Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

Are you currently in a location where you require documents for business or personal purposes on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement, designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement anytime you need. Just select the desired form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it corresponds to the correct city/state.

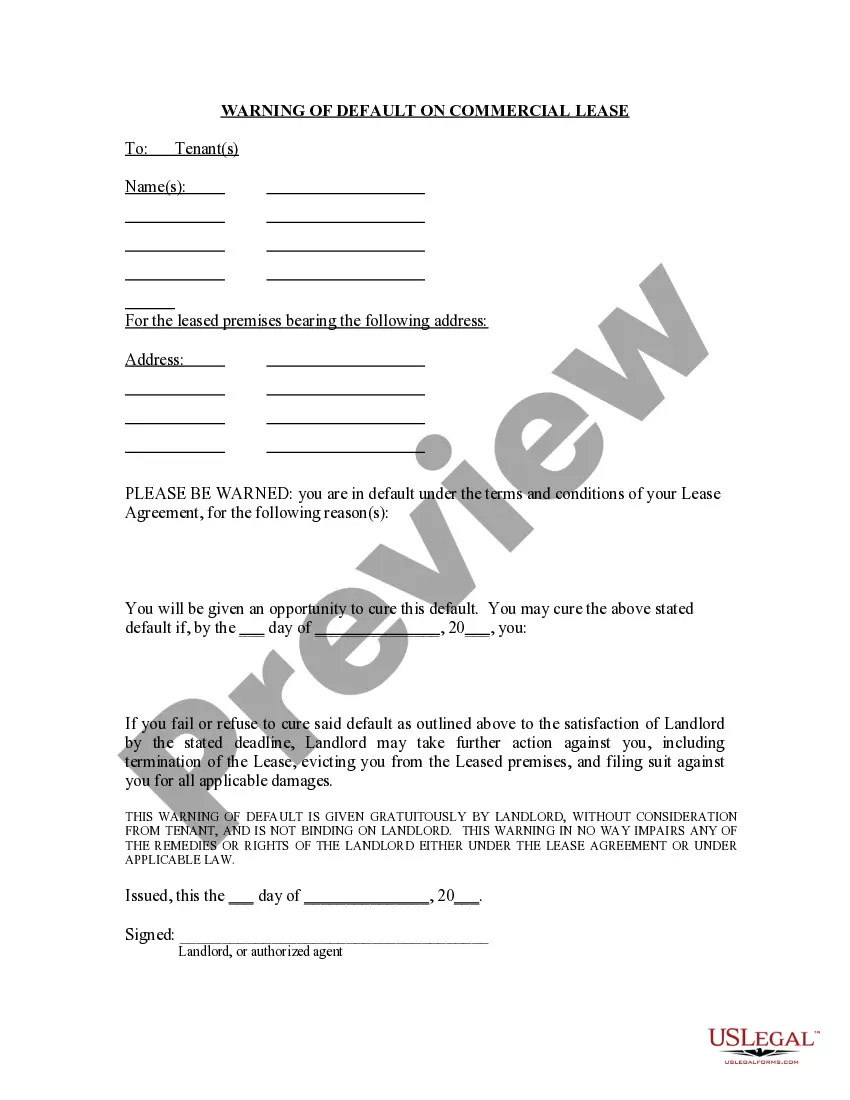

- Utilize the Review button to review the form.

- Read the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your needs and requirements.

- Once you have obtained the correct form, click on Get now.

- Select the pricing plan you require, fill out the necessary information to create your account, and purchase your order using your PayPal or credit card.

Form popularity

FAQ

The mileage rate for Kentucky is specifically tied to the guidelines set at the federal level, typically mirroring the IRS standard. This rate is an essential reference when businesses reimburse employees for vehicle expenses. Including the mileage rate in your Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement can promote transparency and equity.

While specific projections for 2025 have not yet been finalized, the mileage rate in Kentucky will likely adjust based on economic factors and fuel prices. It's crucial to monitor updates from relevant state and federal agencies. If you are forming a Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement, consider forecasting future rates for better planning.

The official mileage reimbursement rate is the amount allowed for taxpayers to use when calculating vehicle expenses for business purposes. This rate typically includes costs such as gas, wear and tear, and insurance. For anyone creating a Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement, referencing the official mileage reimbursement rate ensures clarity and accuracy in financial practices.

The Kentucky mileage reimbursement rate follows the guidelines set by the IRS, which often reflects the national average. As of now, this rate is adjusted periodically to accommodate rising transportation expenses. When drafting a Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement, it’s important to mention the specific rate applicable to stay aligned with state expectations.

The current rate per mile for vehicle expense reimbursement is set according to government standards. This rate can vary yearly, reflecting changes in fuel costs and inflation. For those preparing a Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement, it is essential to stay updated on this figure to ensure compliance and fairness in reimbursement practices.

To write reimbursement in short form, you can simply use 'reimb.' to denote the term. This abbreviation is helpful in informal communications or note-taking. However, for formal documents, such as those based on a Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement, it is best to write the full term to maintain clarity and professionalism.

When requesting reimbursement of expenses in an email, start with a subject line that clearly states your intent. In the body, briefly explain the expenses, why they were incurred, and include any necessary attachments. A Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement can offer a solid template for your email request.

To write a reimbursement note, be concise and straightforward. Start with a greeting, followed by a clear statement of what you are seeking reimbursement for, such as travel or meals. Citing specifics and referencing a Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement can provide clarity and professionalism in your note.

Writing a reimbursement form involves outlining your information coherently. Include your name, dates of travel, purpose, and a detailed list of expenses. Remember to attach relevant documentation to support your request. A Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement can serve as an excellent guide in this process.

When asking for reimbursement of travel expenses, begin with a polite introduction and specify the purpose of your travel. Clearly list the expenses incurred and attach any receipts as proof. Referring to a Kentucky Sample Letter for Policy on Vehicle Expense Reimbursement can help you format your request professionally.