Kentucky Sample Letter for Closing of Estate with Breakdown of Assets and Expenses

Description

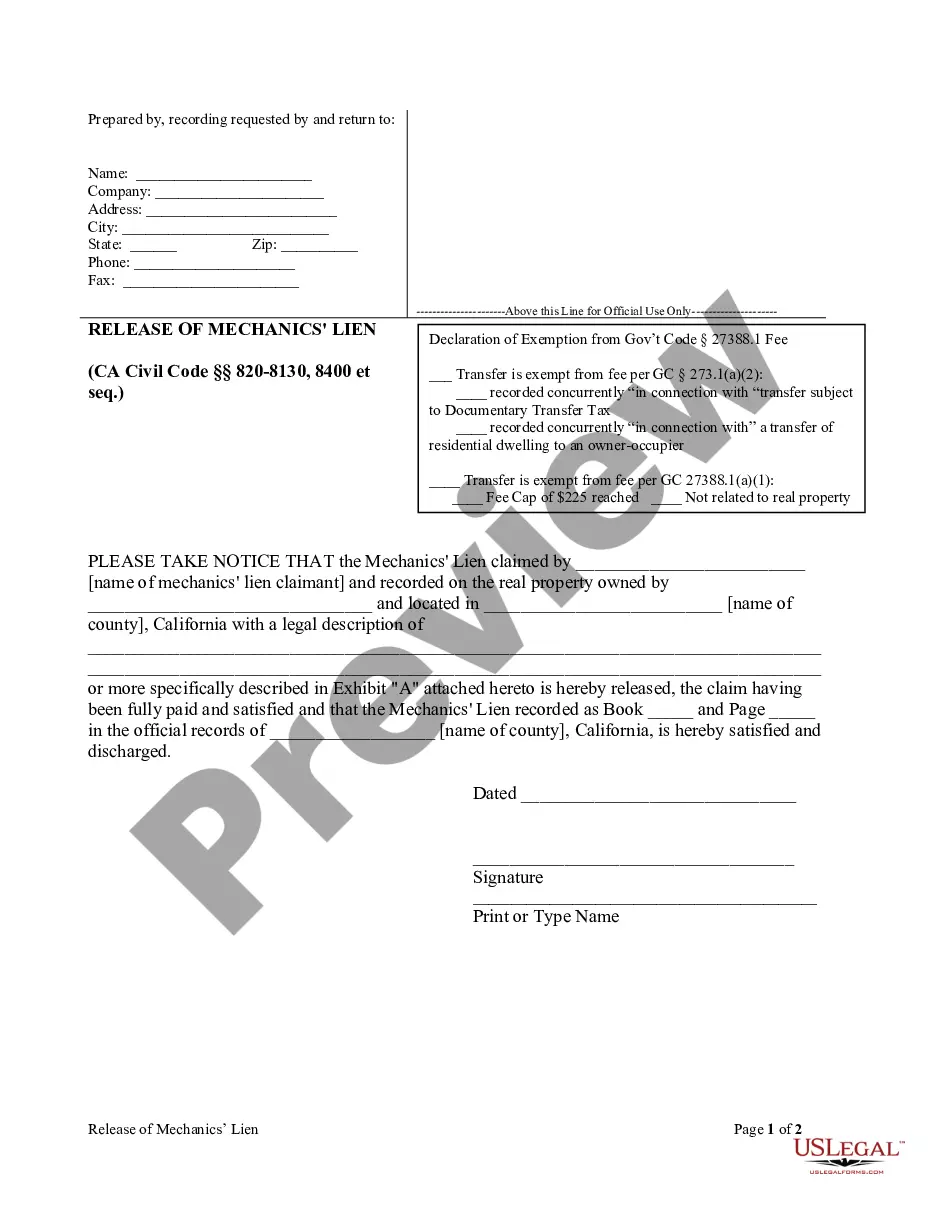

How to fill out Sample Letter For Closing Of Estate With Breakdown Of Assets And Expenses?

US Legal Forms - one of many most significant libraries of lawful types in America - offers a variety of lawful record layouts it is possible to acquire or print out. Making use of the web site, you can get a large number of types for enterprise and specific functions, sorted by categories, says, or search phrases.You can get the most up-to-date variations of types such as the Kentucky Sample Letter for Closing of Estate with Breakdown of Assets and Expenses in seconds.

If you already have a registration, log in and acquire Kentucky Sample Letter for Closing of Estate with Breakdown of Assets and Expenses from the US Legal Forms library. The Download option can look on each form you look at. You get access to all formerly downloaded types from the My Forms tab of your accounts.

If you want to use US Legal Forms initially, here are straightforward instructions to help you get started off:

- Ensure you have picked the proper form to your town/region. Click on the Review option to analyze the form`s content. Browse the form outline to ensure that you have selected the correct form.

- In case the form doesn`t satisfy your requirements, make use of the Look for discipline at the top of the display to get the one who does.

- If you are satisfied with the shape, validate your option by simply clicking the Get now option. Then, opt for the prices program you like and offer your references to sign up to have an accounts.

- Procedure the deal. Use your credit card or PayPal accounts to perform the deal.

- Choose the file format and acquire the shape on the gadget.

- Make adjustments. Fill up, revise and print out and signal the downloaded Kentucky Sample Letter for Closing of Estate with Breakdown of Assets and Expenses.

Every single template you added to your money does not have an expiry date and is also the one you have for a long time. So, if you want to acquire or print out yet another copy, just visit the My Forms segment and click about the form you require.

Obtain access to the Kentucky Sample Letter for Closing of Estate with Breakdown of Assets and Expenses with US Legal Forms, the most considerable library of lawful record layouts. Use a large number of skilled and state-specific layouts that meet up with your business or specific demands and requirements.

Form popularity

FAQ

Kentucky has a lenient time requirement for probate. ing to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

The Creditors' Claim Period The decedent's creditors have six months from the date of the Fiduciary's appointment to present their claims either to the court or to the Fiduciary (or the Fiduciary's lawyer). This means all probate estates must be open for at least this six-month notice period.

In Kentucky, if you die without a will, your spouse will inherit property from you under a law called "dower and curtesy." Usually, this means that your spouse inherits 1/2 of your intestate property. The rest of your property passes to your descendants, parents, or siblings.

The Living Trust If you have a larger estate, you can avoid a long and expensive probate process by using a technique of asset transfer called a Living Trust. A document called a ?trust document?, which is similar to a Will, is created which names a person who will control the trust.

Settling the Estate After paying the debts and any income and death taxes owed by the estate, and after distributing any remaining assets of the estate to the heirs, the personal representative must prepare and file a final settlement with the District Court using form AOC-846. KRS §§395.190, 395.510.

In Kentucky, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed permits a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.

Settling the Estate The settlement may not be filed until at least six months from the date the personal representative was appointed. KRS §395.190. If settling the estate takes more than two years, a periodic settlement may be required.