Kentucky Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

If you wish to finalize, acquire, or generate legitimate document templates, utilize US Legal Forms, the most extensive collection of legal forms that can be accessed online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the Kentucky Breakdown of Savings for Budget and Emergency Fund in just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you acquired in your account. Select the My documents section and choose a form to print or download again.

Be proactive and download, and print the Kentucky Breakdown of Savings for Budget and Emergency Fund with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Kentucky Breakdown of Savings for Budget and Emergency Fund.

- You can also find forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

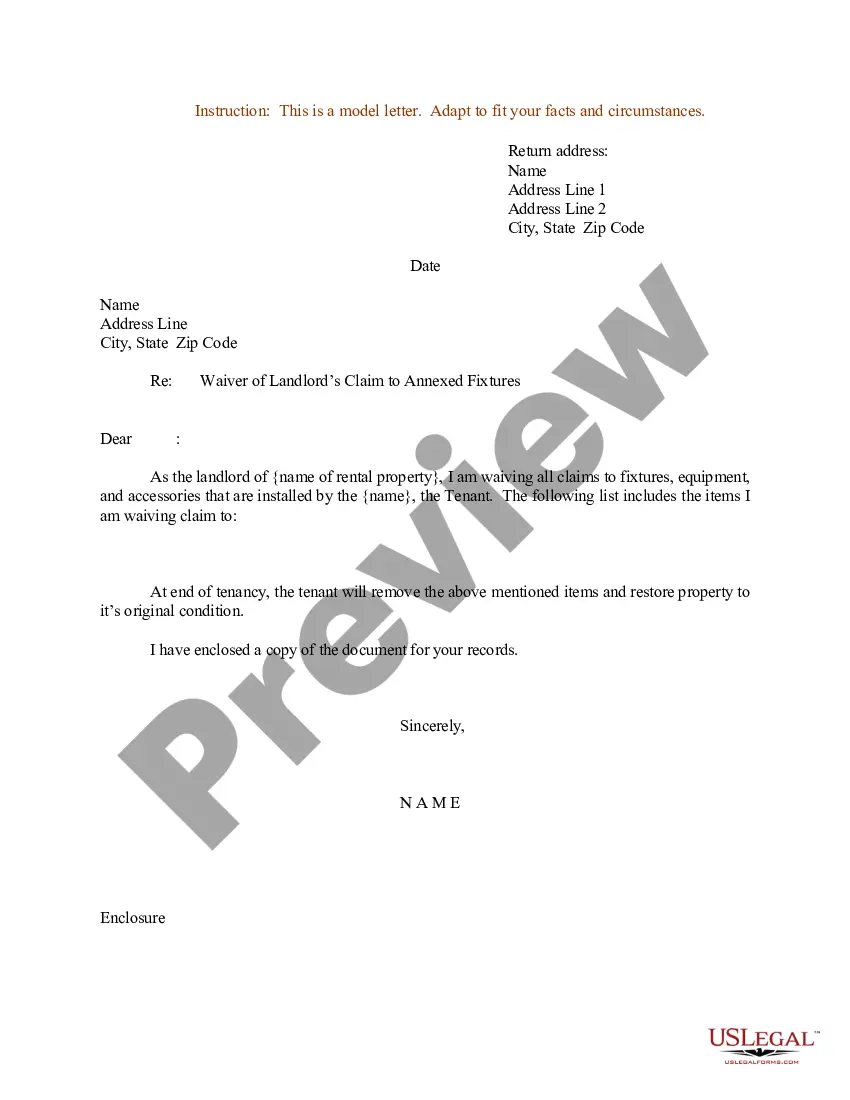

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms of your legal document type.

- Step 4. Once you have identified the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Kentucky Breakdown of Savings for Budget and Emergency Fund.

Form popularity

FAQ

An emergency fund is a type of savings fund. When you create an account for emergencies, you're saving money. It's not so much comparing a savings account versus an emergency fund as it is establishing an emergency fund that gives you a way to save money.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Creating a budgetStep 1: Calculate your net income. The foundation of an effective budget is your net income.Step 2: Track your spending.Step 3: Set realistic goals.Step 4: Make a plan.Step 5: Adjust your spending to stay on budget.Step 6: Review your budget regularly.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

It does work. That $1,000 emergency fund will be enough to have your back while you hustle to pay off your debt as quick as you can. The Baby Steps work, so stick with themno matter how uncomfortable it might make you feel. Lean into that awkward feeling and let that spur you on to pay off your debt even faster.

It's all about your personal expenses Those include things like rent or mortgage payments, utilities, healthcare expenses, and food. If your monthly essentials come to $2,500 a month, and you're comfortable with a four-month emergency fund, then you should be set with a $10,000 savings account balance.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

If you have consumer debt, I recommend saving a starter emergency fund of $1,000 first. Then, once you're out of debt, it's time to beef up that amount and save three to six months of expenses in a fully funded emergency fund.

Dave Ramsey: $1,000; then three to six months of expenses If you follow Ramsey's Seven Baby Steps, which are designed to help people take control of their money through debt payoff and building wealth, the first step is to establish a starter emergency fund of $1,000.