Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Resolution Selecting Depository Bank For Corporation And Account Signatories?

Are you currently in a location where you frequently require documents for both business or personal reasons on a daily basis.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories, designed to comply with state and federal regulations.

Once you find the right form, just click Purchase now.

Select the payment plan you want, provide the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/state.

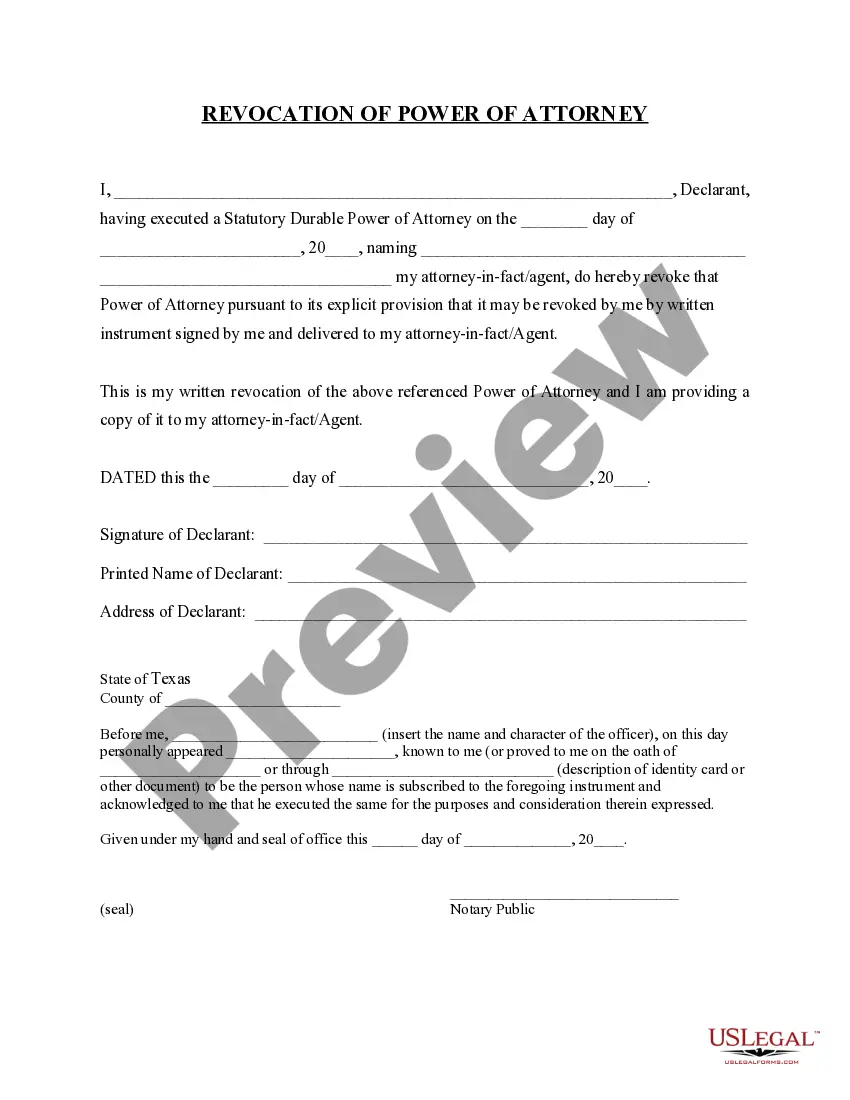

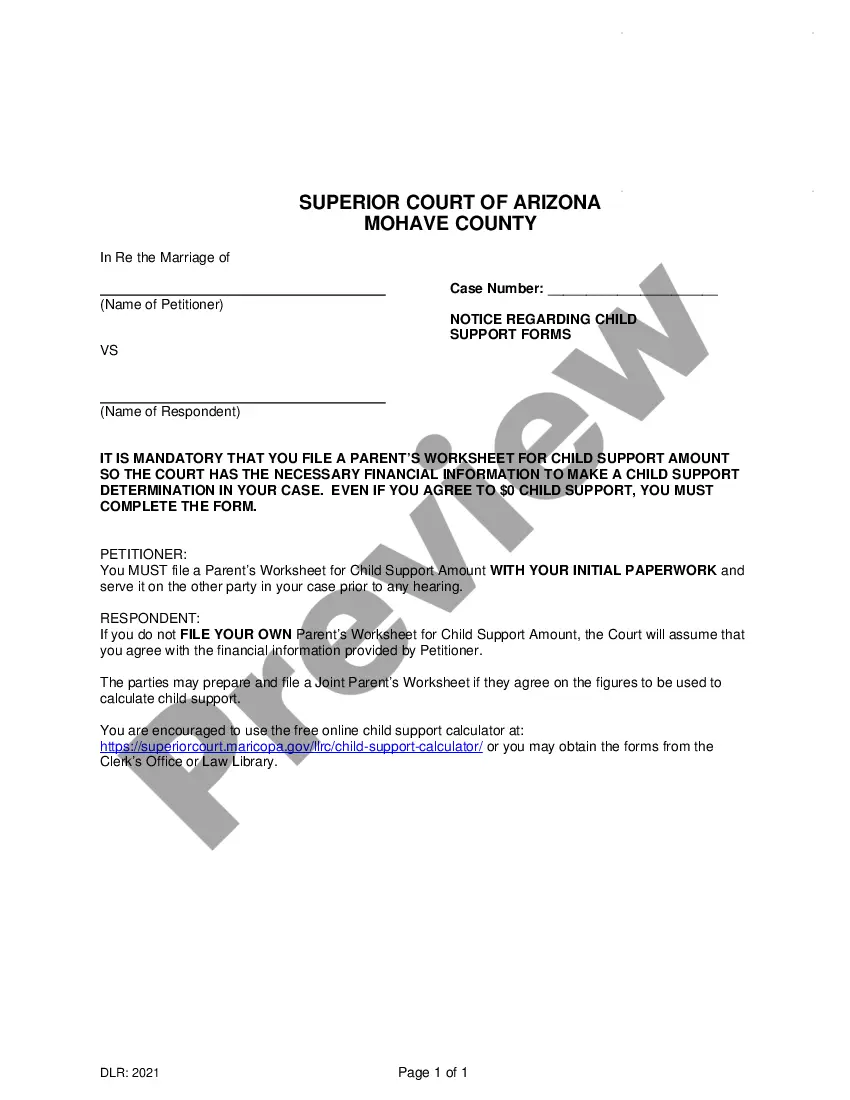

- Utilize the Review button to examine the form.

- Read the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

Writing a resolution document involves outlining the intent clearly and ensuring all essential details are included, such as the corporation's name, action items, and signatory names. Use straightforward language to express what is being authorized, and ensure that the resolution is signed by the appropriate officials. For a complete guide and templates, look into our resources on Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories.

To fill out a banking resolution, start by detailing the corporation's name and the purpose of the resolution. Specify the names of authorized signers and their respective roles. Make sure to also include the bank's name and account details as necessary. For ease and accuracy, consider using a template specifically designed for Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories available on our platform.

A resolution typically starts with a clear title that states the subject matter, followed by a statement of authority and intent. The body outlines the specific action to be taken, along with any required details such as dates and signatures. Using the correct format is important, especially in the context of Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories, where clarity is essential.

Filling out a corporate resolution form requires you to clearly state the resolution’s purpose, identify the corporation, and provide the names of signatories who are authorized to act on behalf of the company. Include dates and any pertinent corporate details. For assistance in completing your form correctly, check out the user-friendly resources on our platform related to Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories.

A corporate resolution to add a signer to a bank account is a formal document that authorizes a new individual to have signing authority on the account. It includes details such as the names of existing and new signers and specifies the account information. This document is crucial for maintaining proper business banking practices, especially in your Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories.

Writing a corporate resolution for an LLC involves clearly identifying the company and specifying the action being authorized. Provide details on the decision, including any necessary bank or account information. Additionally, ensure that all relevant members agree and sign the document. Our platform offers guidance and templates for your Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories.

To fill out a resolution form effectively, start by clearly stating the purpose of the resolution. Include the name of the corporation and the specific action to be taken, such as selecting a depository bank. Make sure to include the names and signatures of authorized signatories. Utilizing our platform, you can easily access templates tailored for your needs in Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories.

To write a resolution letter for changing bank signatories, begin by outlining the purpose of the resolution clearly and succinctly. Include essential details such as the names of the current signers, new signers, and any relevant account information. Utilizing a service like US Legal Forms can provide you with templates designed specifically for the Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories, making it easier to draft an effective document that meets legal requirements.

A corporate resolution identifying authorized signers is a formal document that specifies who has the authority to act on behalf of a corporation in financial matters. This resolution is crucial for the Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories, as it ensures that only designated individuals can access bank accounts and manage corporate funds. By clearly defining the authorized signers, companies can prevent unauthorized access and maintain control over their financial transactions.

A corporate banking resolution is a specific type of corporate resolution that authorizes certain individuals to conduct banking transactions on behalf of the corporation. This document outlines the powers vested in these individuals, allowing for streamlined banking operations. When implementing the Kentucky Resolution Selecting Depository Bank for Corporation and Account Signatories, having a clear corporate banking resolution can enhance efficiency in managing the corporation's financial activities.