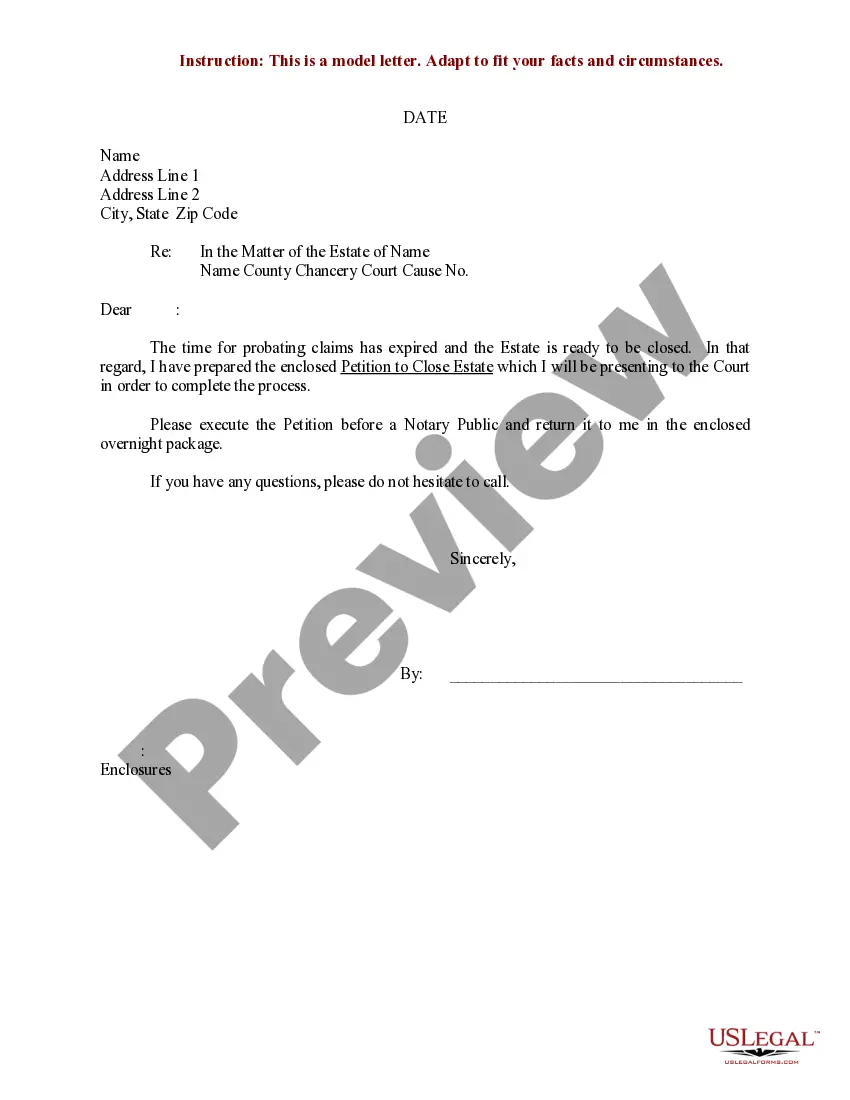

Kentucky Sample Letter for Closing of Estate - Request to Execute

Description

How to fill out Sample Letter For Closing Of Estate - Request To Execute?

Finding the right lawful papers design can be a battle. Needless to say, there are a lot of templates available online, but how will you obtain the lawful kind you require? Use the US Legal Forms internet site. The assistance offers 1000s of templates, including the Kentucky Sample Letter for Closing of Estate - Request to Execute, which you can use for organization and private requires. All the forms are checked by professionals and fulfill state and federal demands.

When you are previously signed up, log in for your bank account and click the Obtain switch to get the Kentucky Sample Letter for Closing of Estate - Request to Execute. Make use of your bank account to check through the lawful forms you might have acquired previously. Go to the My Forms tab of your respective bank account and acquire yet another copy in the papers you require.

When you are a brand new end user of US Legal Forms, listed below are straightforward directions that you should follow:

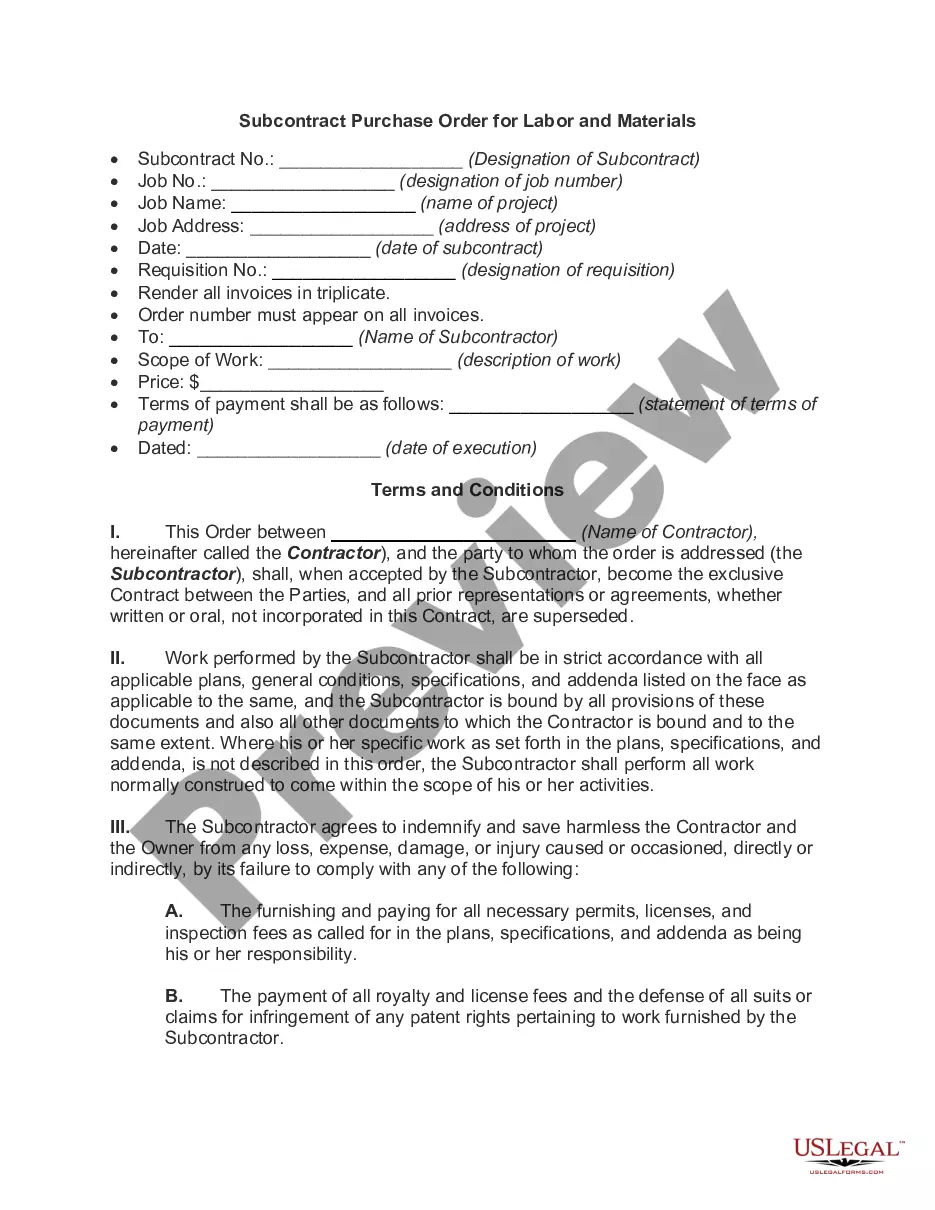

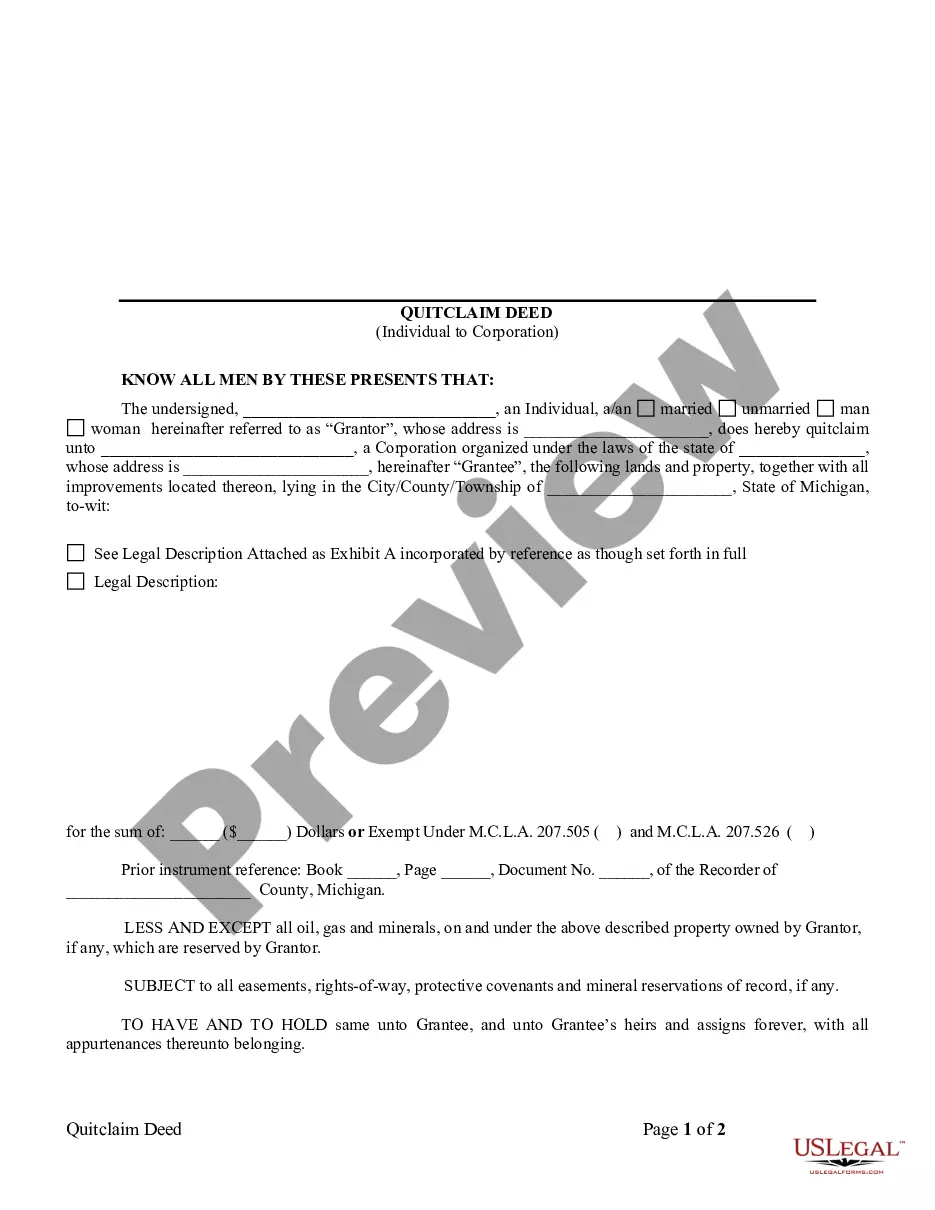

- First, ensure you have chosen the appropriate kind for your metropolis/county. You are able to check out the shape while using Review switch and read the shape information to guarantee it will be the best for you.

- In the event the kind is not going to fulfill your needs, take advantage of the Seach discipline to get the correct kind.

- When you are positive that the shape is acceptable, click on the Get now switch to get the kind.

- Opt for the costs plan you would like and enter in the necessary information and facts. Create your bank account and pay for the order with your PayPal bank account or bank card.

- Pick the submit structure and obtain the lawful papers design for your device.

- Total, edit and produce and sign the attained Kentucky Sample Letter for Closing of Estate - Request to Execute.

US Legal Forms may be the biggest collection of lawful forms for which you can find numerous papers templates. Use the company to obtain expertly-created paperwork that follow state demands.

Form popularity

FAQ

Settling the Estate After paying the debts and any income and death taxes owed by the estate, and after distributing any remaining assets of the estate to the heirs, the personal representative must prepare and file a final settlement with the District Court using form AOC-846. KRS §§395.190, 395.510.

Statute of Limitations by State Statute of Limitations by State (in years)Kentucky55Louisiana103Maine66Maryland3350 more rows ?

Filing Independently Download Kentucky's Form AOC-830. Locate the decedent's will and collect information regarding the estate's debts and assets. Fill out Form AOC-830. Get the form notarized ? if there are multiple surviving children who are filing, they must all swear and sign the petition before a notary.

Upon your death, unsecured debts such as credit card debt, personal loans and medical debt are typically discharged or covered by the estate. They don't pass to surviving family members. Federal student loans and most Parent PLUS loans are also discharged upon the borrower's death.

Although there is no statute that requires an estate to stay open for any particular length of time, estates generally do have to stay open for a minimum of six months. This is because KRS Chapter 396 states that creditors of estates have six months to file claims.

All creditors that wish to be paid from the estate are required to file a claims against the estate within 180 days (6 months) from the date the personal representative is appointed. Valid debts can be paid after the six months are up.

California law does allow creditors to pursue a decedent's potentially inheritable assets. In the event an estate does not possess or contain adequate assets to fulfill a valid creditor claim, creditors can look to assets in which heirs might possess interest, if: The assets are joint accounts.

If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.