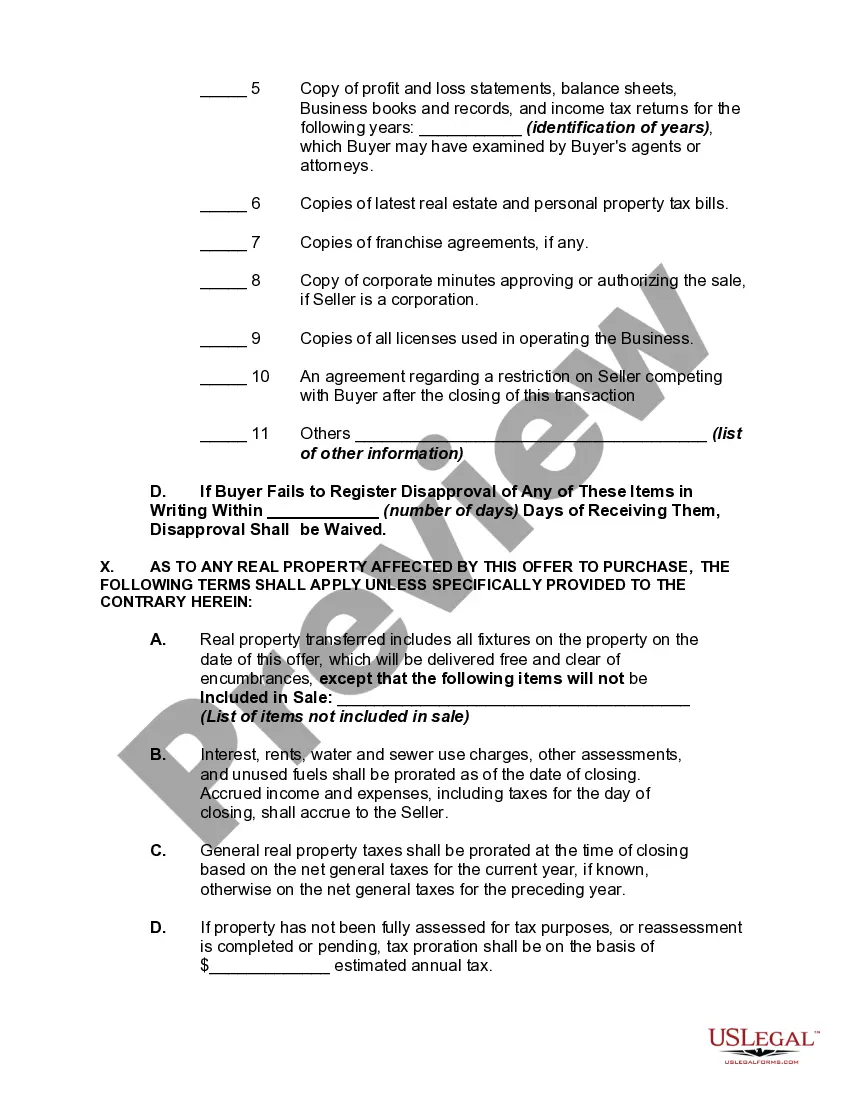

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

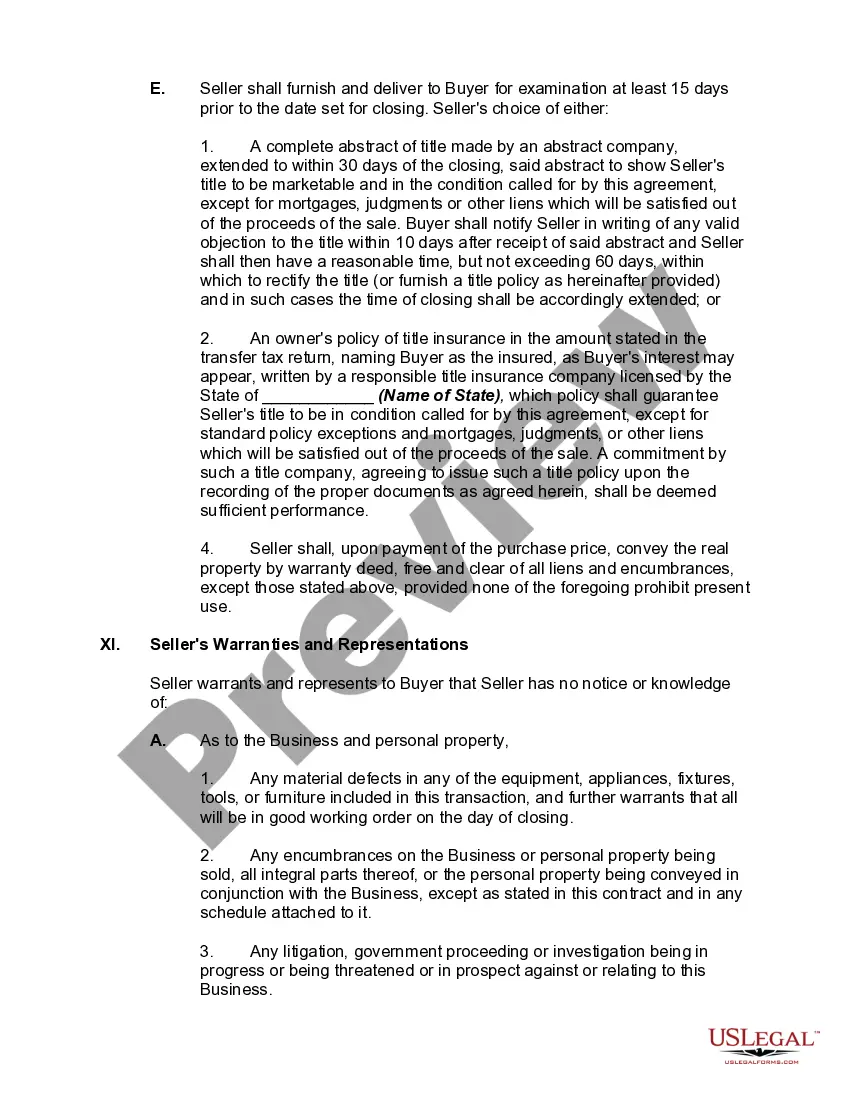

Kentucky Offer to Purchase Business, Including Good Will: A Detailed Description Introduction: The Kentucky Offer to Purchase Business, Including Good Will, is a legally binding agreement used when a party intends to acquire an existing business in the state of Kentucky. This transaction involves the purchaser acquiring not only the tangible assets but also the intangible assets of the business, including its customer base, reputation, and goodwill. This detailed description will provide an overview of the key elements, types, and considerations involved in a Kentucky Offer to Purchase Business, Including Good Will. 1. Key Elements of the Offer to Purchase: a. Parties: The agreement identifies the buyer (purchaser) and the seller (seller), making it clear who is involved in the transaction. b. Purchase Price: The agreement specifies the total amount agreed upon for the purchase, which includes the valuation of both tangible and intangible assets, such as equipment, inventory, trademarks, patents, client lists, and goodwill. c. Payment Terms: The agreement outlines the terms and conditions related to payment, including the payment method, timelines, and any contingencies or escrow arrangements. d. Assets Included: The agreement clearly specifies the assets that are part of the sale, encompassing both tangible and intangible assets related to the business's operations. e. Representations and Warranties: The agreement includes statements by the seller regarding the business's condition, ownership, legal compliance, and absence of undisclosed liabilities. f. Confidentiality: Both parties agree to maintain confidentiality about the transaction details and not disclose any sensitive information to third parties. 2. Types of Kentucky Offer to Purchase Business, Including Good Will: a. Asset Purchase Agreement: This type of agreement focuses on the acquisition of a business's assets and liabilities, including good will, rather than the purchase of stock or ownership interests. b. Stock Purchase Agreement: In contrast to an asset purchase agreement, this type involves buying the ownership interest in a company, including all its assets, liabilities, customer relationships, and goodwill. c. Merger and Acquisition Agreement: This type involves combining two or more businesses into a single entity, where the acquiring company assimilates the target company's assets, liabilities, goodwill, and customers. Considerations: a. Due Diligence: The buyer must conduct a thorough investigation of the business's financial, operational, and legal aspects before finalizing the offer, ensuring the valuation is accurate and identifying any potential risks or hidden liabilities. b. Non-Competition and Non-Solicitation Clauses: These clauses may be included to restrict the seller from engaging in similar business activities or soliciting customers and employees within a specified time and geographic area. c. Transition Assistance: The agreement may include provisions for the seller to provide transition support, such as training, customer introductions, or advisory services, facilitating a smooth transfer of ownership and goodwill. Conclusion: In Kentucky, the Offer to Purchase Business, Including Good Will, is a comprehensive legal agreement that outlines the terms and conditions of acquiring an existing business, including its tangible and intangible assets. With various types of agreements available, such as asset purchase agreements, stock purchase agreements, and merger agreements, potential buyers should carefully evaluate the specific structure that suits their needs. As with any business acquisition, conducting due diligence, incorporating non-competition clauses, and considering transition assistance are significant factors to ensure a successful purchase.Kentucky Offer to Purchase Business, Including Good Will: A Detailed Description Introduction: The Kentucky Offer to Purchase Business, Including Good Will, is a legally binding agreement used when a party intends to acquire an existing business in the state of Kentucky. This transaction involves the purchaser acquiring not only the tangible assets but also the intangible assets of the business, including its customer base, reputation, and goodwill. This detailed description will provide an overview of the key elements, types, and considerations involved in a Kentucky Offer to Purchase Business, Including Good Will. 1. Key Elements of the Offer to Purchase: a. Parties: The agreement identifies the buyer (purchaser) and the seller (seller), making it clear who is involved in the transaction. b. Purchase Price: The agreement specifies the total amount agreed upon for the purchase, which includes the valuation of both tangible and intangible assets, such as equipment, inventory, trademarks, patents, client lists, and goodwill. c. Payment Terms: The agreement outlines the terms and conditions related to payment, including the payment method, timelines, and any contingencies or escrow arrangements. d. Assets Included: The agreement clearly specifies the assets that are part of the sale, encompassing both tangible and intangible assets related to the business's operations. e. Representations and Warranties: The agreement includes statements by the seller regarding the business's condition, ownership, legal compliance, and absence of undisclosed liabilities. f. Confidentiality: Both parties agree to maintain confidentiality about the transaction details and not disclose any sensitive information to third parties. 2. Types of Kentucky Offer to Purchase Business, Including Good Will: a. Asset Purchase Agreement: This type of agreement focuses on the acquisition of a business's assets and liabilities, including good will, rather than the purchase of stock or ownership interests. b. Stock Purchase Agreement: In contrast to an asset purchase agreement, this type involves buying the ownership interest in a company, including all its assets, liabilities, customer relationships, and goodwill. c. Merger and Acquisition Agreement: This type involves combining two or more businesses into a single entity, where the acquiring company assimilates the target company's assets, liabilities, goodwill, and customers. Considerations: a. Due Diligence: The buyer must conduct a thorough investigation of the business's financial, operational, and legal aspects before finalizing the offer, ensuring the valuation is accurate and identifying any potential risks or hidden liabilities. b. Non-Competition and Non-Solicitation Clauses: These clauses may be included to restrict the seller from engaging in similar business activities or soliciting customers and employees within a specified time and geographic area. c. Transition Assistance: The agreement may include provisions for the seller to provide transition support, such as training, customer introductions, or advisory services, facilitating a smooth transfer of ownership and goodwill. Conclusion: In Kentucky, the Offer to Purchase Business, Including Good Will, is a comprehensive legal agreement that outlines the terms and conditions of acquiring an existing business, including its tangible and intangible assets. With various types of agreements available, such as asset purchase agreements, stock purchase agreements, and merger agreements, potential buyers should carefully evaluate the specific structure that suits their needs. As with any business acquisition, conducting due diligence, incorporating non-competition clauses, and considering transition assistance are significant factors to ensure a successful purchase.