Title: Kentucky Call of Special Stockholders' Meeting By President of Corporation: An In-depth Overview Introduction: In the world of corporate governance, special stockholders' meetings serve as crucial events for companies to discuss and decide on important matters that require immediate attention. This article delves into the Kentucky Call of Special Stockholders' Meeting, highlighting its significance, procedures, and potential types of meetings conducted by the President of a corporation. Keywords: — Kentucky Call of Special Stockholders' Meeting — Presidencorporationio— - Stockholders' Meeting — CorporGovernancenanc— - Special Meeting — Kentucky Corporate Law— - Proxy Voting — Agenda Setting I. Understanding the Kentucky Call of Special Stockholders' Meeting: In Kentucky, corporations are governed by specific laws and regulations, dictating the procedures for convening special stockholders' meetings. These meetings are called by the President or other authorized officials of the corporation to address urgent matters that cannot wait until the next regular annual meeting. II. Importance of Special Stockholders' Meetings: 1. Prompt decision-making: Special stockholders' meetings allow corporations to swiftly address time-sensitive issues that may significantly impact the company, its shareholders, or its overall operations. 2. Shareholder participation: These meetings grant shareholders a platform to exercise their voting rights, express opinions, and influence decisions affecting the corporation. 3. Accountability and governance: Special meetings ensure transparency in corporate decision-making processes, providing a sense of openness and ensuring that shareholders have a say in critical matters. III. Kentucky Call of Special Stockholders' Meeting Procedures: 1. Notification: The President or authorized officials must formally notify shareholders of the upcoming meeting, complying with Kentucky corporate laws regarding notice periods and modes of communication. 2. Agenda setting: The President, in consultation with the board of directors, sets the meeting's agenda, ensuring that it encompasses all relevant matters to be discussed and voted upon. 3. Proxy voting: Shareholders unable to attend the meeting may vote by proxy, allowing them to delegate their voting rights to another individual present at the meeting. IV. Different Types of Kentucky Call of Special Stockholders' Meeting: 1. Merger or acquisition meetings: Where shareholders discuss potential mergers, acquisitions, or corporate restructuring plans that require their approval. 2. Board elections and removal: Meetings held to elect new board members or remove existing ones based on shareholders' votes. 3. Capital structure modification: Discussions on changes to the company's capital structure, such as stock splits, consolidations, or issuance of new shares. 4. Dissolution or liquidation meetings: Meetings to discuss and decide on the dissolution, liquidation, or winding up of the corporation. Conclusion: Kentucky Call of Special Stockholders' Meeting plays a pivotal role in the corporate governance landscape, allowing Presidents and authorized officials to address pressing matters at hand. These meetings facilitate transparent decision-making, encourage shareholder participation, and contribute to the long-term success and accountability of corporations. Adherence to Kentucky corporate laws and regulations is crucial to conducting such meetings effectively and ensuring fair outcomes.

Kentucky Call of Special Stockholders' Meeting By President of Corporation

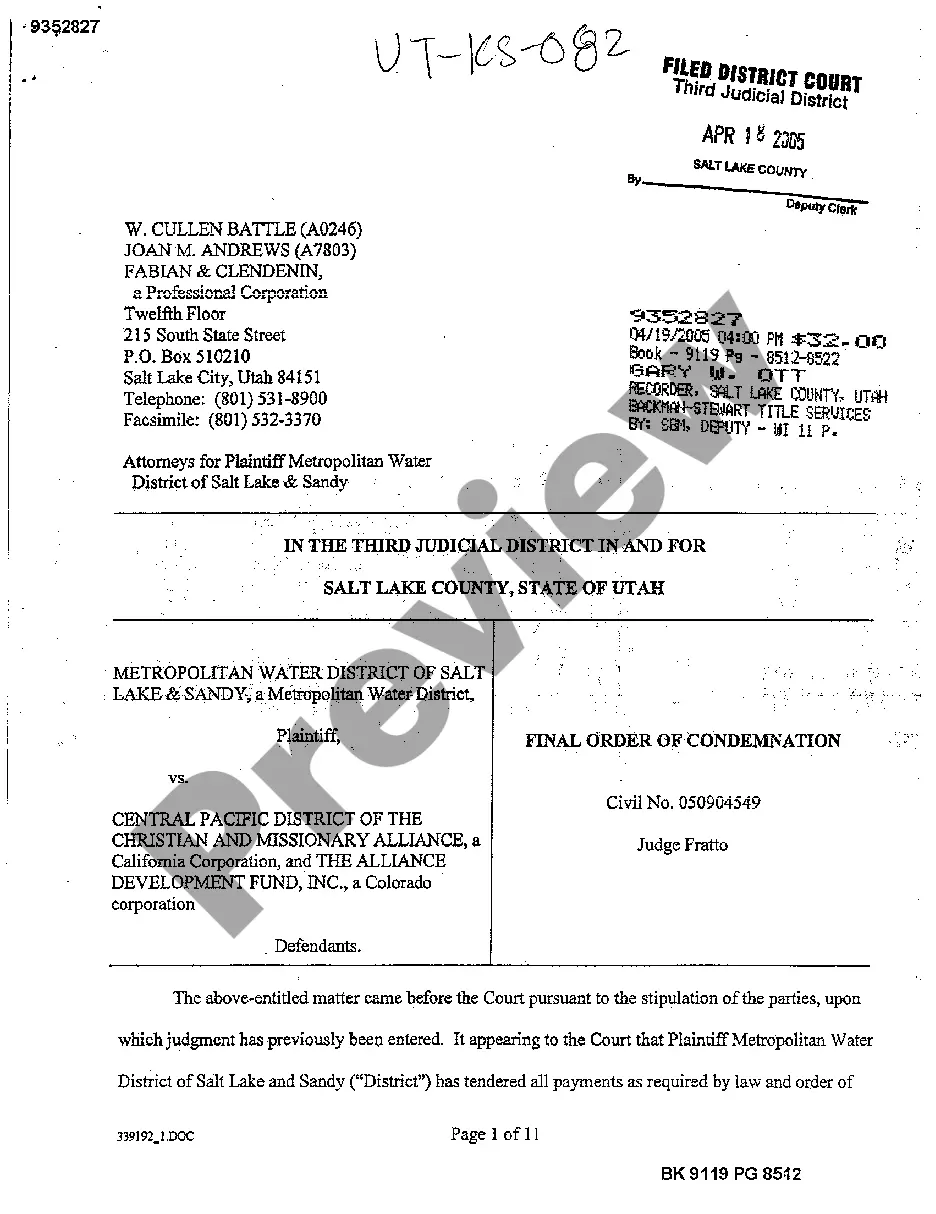

Description

How to fill out Kentucky Call Of Special Stockholders' Meeting By President Of Corporation?

Choosing the right legal record template can be a battle. Needless to say, there are plenty of layouts accessible on the Internet, but how can you get the legal type you need? Utilize the US Legal Forms site. The support provides 1000s of layouts, such as the Kentucky Call of Special Stockholders' Meeting By President of Corporation, that you can use for company and private needs. Every one of the varieties are inspected by experts and meet federal and state demands.

When you are presently authorized, log in in your profile and click on the Download option to obtain the Kentucky Call of Special Stockholders' Meeting By President of Corporation. Use your profile to look throughout the legal varieties you possess ordered previously. Visit the My Forms tab of your own profile and obtain another version in the record you need.

When you are a whole new end user of US Legal Forms, allow me to share simple guidelines so that you can follow:

- Very first, be sure you have chosen the appropriate type for the city/area. You may look over the form utilizing the Preview option and study the form description to ensure this is basically the right one for you.

- In case the type fails to meet your needs, utilize the Seach discipline to obtain the correct type.

- When you are positive that the form would work, click on the Acquire now option to obtain the type.

- Opt for the prices strategy you want and enter the needed information. Build your profile and pay money for your order with your PayPal profile or charge card.

- Select the document file format and obtain the legal record template in your product.

- Complete, modify and produce and signal the received Kentucky Call of Special Stockholders' Meeting By President of Corporation.

US Legal Forms may be the biggest collection of legal varieties where you can discover numerous record layouts. Utilize the service to obtain skillfully-created papers that follow condition demands.