Kentucky Unrestricted Charitable Contribution of Cash

Description

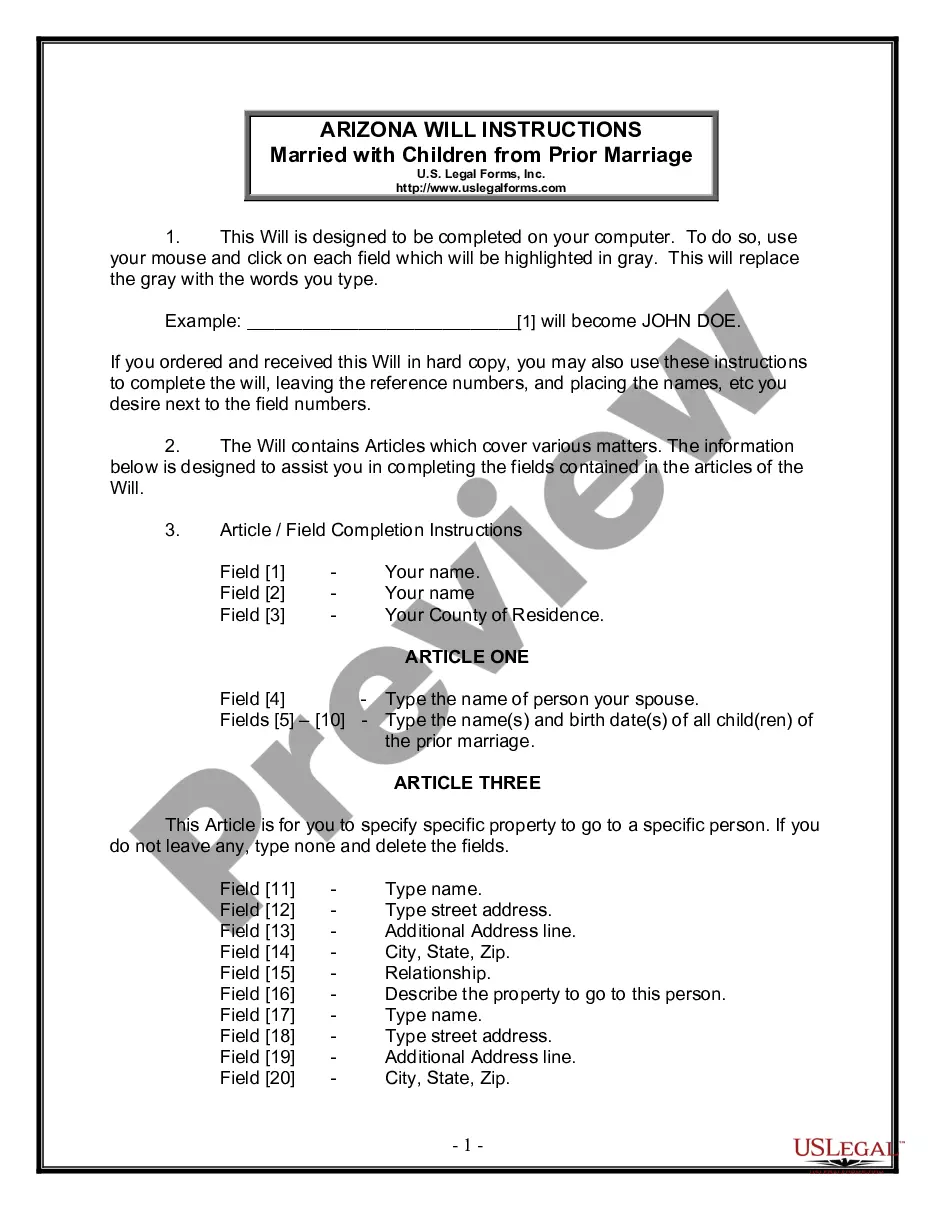

How to fill out Unrestricted Charitable Contribution Of Cash?

You may commit hrs on the Internet looking for the authorized document template that meets the state and federal specifications you require. US Legal Forms offers a large number of authorized kinds which can be analyzed by experts. It is possible to obtain or print out the Kentucky Unrestricted Charitable Contribution of Cash from my service.

If you have a US Legal Forms account, you are able to log in and click on the Download key. Afterward, you are able to total, revise, print out, or sign the Kentucky Unrestricted Charitable Contribution of Cash. Each authorized document template you buy is the one you have for a long time. To have an additional copy for any obtained kind, visit the My Forms tab and click on the related key.

Should you use the US Legal Forms website the very first time, stick to the easy recommendations listed below:

- Initially, be sure that you have chosen the right document template to the area/area that you pick. Look at the kind description to ensure you have picked the appropriate kind. If readily available, use the Preview key to search with the document template also.

- If you want to get an additional variation from the kind, use the Look for field to find the template that suits you and specifications.

- When you have discovered the template you want, click Get now to continue.

- Find the rates strategy you want, type in your accreditations, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You may use your charge card or PayPal account to purchase the authorized kind.

- Find the file format from the document and obtain it to the gadget.

- Make modifications to the document if possible. You may total, revise and sign and print out Kentucky Unrestricted Charitable Contribution of Cash.

Download and print out a large number of document web templates while using US Legal Forms site, which offers the biggest collection of authorized kinds. Use expert and condition-specific web templates to tackle your small business or individual needs.

Form popularity

FAQ

Proof can be provided in the form of an official receipt or invoice from the receiving charitable organization, but can also be provided via credit card statements or other financial records detailing the donation.

For any contribution of $250 or more (including contributions of cash or property), you must obtain and keep in your records a contemporaneous written acknowledgment from the qualified organization indicating the amount of the cash and a description of any property contributed.

If you include a donation that you know is not true, the word for that is "fraud". Once the IRS has determined that you have commited this fraud, they will tear the rest of return apart limb from limb on the assumption that if you are willing to lie about this, you will lie about other things too.

Has the deduction limit for cash charitable contributions been increased to 60% of the Kentucky adjusted gross income? 200bYes. The Tax Cuts and Jobs Act increased the federal limitation threshold for cash contributions and Kentucky adopted that provision.

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

Any donations worth $250 or more must be recognized with a receipt. The charity receiving this donation must automatically provide the donor with a receipt. As a general rule a nonprofit organization should NOT place a value on what is donated (that is the responsibility of the donor).

The availability of charitable and other allowable itemized deductions is limited to resident taxpayers who itemize their federal income tax deductions in DC, GA, ID, KS, LA, ME, MD, MO, NE, NM, ND, OK, SC and VA; other states permit resident taxpayers to itemize state income tax deductions and deduct qualified

The Endow Kentucky Tax Credit allows donors to receive not just a charitable deduction, but also a credit against your Kentucky income taxes. The credit is 20% of your gift, up to $10,000. This means the maximum an individual can give is $50,000, which would allow for a $10,000 tax credit.

Proof can be provided in the form of an official receipt or invoice from the receiving charitable organization, but can also be provided via credit card statements or other financial records detailing the donation.

Most taxpayers can deduct up to $300 in charitable contributions without itemizing deductions.