Kentucky Sample Letter Requesting Payoff Balance of Mortgage

Description

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

Have you been in the placement where you will need documents for either company or specific purposes just about every working day? There are tons of legal file web templates accessible on the Internet, but discovering types you can trust isn`t effortless. US Legal Forms gives a huge number of kind web templates, much like the Kentucky Sample Letter Requesting Payoff Balance of Mortgage, which can be created to fulfill federal and state needs.

When you are presently informed about US Legal Forms internet site and get a merchant account, basically log in. Following that, you may down load the Kentucky Sample Letter Requesting Payoff Balance of Mortgage template.

Unless you have an bank account and need to begin using US Legal Forms, adopt these measures:

- Find the kind you need and make sure it is for your proper area/region.

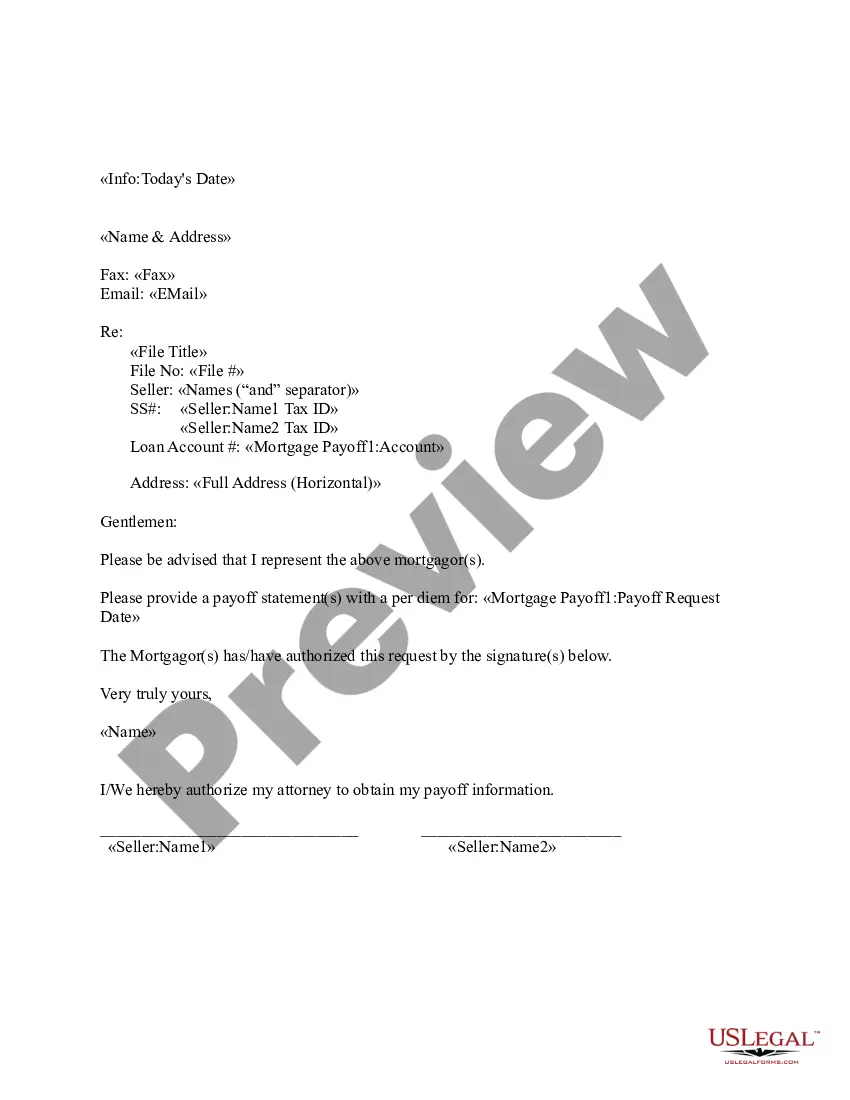

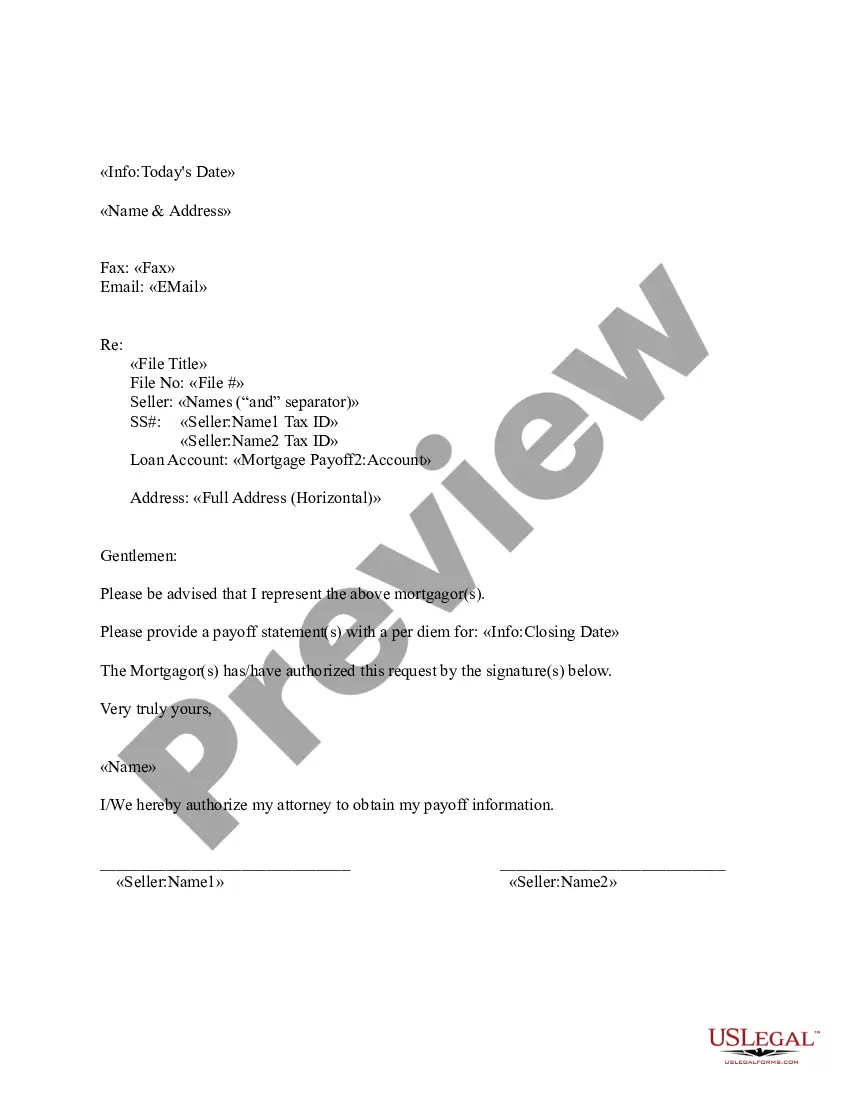

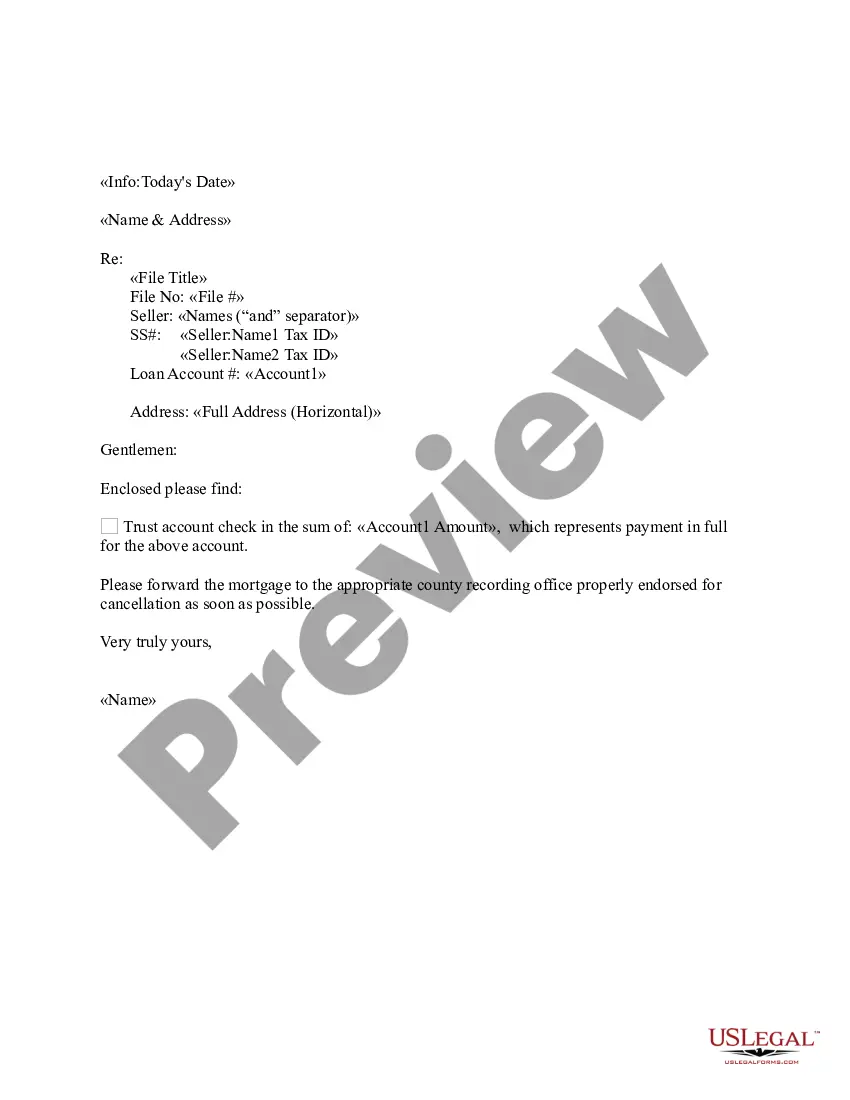

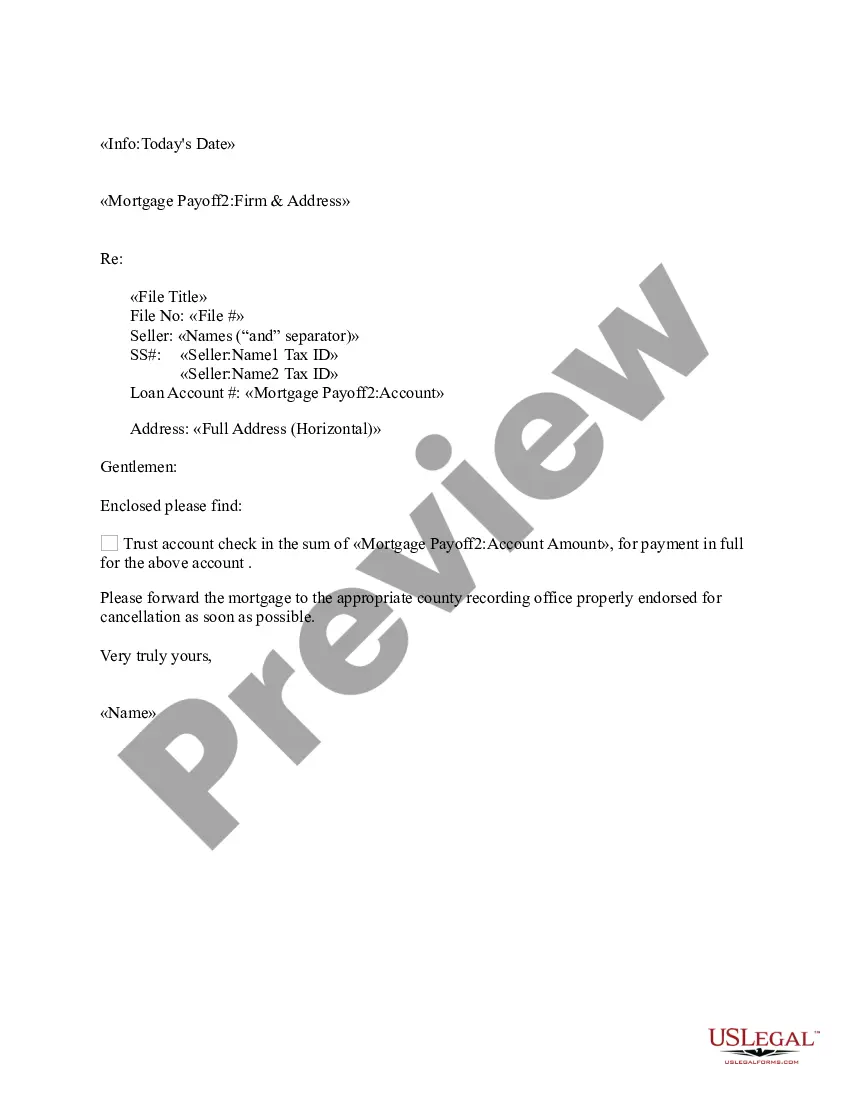

- Make use of the Review button to analyze the form.

- Read the explanation to actually have selected the proper kind.

- When the kind isn`t what you`re searching for, use the Research field to find the kind that meets your requirements and needs.

- When you find the proper kind, click on Get now.

- Choose the pricing prepare you would like, submit the specified information to produce your account, and pay for the order utilizing your PayPal or credit card.

- Pick a convenient data file formatting and down load your copy.

Discover each of the file web templates you have bought in the My Forms menu. You may get a extra copy of Kentucky Sample Letter Requesting Payoff Balance of Mortgage at any time, if possible. Just click the needed kind to down load or print out the file template.

Use US Legal Forms, probably the most substantial collection of legal varieties, to save time as well as steer clear of blunders. The services gives skillfully produced legal file web templates that can be used for an array of purposes. Create a merchant account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

The mortgage company will send you a letter with a payoff amount through a specific date. This amount includes accrued interest through a certain date. Pay the amount due by the due date or expiration of the payoff statement to eliminate your mortgage. Any excess amount that you pay will be refunded.

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

Include all relevant information in the payoff letter, including: Include the name of the loan or mortgage holder. Include the loan or mortgage number. Include the payment amount. Include the date you plan to make the payment. Include your name and address. Include your contact information.

How do I figure out my loan payoff amount? you can just call your bank and ask them to share the payoff amount with you. you can go to your online banking and look for the link to your payoff amount and print out a PDF file. you can dial a 1-800 number and use the IVR to get to the payoff amount.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.

Your principal balance is not the payoff amount because the interest on your loan is calculated in arrears. For example, when you paid your August payment you actually paid interest for July and principal for August.

A payoff statement is a statement prepared by a lender providing a payoff amount for prepayment on a mortgage or other loan. A payoff statement or a mortgage payoff letter will typically show the balance you must pay in order to close your loan.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.