Kentucky Jury Instruction - 10.10.2 Debt vs. Equity

Description

How to fill out Jury Instruction - 10.10.2 Debt Vs. Equity?

Have you been in the placement that you need files for possibly enterprise or individual reasons virtually every day time? There are plenty of legal papers web templates available online, but discovering kinds you can rely is not effortless. US Legal Forms offers a large number of type web templates, just like the Kentucky Jury Instruction - 10.10.2 Debt vs. Equity, which can be composed to meet federal and state requirements.

If you are already acquainted with US Legal Forms site and get your account, simply log in. Next, you can acquire the Kentucky Jury Instruction - 10.10.2 Debt vs. Equity web template.

Unless you come with an account and want to start using US Legal Forms, abide by these steps:

- Get the type you need and ensure it is to the correct town/area.

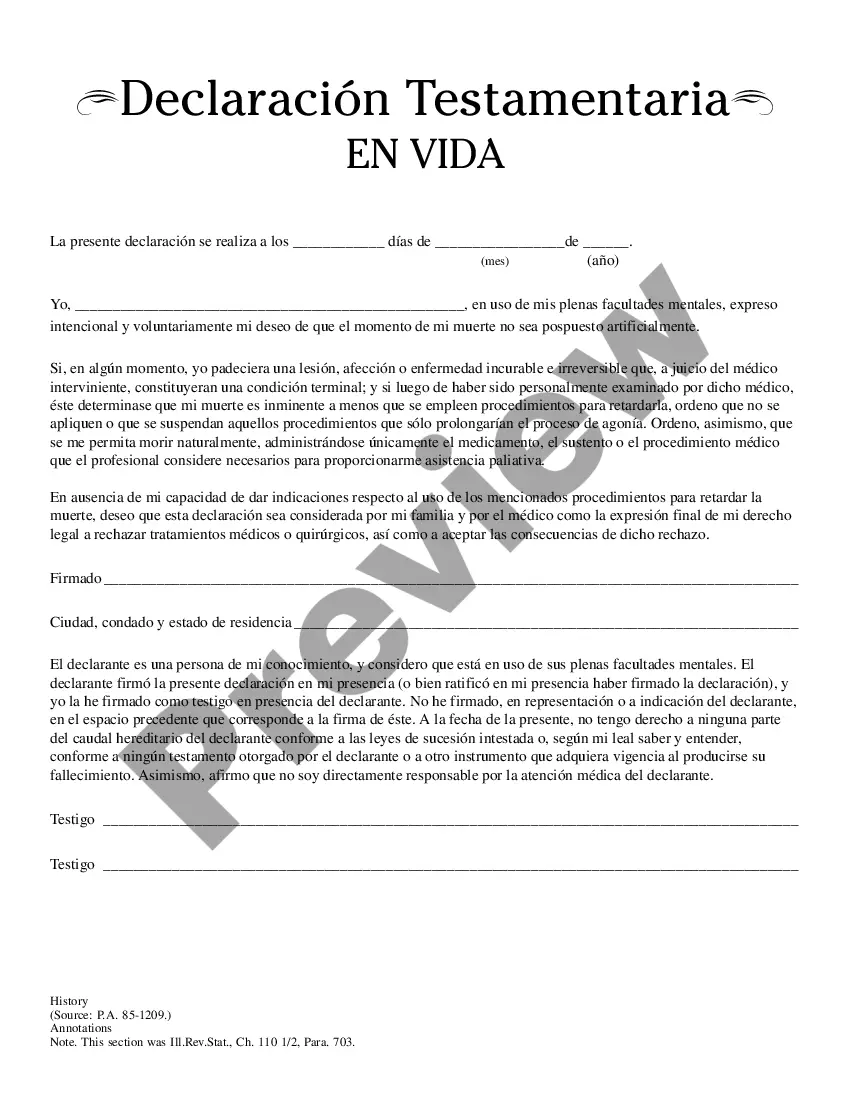

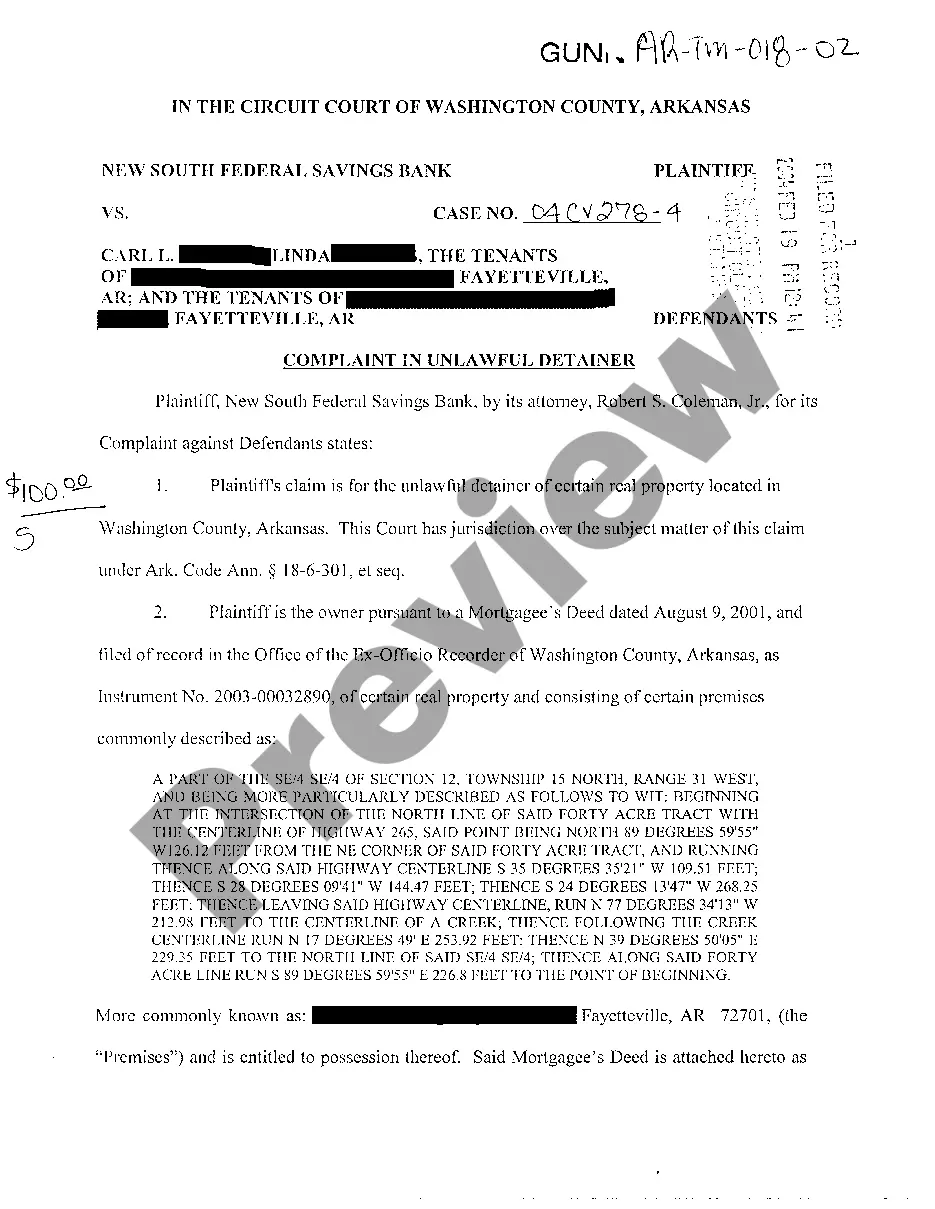

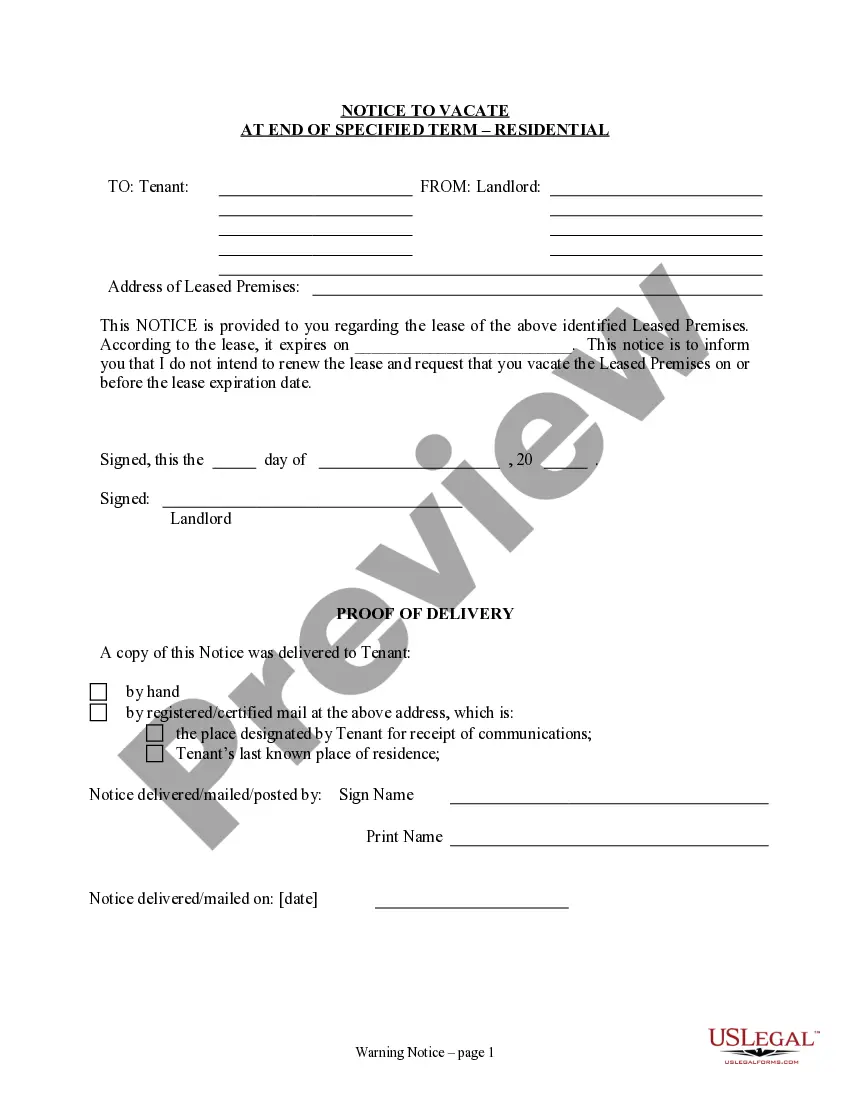

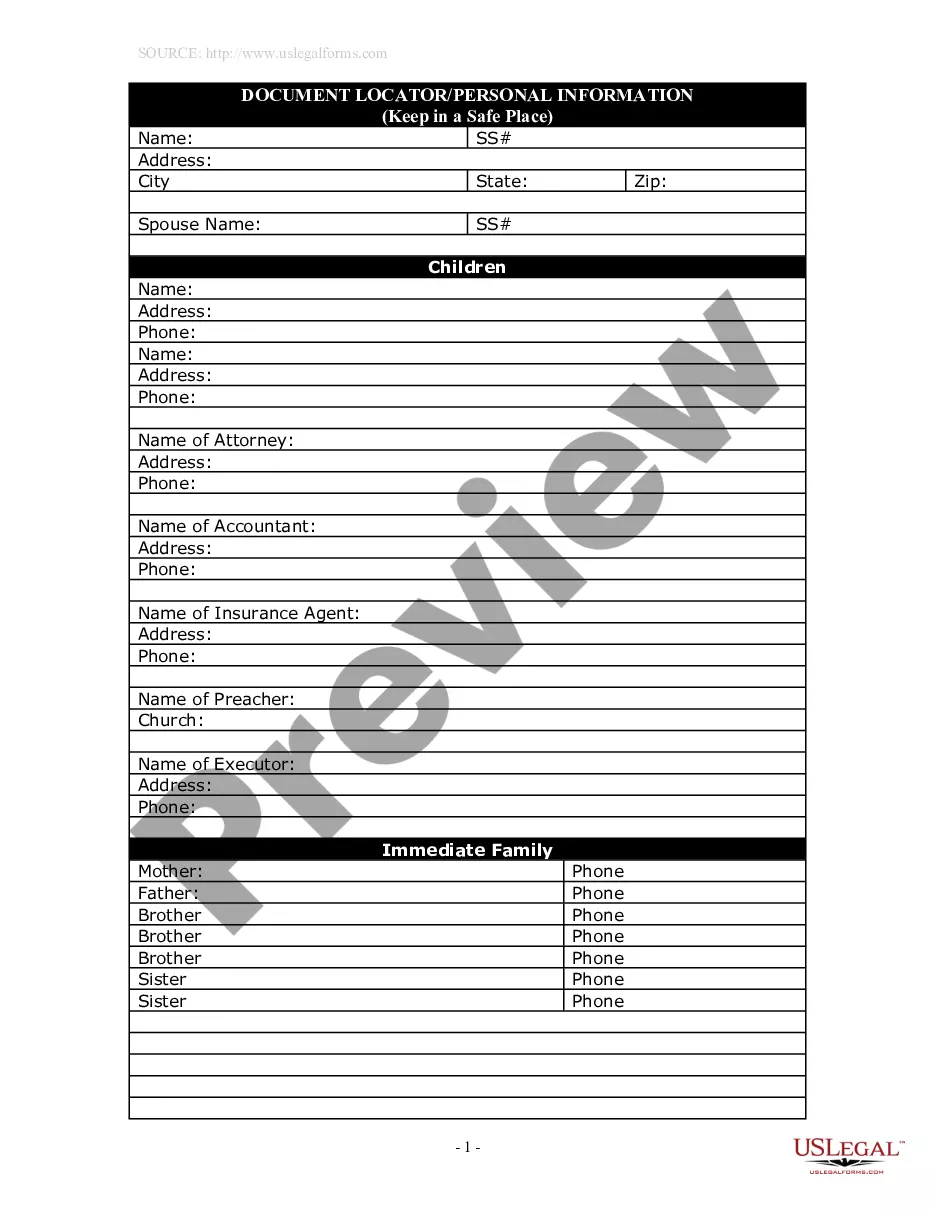

- Utilize the Preview button to analyze the form.

- See the explanation to ensure that you have selected the correct type.

- When the type is not what you`re trying to find, make use of the Lookup discipline to discover the type that fits your needs and requirements.

- Once you obtain the correct type, click Get now.

- Choose the rates plan you desire, fill in the required details to make your bank account, and pay money for an order making use of your PayPal or bank card.

- Pick a hassle-free file structure and acquire your copy.

Find every one of the papers web templates you may have purchased in the My Forms menu. You can aquire a additional copy of Kentucky Jury Instruction - 10.10.2 Debt vs. Equity anytime, if needed. Just click on the needed type to acquire or print out the papers web template.

Use US Legal Forms, by far the most considerable assortment of legal kinds, in order to save some time and stay away from errors. The assistance offers expertly produced legal papers web templates that can be used for an array of reasons. Make your account on US Legal Forms and start making your daily life easier.