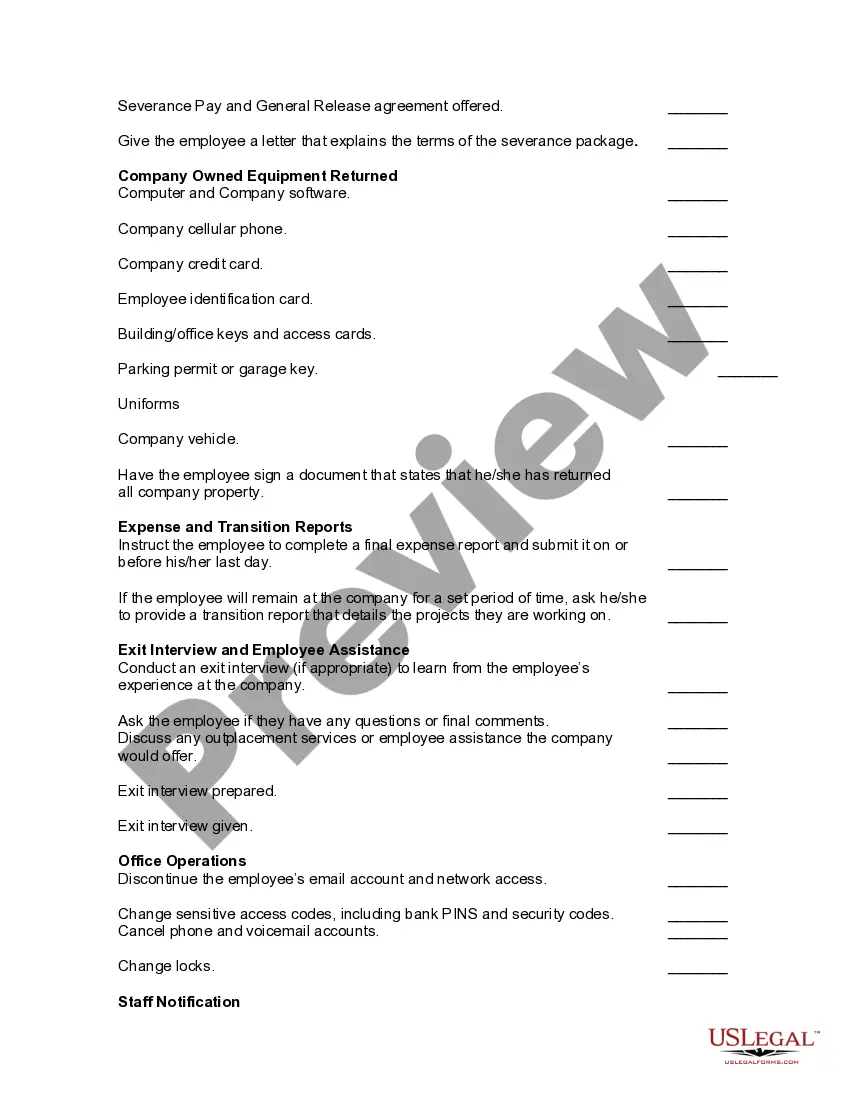

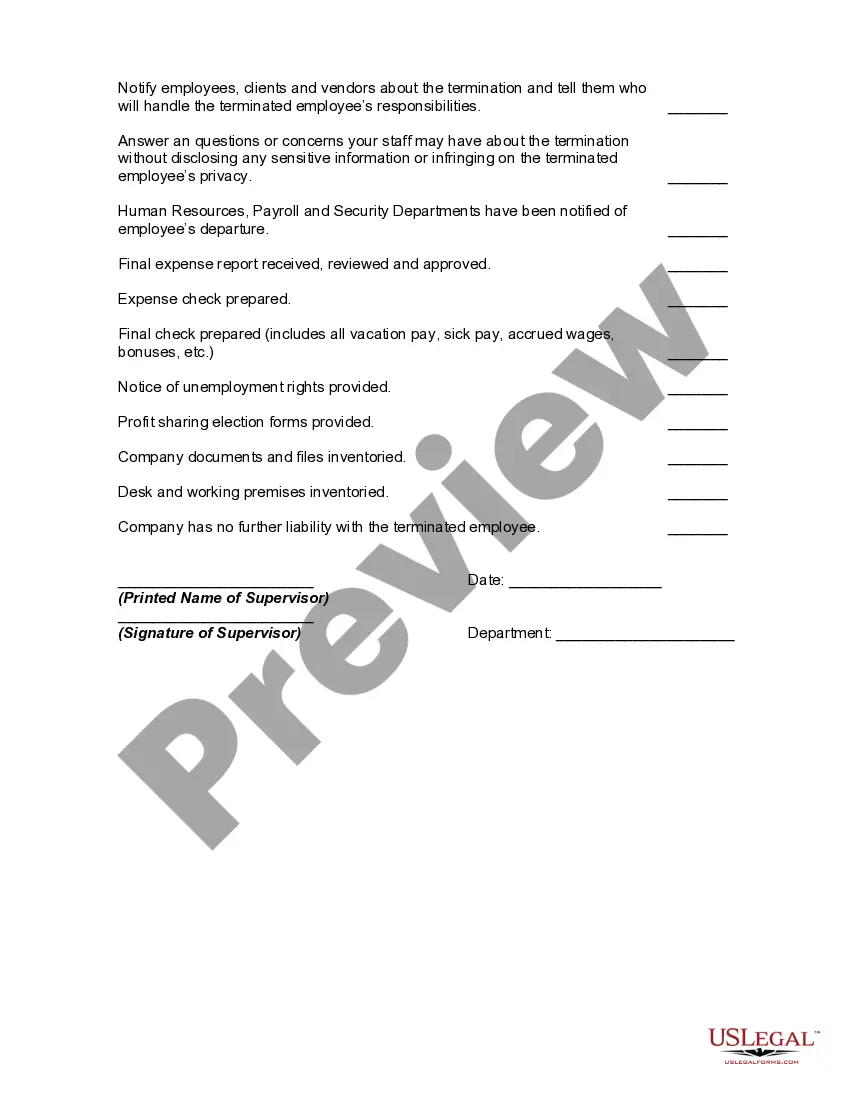

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Kentucky Worksheet — Termination of Employment is a comprehensive document designed to assist employers and employees in the state of Kentucky when terminating employment. This worksheet covers various aspects related to the termination process, ensuring legal compliance and fair treatment of both parties involved. It provides a structured format to help navigate through all essential information and obligations, streamlining the termination process for smoother transitions. Key topics covered in the Kentucky Worksheet — Termination of Employment include: 1. Notice Periods: This section outlines the required notice periods for both employers and employees when terminating employment. It specifies the duration of notice required based on the length of employment, ensuring adherence to Kentucky labor laws. 2. Severance and Final Payments: This section provides guidance on severance pay, if applicable, as well as the calculation and distribution of final payments such as wages, accrued vacation, bonuses, and other benefits. It clarifies the legal requirements to ensure employees receive their entitled compensation promptly. 3. Employee Benefits: This segment explains the impact of termination on employee benefits such as health insurance, retirement plans, and other perks. It provides guidance on COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation rights, allowing former employees to maintain their health coverage temporarily. 4. Return of Company Property: This section outlines the procedures for employees to return any company property, including but not limited to uniforms, equipment, keys, badges, and confidential information. It emphasizes the importance of safeguarding company assets and maintaining confidentiality even after termination. 5. Unemployment Benefits: This segment provides information about unemployment benefits available to employees after termination. It explains the eligibility criteria, application process, and potential forms of disqualification. It aims to assist employees in understanding their rights and obligations to navigate the unemployment benefits system effectively. Different types of Kentucky Worksheets — Termination of Employment may include variations based on specific circumstances, such as: 1. Voluntary Resignation Worksheet: Covers situations where an employee voluntarily resigns from their position, outlining the necessary steps for a smooth exit and addressing any outstanding matters, such as return of company property and final payments. 2. Involuntary Termination Worksheet: Focuses on terminations initiated by the employer, providing guidelines for compliance with legal requirements and ensuring fair treatment of the employee during the process. 3. Layoff or Reduction in Force Worksheet: Specifically designed for situations where employers need to downsize or eliminate positions due to business reasons, this worksheet covers topics such as severance packages, notification periods, and assistance with job searches or retraining programs. These Kentucky Worksheets — Termination of Employment are essential tools for employers and HR professionals, ensuring they act in accordance with Kentucky labor laws and best practices while maintaining transparency and respecting employees' rights during the termination process.