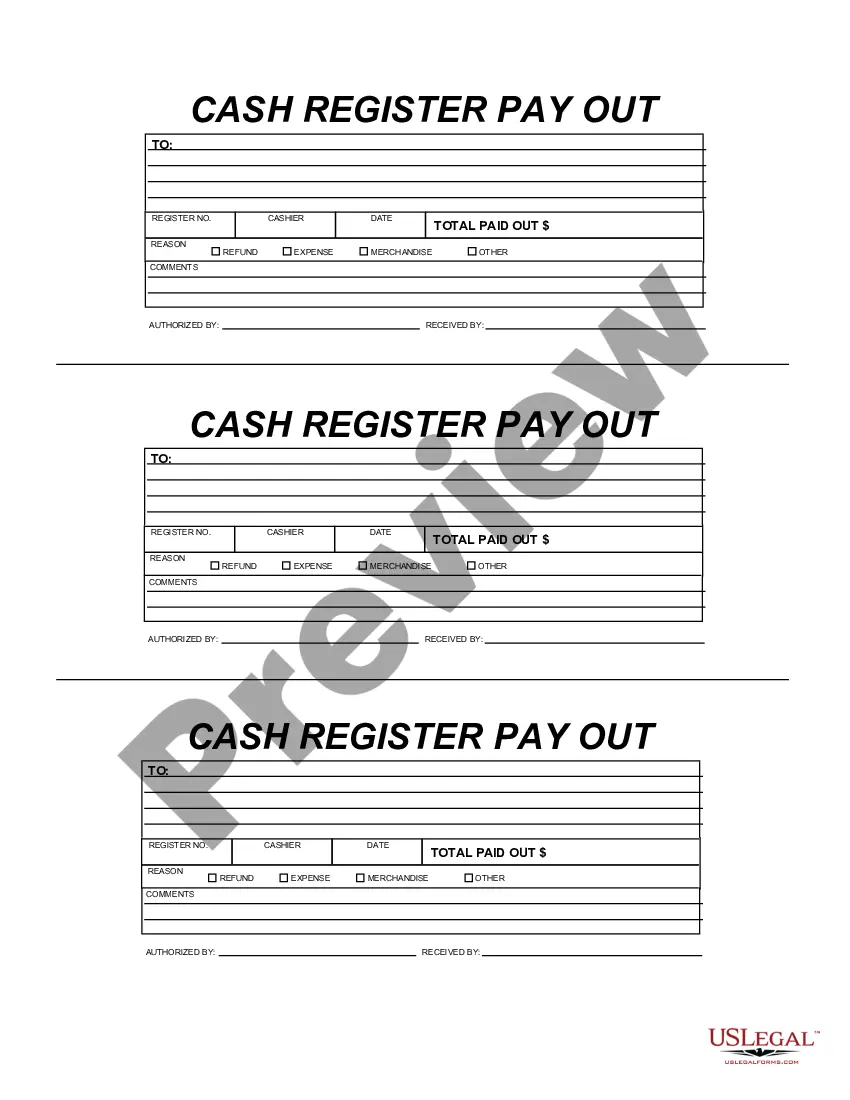

Kentucky Cash Register Payout

Description

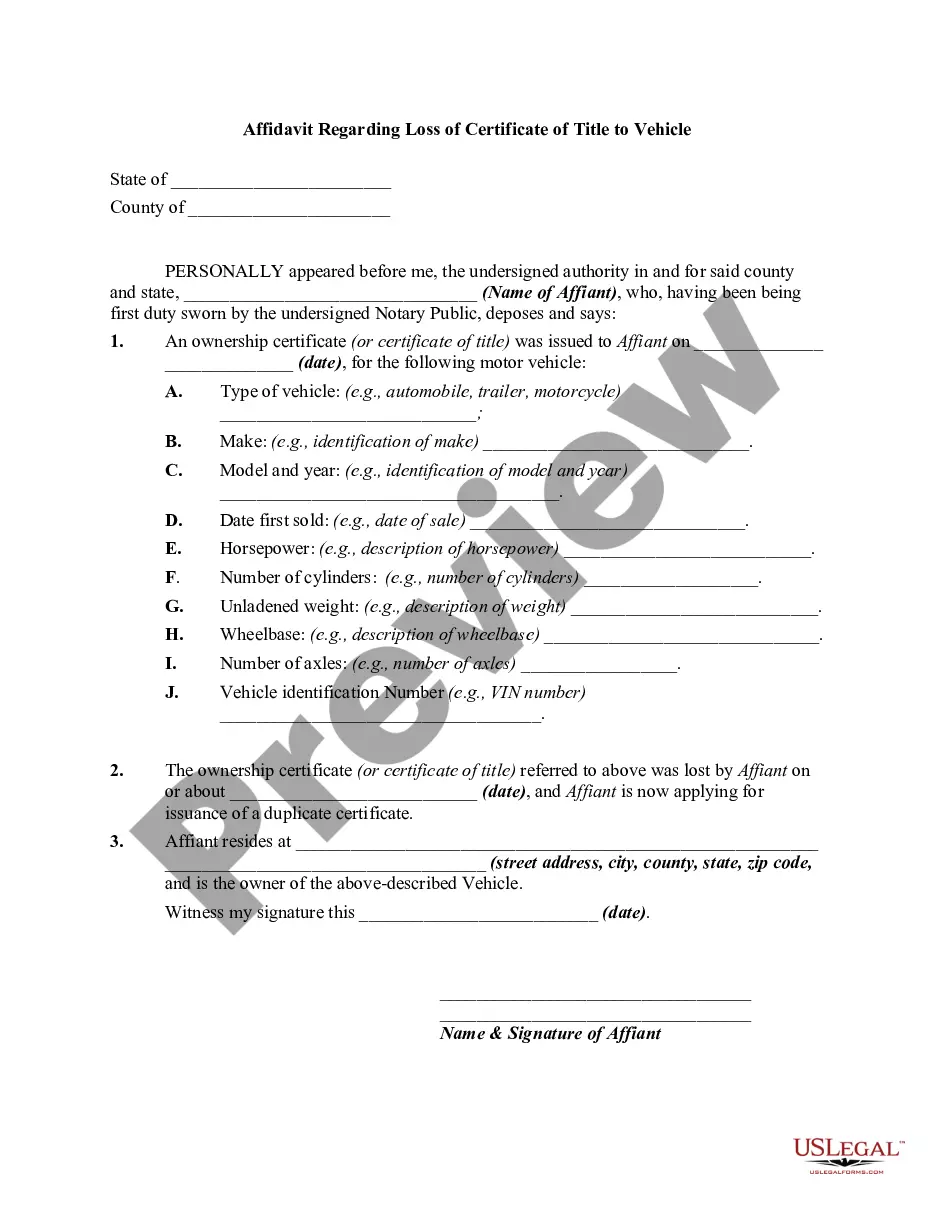

How to fill out Cash Register Payout?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the site, you will find thousands of forms for business and personal use, organized by category, state, or keywords. You can access the latest versions of forms, such as the Kentucky Cash Register Payout, in just a few moments.

If you have an active subscription, Log In to download the Kentucky Cash Register Payout from your US Legal Forms library. The Download button will be visible on every form you view. You can find all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form onto your device. Edit. Fill out, modify, print, and sign the downloaded Kentucky Cash Register Payout. Each template you added to your account has no expiration date and is yours indefinitely. So if you wish to download or print another copy, simply go to the My documents section and click on the desired form.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to check the form's content.

- Examine the form description to verify that you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

Kentucky requires that final paychecks be sent either on the next scheduled payday or with 14 days, whichever is later. The final paycheck should contain the employee's regular wages from the most recent pay period, plus other types of compensation such as commissions, bonuses, and accrued sick and vacation pay.

There are no circumstances that allow an employer in the state of Kentucky to refuse a worker their last paycheck. Employees that have quit or been fired by their employer must be sent a final paycheck containing compensation for any earned and unpaid wages.

Kentucky is an "employee at will" doctrine state. In Kentucky your employer can terminate you at any time, with or without reason, and you can quit at any time, with or without reason (provided there is not a written contract to the contrary).

In Kentucky, the minimum wage is $7.25/hour; employers must pay their employees no less than this amount. However, there is an exception to minimum wage pay for tipped employees. Tipped workers can be paid less than the federal minimum wage, as long as the employee makes at least $7.25/hour with both tips and wages.

Law Firm in Metro Manila, Philippines Corporate, Family, IP law, and Litigation Lawyers > Philippine Legal Advice > When do You Get your Final Pay When You Resign? You should get your final pay within thirty (30) days from the date of separation or termination of employment.

Luckily, in Kentucky, at least, there are some situations where you would be entitled to be paid out those earned vacation days when your employment ends. So, the Kentucky law requires your employer to pay out any vested vacation pay at the end of your employment.

Ann. § 337.055, an employee who quits his or her job is entitled to a final paycheck no later than the next regularly scheduled pay date or fourteen days, whichever is later.

When you leave employment for any reason your employer has until the next regular payday or fourteen (14) days whichever last occurs.

352.540). Payment must be made for all wages earned up to a date that is not more than 15 days before the date of payment. An employee who is absent from work, or for any other reason is not paid on payday, must be paid on demand.