Kentucky Account Stated Between Partners and Termination of Partnership

Description

How to fill out Account Stated Between Partners And Termination Of Partnership?

You are able to spend hours online trying to find the lawful record design that suits the federal and state demands you need. US Legal Forms supplies 1000s of lawful types that are reviewed by professionals. You can actually acquire or printing the Kentucky Account Stated Between Partners and Termination of Partnership from my service.

If you already possess a US Legal Forms bank account, you can log in and then click the Down load key. Following that, you can complete, revise, printing, or indication the Kentucky Account Stated Between Partners and Termination of Partnership. Each and every lawful record design you acquire is the one you have permanently. To obtain yet another duplicate for any purchased type, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website the first time, adhere to the straightforward recommendations under:

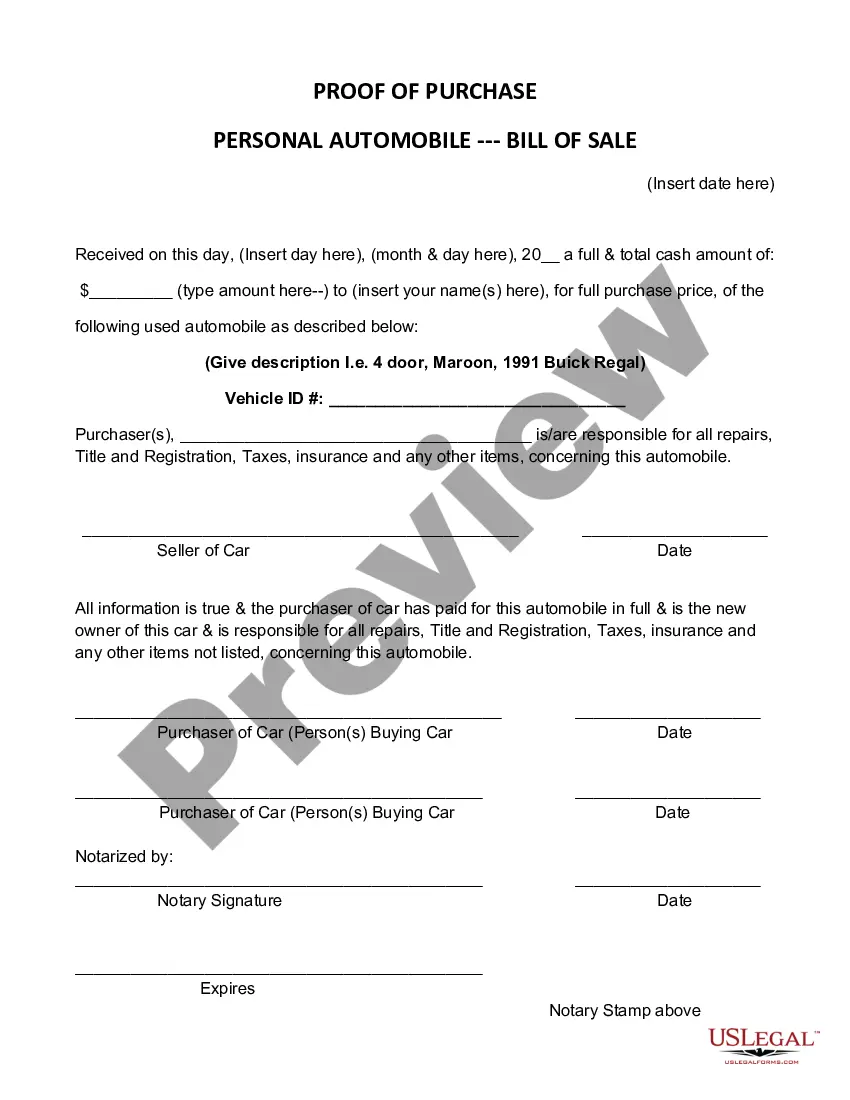

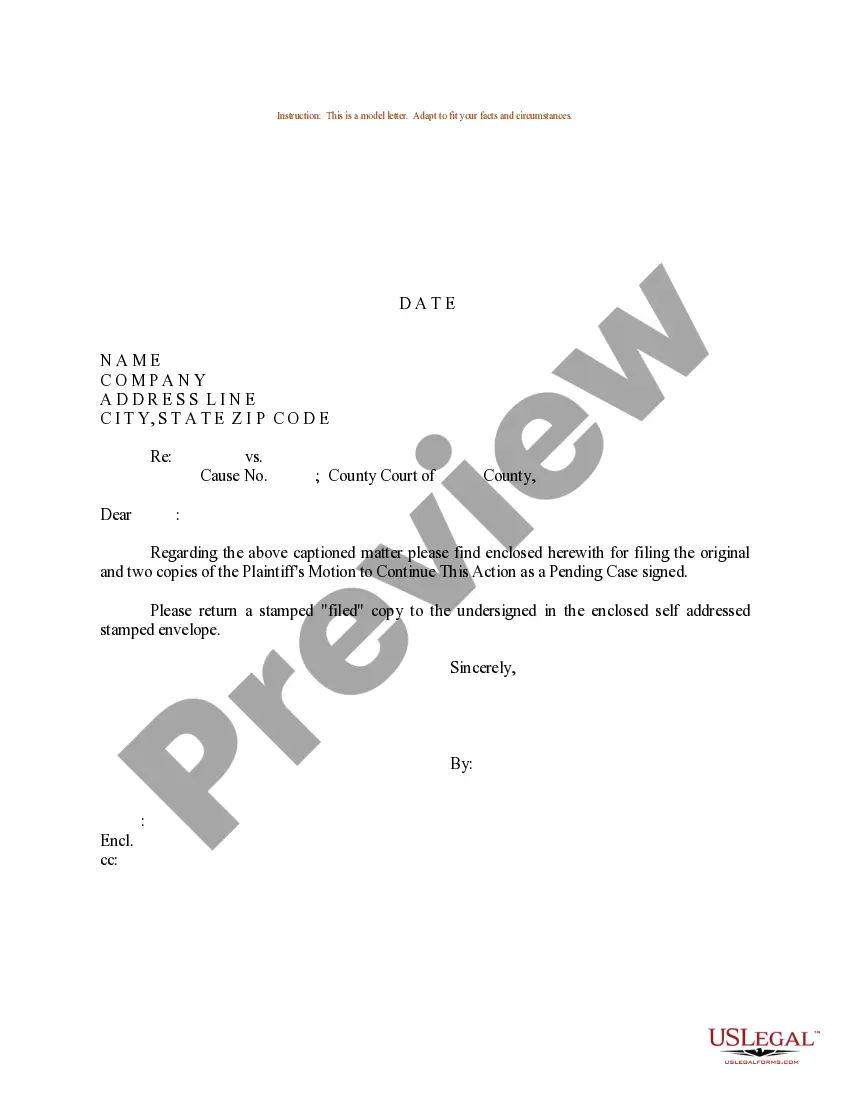

- Very first, make sure that you have chosen the proper record design for your area/city of your choice. See the type outline to ensure you have picked out the right type. If readily available, use the Review key to search from the record design as well.

- If you want to get yet another model of the type, use the Lookup field to discover the design that meets your needs and demands.

- When you have located the design you want, click Acquire now to move forward.

- Find the pricing strategy you want, enter your qualifications, and sign up for an account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal bank account to pay for the lawful type.

- Find the file format of the record and acquire it to your gadget.

- Make adjustments to your record if required. You are able to complete, revise and indication and printing Kentucky Account Stated Between Partners and Termination of Partnership.

Down load and printing 1000s of record themes while using US Legal Forms website, that provides the biggest collection of lawful types. Use skilled and express-distinct themes to take on your company or specific needs.

Form popularity

FAQ

How to Dissolve an LLC in Kentucky in 7 Steps Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... File Articles of Dissolution. ... Notify Tax Agencies and Pay Remaining Taxes. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.

To make payments, the FEIN is required along with the Kentucky Corporate/LLET 6-digit account number.

File with the Secretary of State: When a corporation wishes to cease doing business, Articles of Dissolution must be filed with the Secretary of State if authorized by statute. Articles of Dissolution for a business corporation must comply with KRS 271B.

If you already have a KY Withholding Tax Account Number and an assigned deposit frequency, you can find this online, or on any previous Form K-1 or K-3, or on correspondence from the KY Department of Revenue. If you are unsure, you can contact the KY Department of Revenue at 502-564-3306 or 502-564-7287.

Withholding (income) tax account number from the Department of Revenue. Your KY DOR account number will be 6 digits and can be found on any return (K-1, K-1E, K-3 and K-3E) sent from the Kentucky Department of Revenue. If you have a 9-digit number with 3 leading zeroes, leave the zeroes off.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.

A Kentucky Corporation and/or Limited Liability Company that is no longer operating is required to file a ?final? corporate and/or limited liability entity tax return in order for those tax accounts to be closed; other business tax accounts may be cancelled by utilizing the 10A104 Update to Business Information or ...

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306.