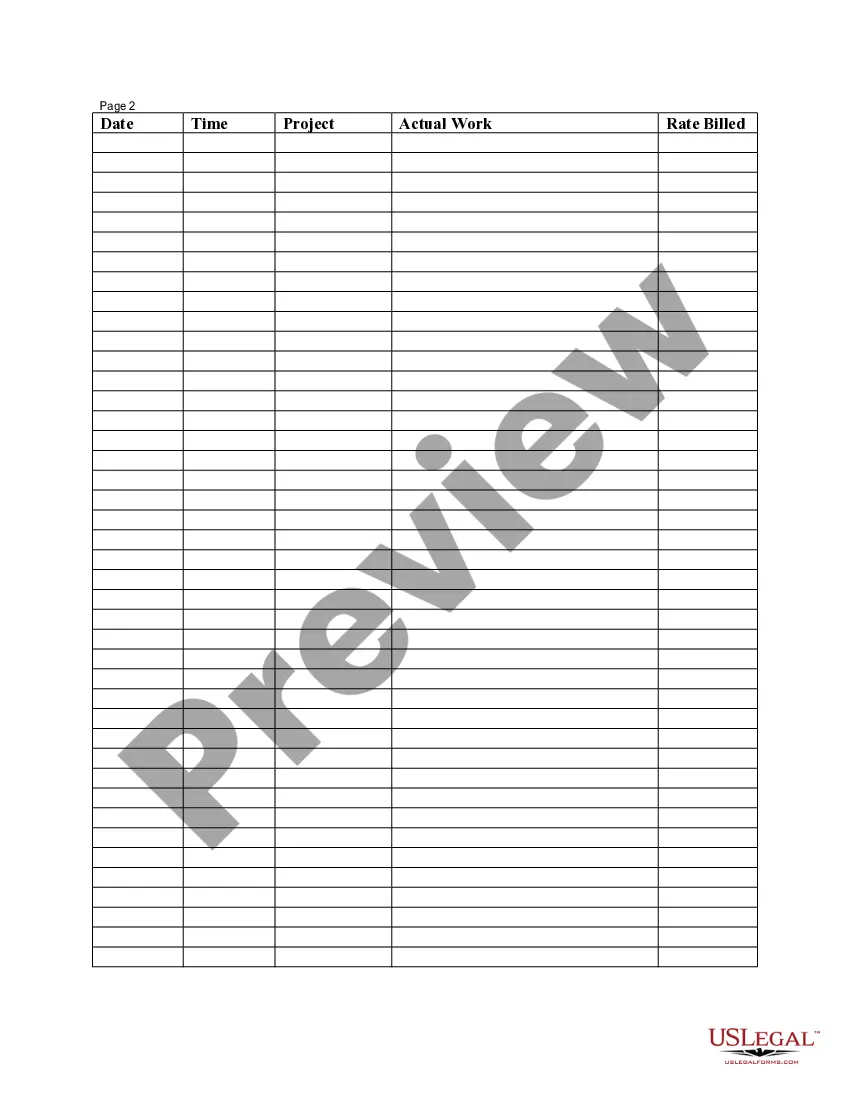

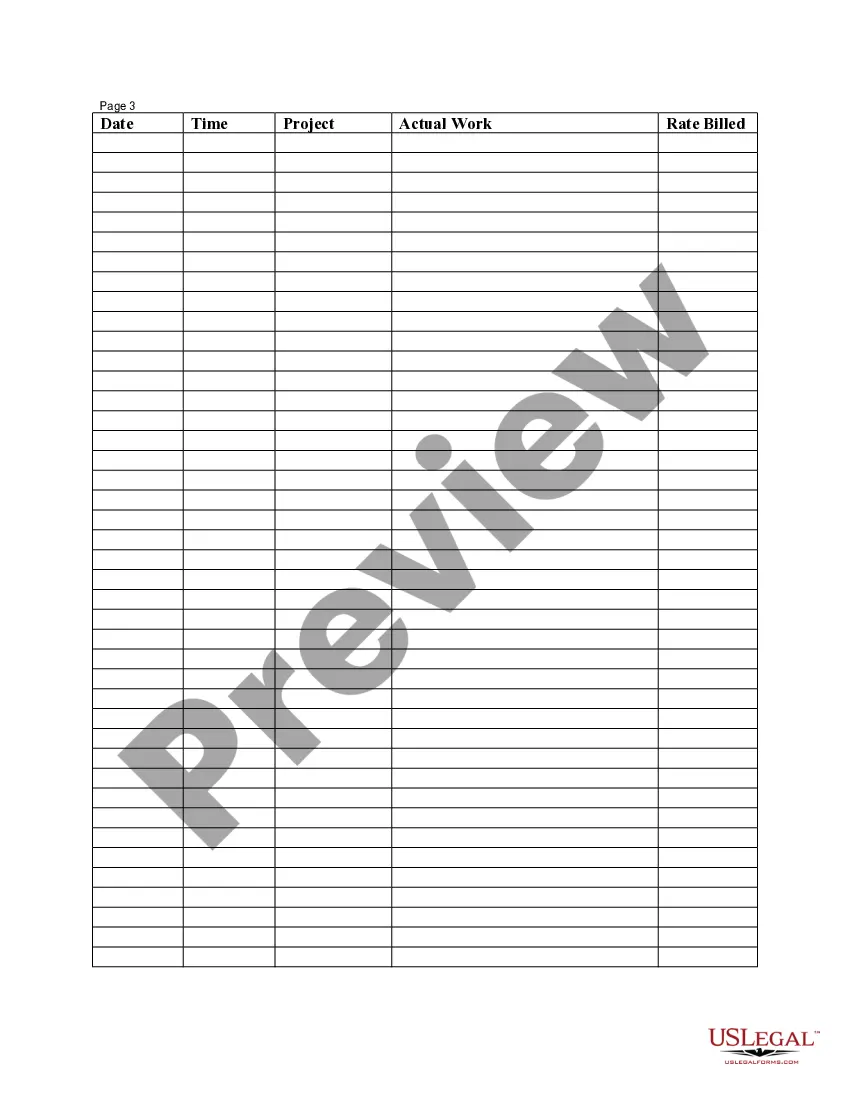

The Kentucky Employee Time Sheet is a crucial document used by employees in the state of Kentucky to accurately record their working hours and ultimately calculate their wages. This time sheet serves as a detailed record of an employee's daily or weekly attendance, depicting the starting and ending times for each shift worked. It plays a significant role in ensuring payroll accuracy and compliance with labor laws. The Kentucky Employee Time Sheet includes various relevant sections that are necessary for proper time tracking. This typically consists of spaces to record the employee's full name, department or position, employee ID or number, and the designated pay period. Additionally, the time sheet provides columns for the specific date, regular hours worked, additional overtime hours if applicable, breaks taken, and any necessary notes or comments. There are several types of Kentucky Employee Time Sheets that may be utilized based on the particular requirements of the organization or industry. Some common variations include electronic time sheets, paper-based time sheets, and digital timekeeping systems. Electronic time sheets allow employees to submit their hours online, while paper-based time sheets are filled out manually and typically signed by both the employee and their supervisor. Digital timekeeping systems employ advanced technology such as biometric scanners or time clock applications to automatically record employee attendance and eliminate manual entry. It is important to note that each employer may have specific guidelines or formats for these time sheets, which must be adhered to by their employees. Accuracy and adherence to these guidelines are paramount to avoid any discrepancies or payroll errors. Timely submission of the Kentucky Employee Time Sheet is also crucial to ensure payment is processed accurately and on time. Overall, the Kentucky Employee Time Sheet serves as a detailed recording mechanism for employees to track their working hours, whether through electronic, paper, or digital means. It is an essential component of the payroll process, ensuring fair compensation and maintaining compliance with labor regulations in the state of Kentucky.

Kentucky Employee Time Sheet

Description

How to fill out Kentucky Employee Time Sheet?

Have you been in a position where you will need documents for possibly business or individual functions virtually every day? There are tons of legitimate record web templates available online, but getting types you can depend on is not effortless. US Legal Forms provides a huge number of develop web templates, like the Kentucky Employee Time Sheet, that are published to fulfill federal and state requirements.

When you are currently acquainted with US Legal Forms web site and possess an account, just log in. Afterward, you can acquire the Kentucky Employee Time Sheet web template.

If you do not come with an account and need to begin to use US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for your right area/area.

- Make use of the Review option to check the shape.

- See the explanation to actually have chosen the correct develop.

- When the develop is not what you`re searching for, make use of the Search industry to obtain the develop that fits your needs and requirements.

- If you discover the right develop, click on Acquire now.

- Pick the pricing prepare you would like, fill in the required info to produce your account, and pay money for an order with your PayPal or Visa or Mastercard.

- Choose a handy paper format and acquire your backup.

Locate each of the record web templates you might have purchased in the My Forms food selection. You may get a further backup of Kentucky Employee Time Sheet whenever, if necessary. Just click the required develop to acquire or produce the record web template.

Use US Legal Forms, probably the most substantial assortment of legitimate types, to save lots of time and prevent blunders. The services provides skillfully created legitimate record web templates which can be used for an array of functions. Make an account on US Legal Forms and initiate creating your lifestyle a little easier.