Kentucky Time Sheet Instructions provide detailed guidelines on how to accurately record and report working hours for employees in the state of Kentucky. These instructions ensure compliance with state labor laws and are essential for employers and employees alike to maintain accurate payroll records. Here are some relevant keywords that can be used in the content: 1. Kentucky Time Sheet: This refers to the form or document used by employers to record and track employee working hours. 2. Timekeeping: It encompasses the process of capturing employee work hours, including clock-in and clock-out times, breaks, and overtime. 3. FLEA Regulations: The Kentucky Time Sheet Instructions may outline the Fair Labor Standards Act (FLEA) regulations that govern minimum wage, overtime pay, and related record-keeping requirements. 4. Employee Classification: Instructions may specify how different types of employees should complete their time sheets, such as full-time, part-time, temporary, or exempt employees. 5. Daily, Weekly, or Biweekly Time Sheets: Depending on the employer's pay periods, time sheets may need to be filled out daily, weekly, or biweekly. The instructions should clarify the correct frequency. 6. Record Keeping: Detailed instructions on how to accurately record and maintain time sheet records, including the required information like employee name, job title, date, start and end times, and meal breaks. 7. Overtime Calculation: Instructions may provide guidance on how to calculate and report overtime hours worked, as well as any additional pay rates and overtime premium that may apply. 8. Breaks and Meal Periods: Specific instructions for correctly documenting and tracking breaks and meal periods to ensure compliance with Kentucky labor laws. 9. Reporting and Submission: Instructions on when and how completed time sheets should be submitted to the employer, including any digital platforms or specific software requirements. 10. Compliance and Penalties: The importance of compliance with time sheet instructions and potential penalties for inaccurate or fraudulent time reporting. By following Kentucky Time Sheet Instructions, employers can ensure accurate payroll and avoid any legal issues related to wage and hour violations. Employees can also utilize these instructions to understand proper timekeeping practices and ensure they are compensated fairly for their work.

Kentucky Time Sheet Instructions

Description

How to fill out Kentucky Time Sheet Instructions?

It is possible to devote hours online looking for the legitimate record web template that fits the state and federal needs you need. US Legal Forms provides a huge number of legitimate types which are reviewed by professionals. It is possible to acquire or print out the Kentucky Time Sheet Instructions from your assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Down load key. Afterward, it is possible to complete, revise, print out, or signal the Kentucky Time Sheet Instructions. Each and every legitimate record web template you buy is yours for a long time. To have another duplicate of the obtained kind, proceed to the My Forms tab and then click the related key.

If you work with the US Legal Forms internet site for the first time, stick to the straightforward directions below:

- Initially, make certain you have chosen the correct record web template for the county/area of your choosing. See the kind explanation to make sure you have picked the appropriate kind. If accessible, utilize the Preview key to search throughout the record web template at the same time.

- If you want to find another edition of your kind, utilize the Lookup field to discover the web template that fits your needs and needs.

- After you have located the web template you need, simply click Get now to proceed.

- Choose the costs plan you need, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal bank account to fund the legitimate kind.

- Choose the structure of your record and acquire it in your device.

- Make modifications in your record if necessary. It is possible to complete, revise and signal and print out Kentucky Time Sheet Instructions.

Down load and print out a huge number of record themes utilizing the US Legal Forms web site, which offers the most important variety of legitimate types. Use skilled and condition-particular themes to handle your business or personal demands.

Form popularity

FAQ

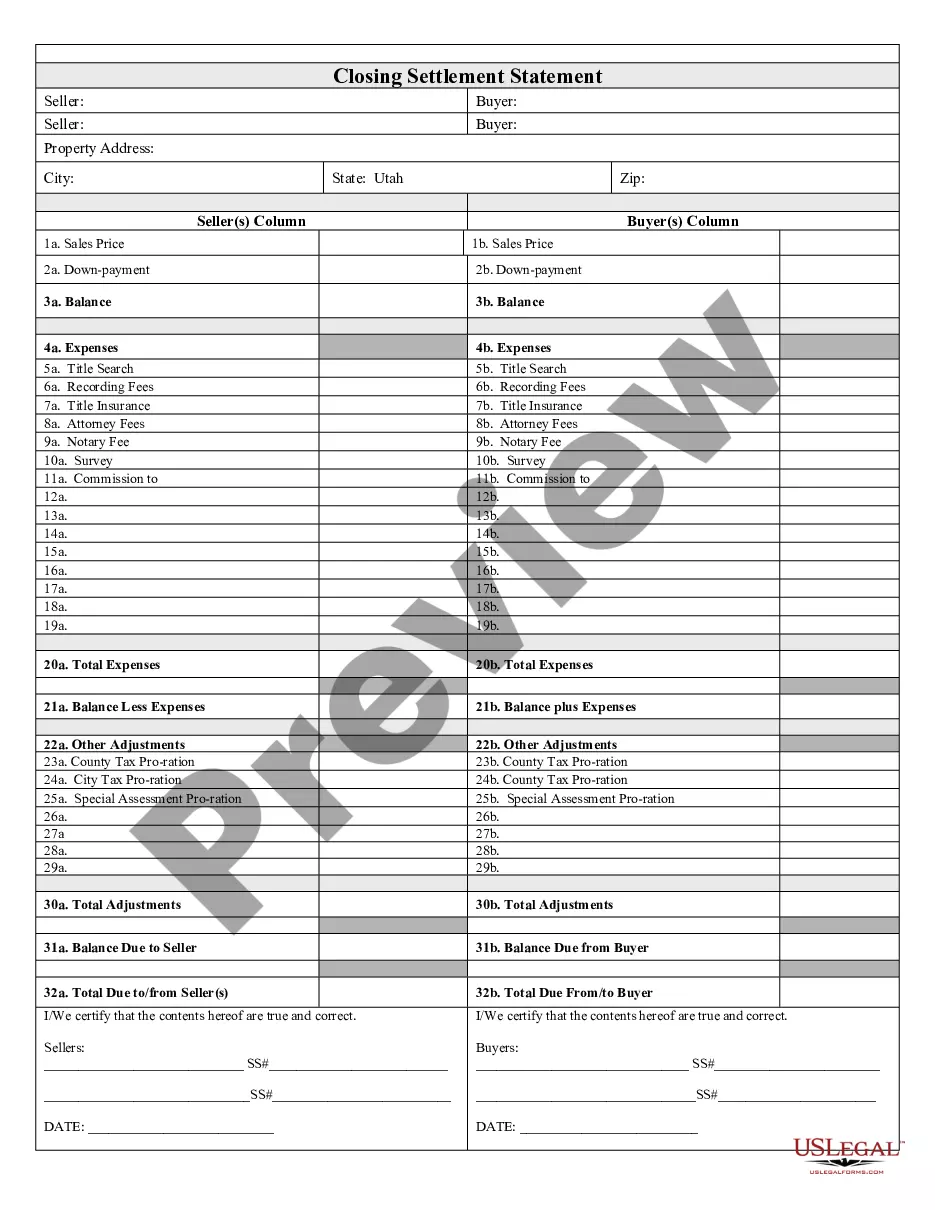

A timesheet is a data table which an employer can use to track the time a particular employee has worked during a certain period. Businesses use timesheets to record time spent on tasks, projects, or clients.

Companies use timesheets to determine an employee's pay for a given period. For example, a weekly timesheet would calculate how much income an employee earned in a given week given the amount of time they spent working in that time period.

A timesheet is a data table which an employer can use to track the time a particular employee has worked during a certain period. Businesses use timesheets to record time spent on tasks, projects, or clients.

How to Fill Out a Timesheet (Step-by-Step Guide)Step 1: Enter the Employee Name.Step 2: Add the Date or Date Range.Step 3: Fill in the Project and Task Details.Step 4: Add Working Hours for Each Day of the Week.Step 5: Calculate the Total Hours.Step 6: Add Notes if Required.Step 7: Get Approval.

Information included on timesheetsEmployee's name.Pay period.Date worked.Day worked.Hours worked.Total workweek hours.

How to Fill Out a Timesheet (Step-by-Step Guide)Step 1: Enter the Employee Name.Step 2: Add the Date or Date Range.Step 3: Fill in the Project and Task Details.Step 4: Add Working Hours for Each Day of the Week.Step 5: Calculate the Total Hours.Step 6: Add Notes if Required.Step 7: Get Approval.