Kentucky Loan Agreement for Property

Description

How to fill out Loan Agreement For Property?

Have you been in a position the place you require paperwork for either company or personal purposes just about every day? There are a variety of legal file templates available online, but getting types you can rely on is not simple. US Legal Forms provides 1000s of develop templates, much like the Kentucky Loan Agreement for Property, which are composed to meet federal and state specifications.

In case you are previously knowledgeable about US Legal Forms web site and also have a merchant account, merely log in. Afterward, it is possible to acquire the Kentucky Loan Agreement for Property design.

Should you not offer an bank account and would like to start using US Legal Forms, follow these steps:

- Get the develop you want and make sure it is for your right area/area.

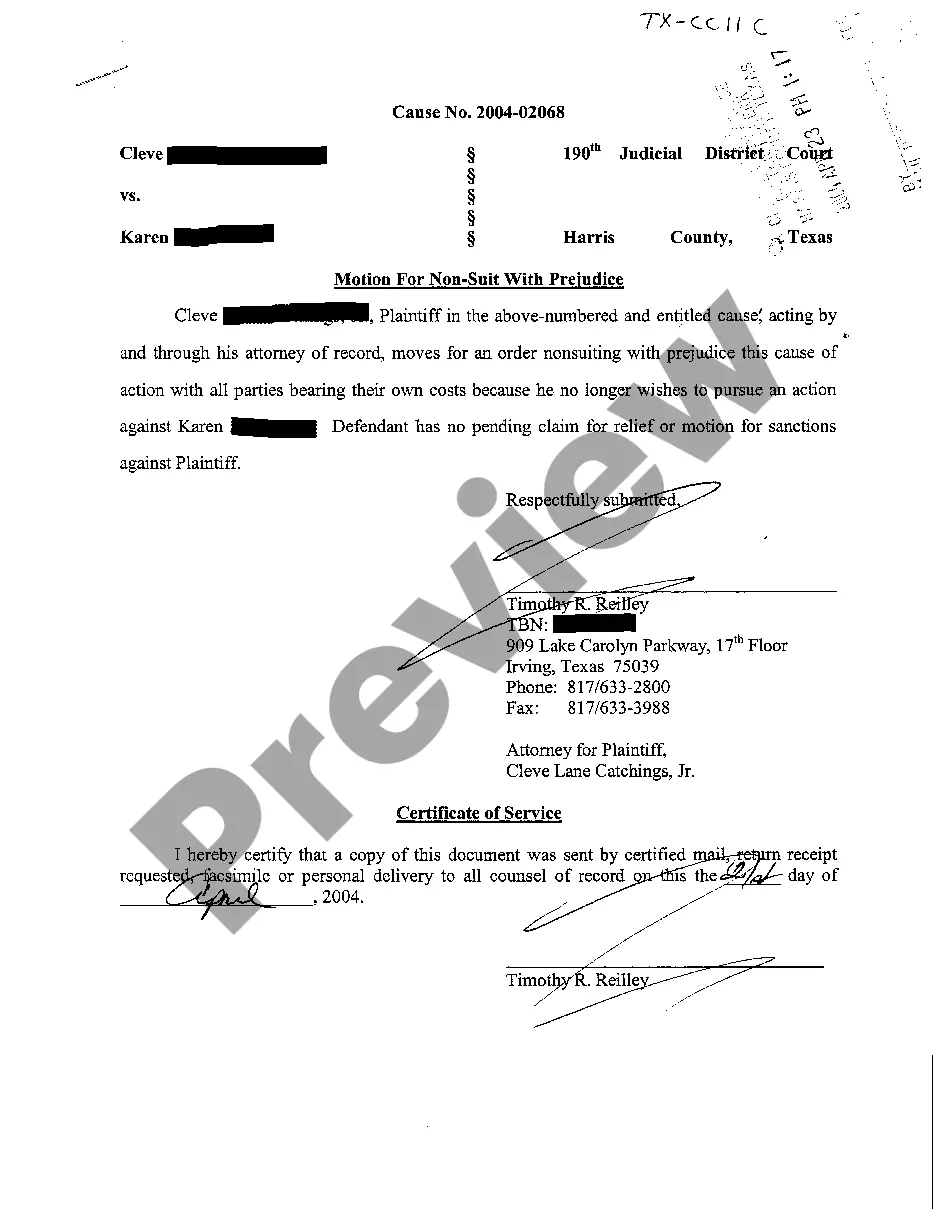

- Take advantage of the Preview button to examine the form.

- Browse the information to actually have selected the appropriate develop.

- In case the develop is not what you are seeking, take advantage of the Search area to get the develop that suits you and specifications.

- When you discover the right develop, just click Purchase now.

- Choose the prices program you would like, fill out the specified details to create your account, and purchase the transaction with your PayPal or charge card.

- Decide on a practical file format and acquire your duplicate.

Find every one of the file templates you may have purchased in the My Forms menu. You can aquire a extra duplicate of Kentucky Loan Agreement for Property anytime, if required. Just select the required develop to acquire or print the file design.

Use US Legal Forms, the most extensive variety of legal types, to save efforts and avoid blunders. The services provides appropriately manufactured legal file templates that you can use for a variety of purposes. Create a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

The purpose for which funds may be used. Loan funding mechanics, and applicable interest. Repayment obligations. Representations, warranties and undertakings.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.