Kentucky Loan Agreement for Family Member

Description

How to fill out Loan Agreement For Family Member?

Are you in a place that you require files for both organization or specific uses nearly every day time? There are a variety of authorized document themes available on the net, but finding versions you can trust isn`t straightforward. US Legal Forms provides a large number of type themes, just like the Kentucky Loan Agreement for Family Member, which can be composed to meet federal and state needs.

Should you be already acquainted with US Legal Forms web site and have an account, simply log in. Next, it is possible to acquire the Kentucky Loan Agreement for Family Member template.

Should you not have an profile and would like to begin using US Legal Forms, adopt these measures:

- Get the type you require and make sure it is to the appropriate town/region.

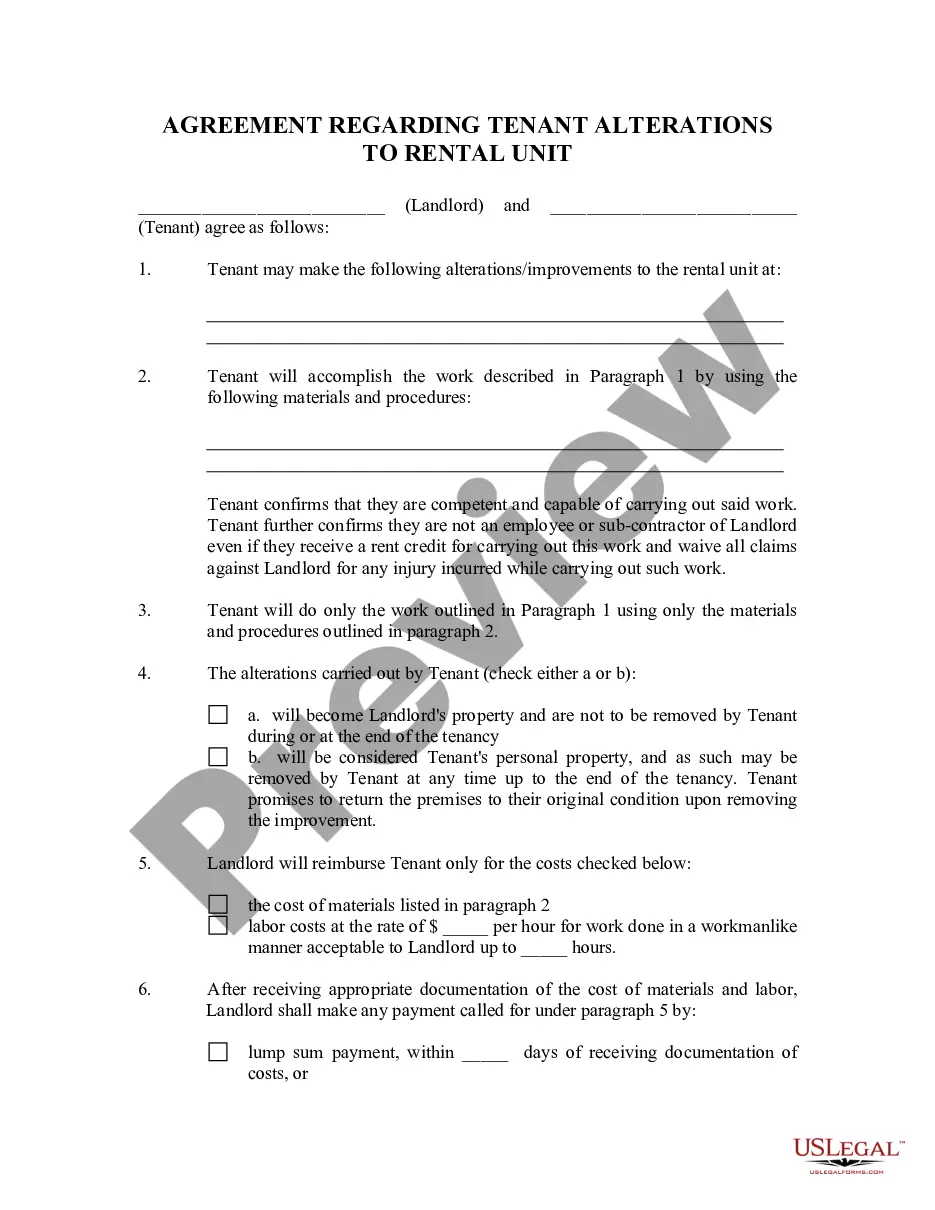

- Make use of the Review button to analyze the shape.

- See the explanation to actually have selected the proper type.

- In the event the type isn`t what you are trying to find, use the Search field to obtain the type that fits your needs and needs.

- Once you get the appropriate type, simply click Buy now.

- Select the pricing prepare you want, submit the necessary information to make your bank account, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Choose a handy data file format and acquire your duplicate.

Find each of the document themes you may have purchased in the My Forms food list. You can obtain a extra duplicate of Kentucky Loan Agreement for Family Member any time, if possible. Just select the needed type to acquire or printing the document template.

Use US Legal Forms, one of the most considerable collection of authorized types, to save lots of time as well as steer clear of faults. The support provides skillfully made authorized document themes which can be used for a variety of uses. Generate an account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

The IRS mandates that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate.

Once executed a loan agreement will be legally binding and in effect.

If you have the means, lending to friends and family can be a convenient way to help out loved ones. In particular, it's very common to help them with a big financial expense, such as a wedding or buying a house.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

Draw Up a Loan Agreement Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

A family loan, sometimes called an intra-family loan, is a loan between family members. Family loans are often less formal than personal loans from traditional lenders or in the peer-to-peer (P2P) marketplace, which connects potential investors directly to borrowers.