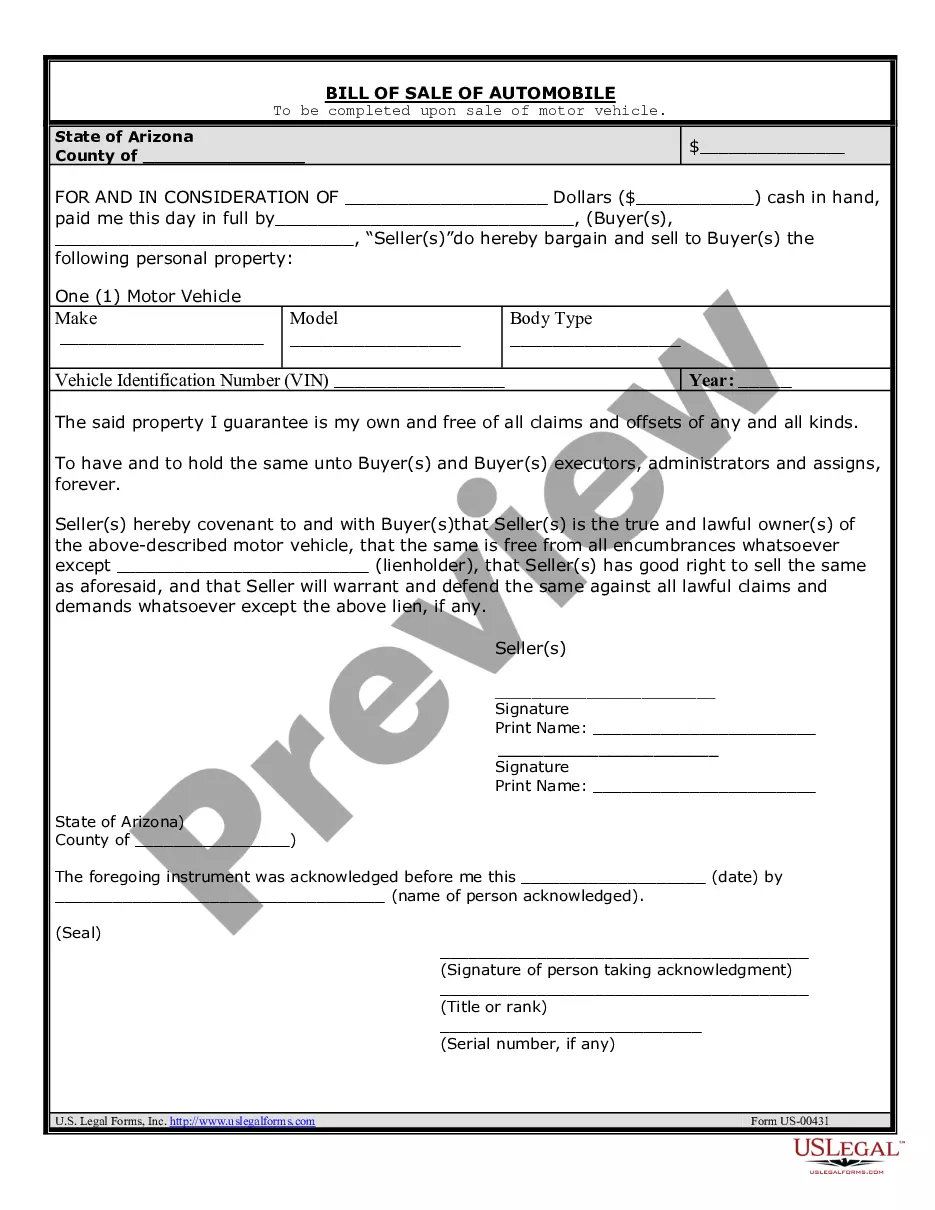

Kentucky Sample Letter for Note and Deed of Trust

Description

How to fill out Sample Letter For Note And Deed Of Trust?

It is possible to invest hours online attempting to find the authorized document template which fits the state and federal demands you will need. US Legal Forms provides 1000s of authorized kinds which can be examined by specialists. It is possible to acquire or printing the Kentucky Sample Letter for Note and Deed of Trust from my service.

If you have a US Legal Forms accounts, you can log in and click on the Down load button. Following that, you can comprehensive, revise, printing, or signal the Kentucky Sample Letter for Note and Deed of Trust. Each authorized document template you buy is your own property eternally. To get another copy of the bought form, go to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms internet site the first time, adhere to the simple guidelines listed below:

- Initially, ensure that you have chosen the right document template to the state/area of your choosing. Look at the form information to ensure you have selected the correct form. If offered, utilize the Review button to check with the document template too.

- If you wish to get another model of your form, utilize the Research discipline to find the template that meets your needs and demands.

- Once you have located the template you want, just click Buy now to carry on.

- Choose the pricing program you want, type your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You can utilize your credit card or PayPal accounts to purchase the authorized form.

- Choose the file format of your document and acquire it to your device.

- Make modifications to your document if needed. It is possible to comprehensive, revise and signal and printing Kentucky Sample Letter for Note and Deed of Trust.

Down load and printing 1000s of document layouts while using US Legal Forms site, that offers the largest selection of authorized kinds. Use specialist and express-certain layouts to handle your business or specific needs.

Form popularity

FAQ

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

An All Inclusive Trust Deed (AITD) is a new deed of trust that includes the balance due on the existing note plus new funds advanced; also known as a wrap-around mortgage. A wrap-around mortgage, more-commonly known as a ?wrap?, is a form of secondary financing for the purchase of real property.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

While most states have either mortgages or deeds of trust, there are a few states that allow you to choose which is better for you. These states include Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, and Montana.

A Promissory note with a deed of trust is like an I owe you (IOU). This is a contract that promises to repay the loan. The deed of trust is the document that secures the loan with the property in case of default.

The Deed is a recorded document memorializing the transfer of property from the Grantor to the Grantee. The Note is an unrecorded paper that binds an individual who has assumed debt through a promise-to-pay instrument.