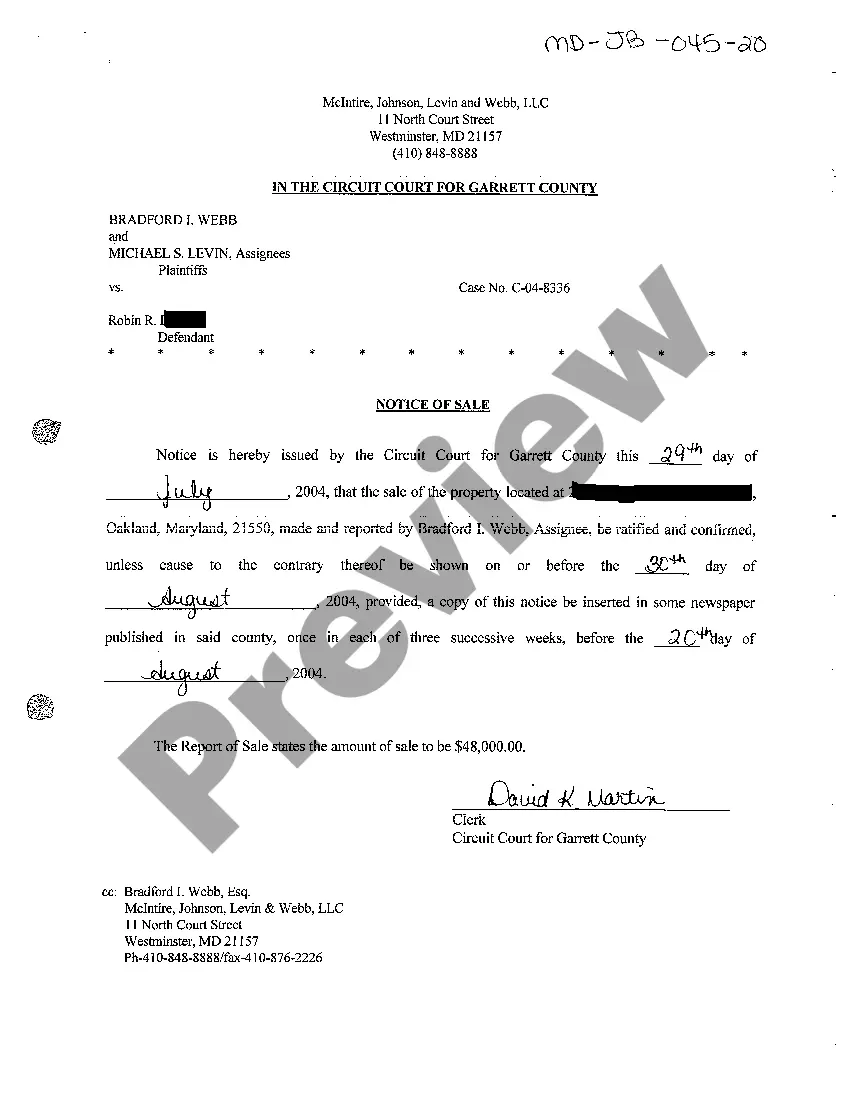

Kentucky Sample Letter for Review of Form 1210

Description

How to fill out Sample Letter For Review Of Form 1210?

If you have to comprehensive, download, or produce lawful papers templates, use US Legal Forms, the greatest assortment of lawful types, which can be found online. Take advantage of the site`s simple and easy convenient lookup to obtain the papers you need. A variety of templates for company and personal reasons are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Kentucky Sample Letter for Review of Form 1210 in just a number of mouse clicks.

If you are already a US Legal Forms buyer, log in in your profile and click the Obtain switch to get the Kentucky Sample Letter for Review of Form 1210. You can even entry types you previously downloaded from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the appropriate area/country.

- Step 2. Use the Review method to check out the form`s articles. Do not overlook to learn the description.

- Step 3. If you are not happy with the kind, utilize the Look for discipline on top of the display screen to discover other variations of your lawful kind format.

- Step 4. Once you have found the form you need, click the Purchase now switch. Select the pricing strategy you prefer and add your credentials to sign up to have an profile.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal profile to perform the financial transaction.

- Step 6. Select the structure of your lawful kind and download it on your product.

- Step 7. Comprehensive, revise and produce or sign the Kentucky Sample Letter for Review of Form 1210.

Each lawful papers format you acquire is your own property eternally. You possess acces to each and every kind you downloaded inside your acccount. Click the My Forms section and pick a kind to produce or download again.

Contend and download, and produce the Kentucky Sample Letter for Review of Form 1210 with US Legal Forms. There are thousands of professional and state-certain types you can use to your company or personal needs.

Form popularity

FAQ

This identity confirmation process is in the form of a verification quiz. The quiz should take no more than 5 minutes and will help us protect your refund and identity. The verification quiz is comprised of questions from information associated with the taxpayer's name listed on the letter.

If you travel through the state of Kentucky, in a commercial vehicle (private and/or for-hire), with a registered GVWR of 60,000 lbs or more, you will need a KYU # or you will need to buy a temporary KYU permit.

???????????The Medical Review Board identifies drivers with physical or mental impairments that hamper their ability to operate a motor vehicle safely. The Medical Review Board consists of ophthalmologists, neurologists, psychiatrists, and rehabilitation specialists.

Note: The quiz verifies your identity and confirms the return we received was filed by you or on your behalf. It does not confirm that the return is accurate.

The identity verification quiz is one safeguard to prevent someone from using another person's identity to file a false income tax return and get a refund.

The quiz consists of multiple choice questions with answers that help us verify your identity. The quiz can be taken online or by telephone with an authorized representative to help with the process. At the completion of the quiz you will be advised whether you passed or failed.

If you received a letter from us, your return has been selected for identity confirmation and verification is required in order to complete the processing of your tax return.

This is a safeguard to prevent someone from using your identity to file a false tax return.