A Kentucky Software Sales Agreement is a legally binding contract between two parties, where one party agrees to sell software products or licenses, and the other party agrees to purchase them. This agreement outlines the terms and conditions of the sale, including the rights and responsibilities of both parties involved. Keywords: Kentucky, software sales agreement, legally binding, contract, software products, licenses, purchase, terms and conditions, rights, responsibilities. There can be different types of Kentucky Software Sales Agreements, depending on the specific requirements and nature of the software being sold. Some common types include: 1. Perpetual License Agreement: This type of agreement allows the customer to purchase a software license that grants them the right to use the software indefinitely, without any recurring fees. The agreement may specify the number of users, installations, or any other limitations. 2. Subscription Agreement: In this type of agreement, the software is typically provided as a service and the customer pays a recurring subscription fee to access and use the software. The agreement outlines the duration, pricing, and terms of the subscription, including any renewal or cancellation provisions. 3. Volume License Agreement: This agreement is suitable for businesses or organizations that require multiple software licenses for their employees or departments. It provides flexibility in terms of pricing, quantity discounts, and centralized management of licenses. 4. Reseller Agreement: A reseller agreement is relevant when a third-party company or individual wants to sell software products that they have obtained from the software provider. This agreement establishes the terms, conditions, and responsibilities of the reseller, including pricing, marketing, support, and intellectual property rights. 5. OEM Agreement: An Original Equipment Manufacturer (OEM) agreement is applicable when a software developer grants a third-party company the right to bundle their software with hardware products for distribution. This agreement sets forth the terms, licensing fees, branding, and intellectual property rights involved in the partnership. In summary, a Kentucky Software Sales Agreement is a comprehensive contract between software sellers and purchasers, defining the terms and conditions of the sale. It is crucial to understand the different types of agreements available to choose the most appropriate one for your specific software sales scenario.

Kentucky Software Sales Agreement

Description

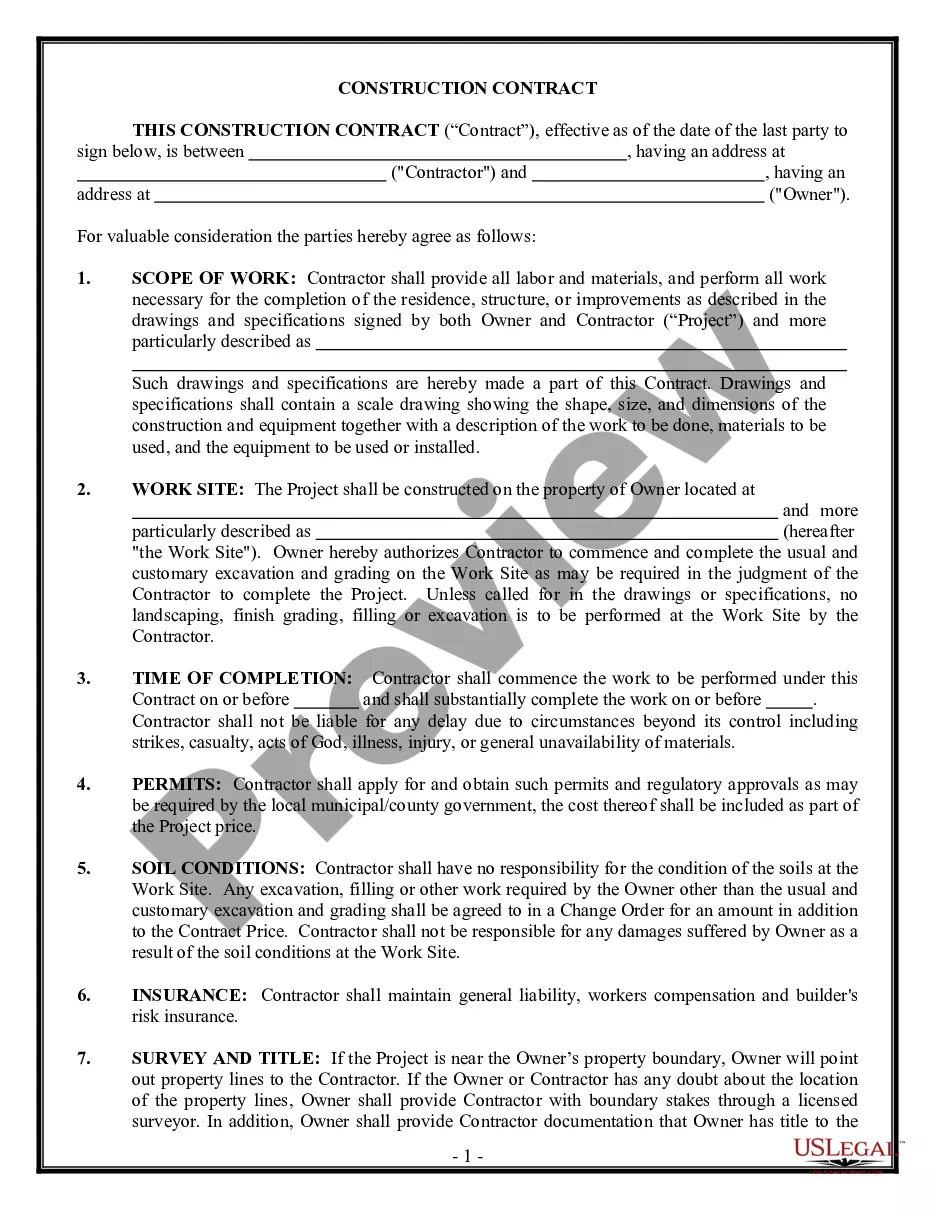

How to fill out Kentucky Software Sales Agreement?

Are you currently within a situation the place you will need documents for possibly company or personal functions nearly every working day? There are a variety of authorized record layouts available online, but locating types you can depend on isn`t straightforward. US Legal Forms offers a huge number of form layouts, like the Kentucky Software Sales Agreement, which can be created to fulfill federal and state needs.

If you are currently knowledgeable about US Legal Forms web site and get your account, just log in. Following that, you may download the Kentucky Software Sales Agreement template.

Should you not come with an accounts and wish to start using US Legal Forms, adopt these measures:

- Discover the form you want and ensure it is for your appropriate city/region.

- Utilize the Preview key to examine the shape.

- See the description to actually have selected the appropriate form.

- If the form isn`t what you`re searching for, utilize the Lookup discipline to discover the form that suits you and needs.

- If you discover the appropriate form, click Acquire now.

- Opt for the prices strategy you would like, complete the desired information to produce your bank account, and pay for your order with your PayPal or charge card.

- Decide on a practical data file file format and download your backup.

Get all of the record layouts you have purchased in the My Forms food list. You may get a more backup of Kentucky Software Sales Agreement anytime, if possible. Just click on the essential form to download or produce the record template.

Use US Legal Forms, the most substantial collection of authorized forms, to save lots of efforts and stay away from errors. The services offers professionally created authorized record layouts which you can use for a selection of functions. Produce your account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Certain goods are exempt from sales and use tax including coal and other energy-producing fuels, certain medical items, locomotives or rolling stock, certain farm machinery and livestock, certain seeds and farm chemicals, machinery for new and expanded industry, tombstones, textbooks, property certified as an alcohol

Ideally, all software purchases should be taxable to final users and exempt for business users. Instead, states tax some kinds of software and exempt others, based on whether it is customized or off-the-shelf and whether it is on CD or downloaded, all silly distinctions for tax purposes.

How to Write a Sales AgreementStep 1 Identify Party Information.Step 2 Provide a Description of the Goods.Step 3 Include the Purchase Price and Payment Information.Step 4 Determine Delivery Method.Step 5 Allocate Risk of Loss.Step 6 Include a Right of Inspection Provision.Step 7 Establish Warranties.More items...

In other words, Software-as-a-Service as a cloud-computing program that is only accessed remotely without delivery of a tangible media and does not include the user taking possession of the program is not subject to sales or use tax.

Sales of canned software - delivered on tangible media are subject to sales tax in Kentucky. Sales of canned software - downloaded are subject to sales tax in Kentucky. Sales of custom software - delivered on tangible media are exempt from the sales tax in Kentucky.

Kentucky SaaS is non-taxable because it isn't tangible personal property.

A sales contract is a legally binding document between a buyer and seller. The document includes the details of the exchange, the terms of sale, clear product or service descriptions and more. A good sales contract should leave no doubt in either party's mind about their rights and obligations during a transaction.

The agreement should identify the following essential elements:200cSeller: the party who owns the property and wants to sell it.200cBuyer: the party who will buy the property and become the new owner.200cProperty: a detailed description of the property that is being sold.200cPurchase price: how much the buyer will be paying.More items...