In most states, the process for forming a nonprofit corporation is different from the process for forming a for-profit corporation. A nonprofit corporation must file additional documentation with state and federal authorities to be recognized and obtain the advantages of nonprofit status. You can complete and file the paperwork yourself, or use an online document preparation website. Recognition as a nonprofit corporation confers three main advantages: tax breaks for the corporation, tax breaks for donors, and the legal right to solicit donations. In most states, nonprofit corporations are governed by the Model Nonprofit Corporation Act.

Kentucky Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association

Description

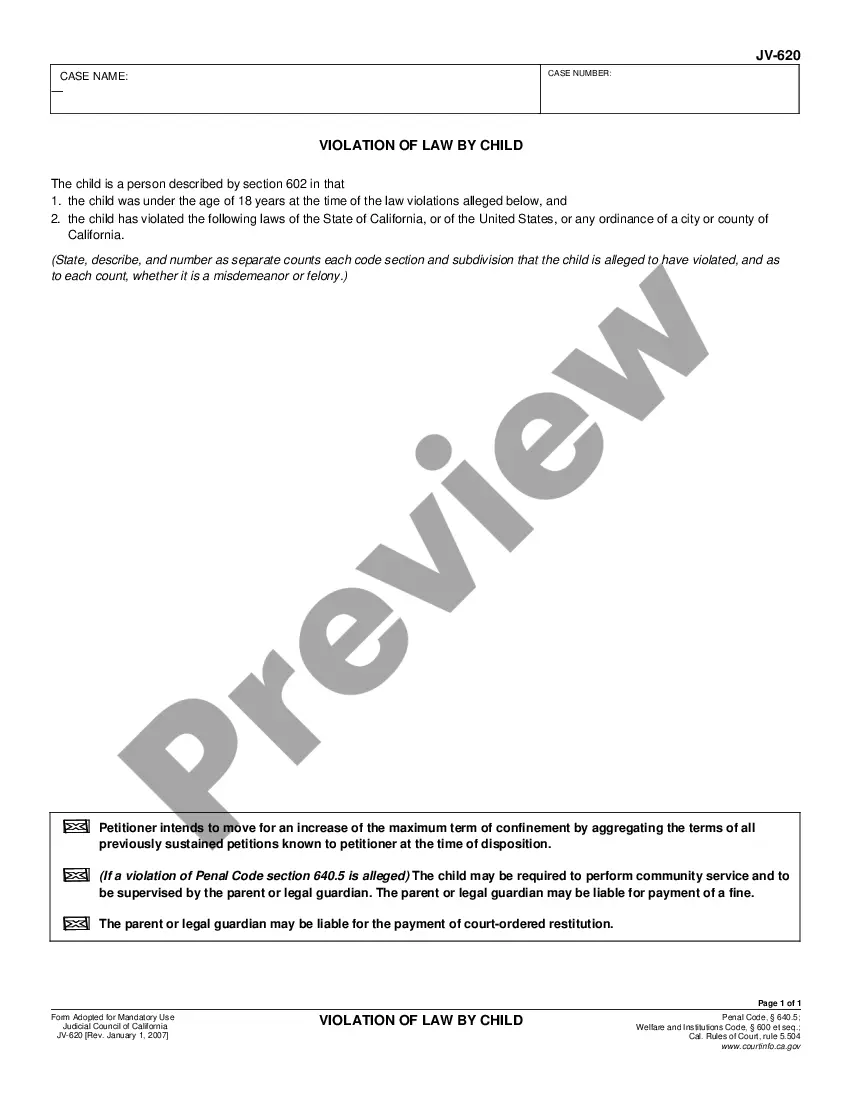

How to fill out Resolution To Incorporate ASCAP Nonprofit Corporation By Members Of Unincorporated Association?

If you need to complete, obtain, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the Kentucky Resolution to Establish ASCAP Nonprofit Corporation by Members of an Unincorporated Association with just a few clicks.

Every legal document template you receive is yours indefinitely. You have access to all forms you obtained within your account. Browse the My documents section and select a template to print or download again.

Stay competitive and obtain, and print the Kentucky Resolution to Establish ASCAP Nonprofit Corporation by Members of an Unincorporated Association with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and then click the Download button to get the Kentucky Resolution to Establish ASCAP Nonprofit Corporation by Members of an Unincorporated Association.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the correct form for your specific region/state.

- Step 2. Use the Review function to check the form's details. Remember to verify the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to look for other variations of the legal document design.

- Step 4. After finding the form you want, click the Acquire now button. Choose the payment option you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, revise, and print or sign the Kentucky Resolution to Establish ASCAP Nonprofit Corporation by Members of an Unincorporated Association.

Form popularity

FAQ

To write articles of incorporation for a nonprofit, start by including the organization's name and purpose. Clearly state that the organization is formed under Kentucky law, outline the management structure, and provide details regarding the distribution of assets upon dissolution. Engaging with platforms like uslegalforms can simplify the process for those pursuing a Kentucky Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association.

The organizing documents for a nonprofit organization typically include articles of incorporation, bylaws, and meeting minutes. These documents serve as the foundation for how the organization will operate and outline member responsibilities and governance. For those considering a Kentucky Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, these documents ensure that the nonprofit runs smoothly and effectively.