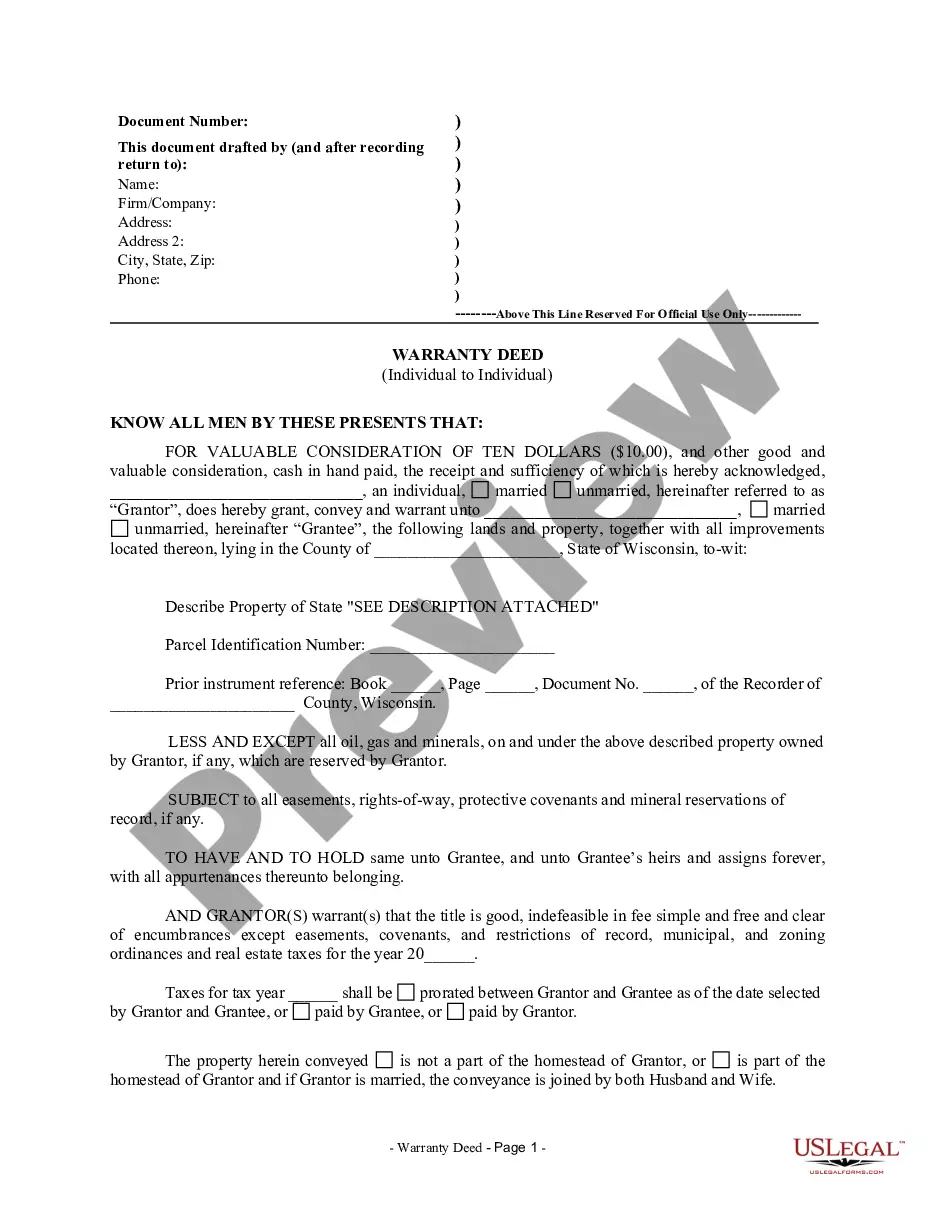

Kentucky Agreement to Sell Partnership Interest to Third Party is a legally binding document that outlines the terms and conditions for the sale of a partnership interest to a third party in the state of Kentucky. This agreement serves as a crucial tool for partners who want to transfer their ownership rights and responsibilities to another individual or entity. The Kentucky Agreement to Sell Partnership Interest to Third Party typically includes key information such as the names and addresses of the parties involved, the effective date of the agreement, specific details about the partnership interest being sold, and the purchase price or consideration involved. This agreement may also address the rights and obligations of both the selling partner and the purchasing party. It may include provisions related to any restrictions on the transfer of partnership interests, consents required from other partners or the partnership itself, and any warranties or representations made by the selling partner regarding the interest being sold. It is important to note that there may be different types or variations of the Kentucky Agreement to Sell Partnership Interest to Third Party, depending on factors such as the nature of the partnership, the specific needs of the parties involved, and any unique state-specific requirements. Some common types or variations of this agreement may include: 1. General Kentucky Agreement to Sell Partnership Interest to Third Party: This is a standard agreement that covers the sale of a partnership interest between two parties, wherein the terms are mutually agreed upon. 2. Limited Partnership Agreement to Sell Partnership Interest to Third Party: This variation is specifically designed for limited partnerships, where a limited partner wishes to sell their interest to a third party. The agreement may include provisions related to the transfer restrictions imposed by the partnership agreement or state laws governing limited partnerships. 3. Kentucky Agreement to Sell Partnership Interest to Third Party with Consent of All Partners: In situations where all partners of the partnership need to provide their consent for the sale of a partnership interest, this agreement variation ensures that all necessary consents are obtained and documented. 4. Kentucky Agreement to Sell Partnership Interest to Third Party with Right of First Refusal: This type of agreement is used when the partnership or other partners have the right of first refusal to purchase the partnership interest being sold. It outlines the specific procedures and timelines for exercise of the right of first refusal. When drafting or using a Kentucky Agreement to Sell Partnership Interest to Third Party, it is crucial to seek legal advice to ensure compliance with state laws and to address any specific requirements or circumstances unique to the partnership at hand.

Kentucky Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Kentucky Agreement To Sell Partnership Interest To Third Party?

You are able to invest time on the Internet attempting to find the legal document template that meets the federal and state specifications you need. US Legal Forms gives a large number of legal types which can be evaluated by pros. You can easily down load or print out the Kentucky Agreement to Sell Partnership Interest to Third Party from my support.

If you already possess a US Legal Forms profile, you are able to log in and click the Download option. Afterward, you are able to comprehensive, revise, print out, or sign the Kentucky Agreement to Sell Partnership Interest to Third Party. Each and every legal document template you acquire is your own eternally. To get one more version of the bought type, check out the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website the first time, follow the basic recommendations below:

- First, ensure that you have chosen the correct document template to the area/city that you pick. Browse the type description to ensure you have picked out the proper type. If accessible, utilize the Preview option to look through the document template as well.

- In order to locate one more variation in the type, utilize the Look for industry to get the template that suits you and specifications.

- After you have located the template you would like, click Acquire now to continue.

- Find the rates prepare you would like, key in your accreditations, and sign up for an account on US Legal Forms.

- Complete the purchase. You can use your bank card or PayPal profile to fund the legal type.

- Find the structure in the document and down load it to your gadget.

- Make adjustments to your document if required. You are able to comprehensive, revise and sign and print out Kentucky Agreement to Sell Partnership Interest to Third Party.

Download and print out a large number of document layouts using the US Legal Forms Internet site, that offers the biggest selection of legal types. Use specialist and status-specific layouts to tackle your organization or personal requirements.

Form popularity

FAQ

A partner can transfer his interest so as to substitute the transferee in his place as the partner, without the consent of all the other partners; a member of company cannot transfer his share to any one he likes.

The gain or loss from the sale of a partnership interest is the difference between the sales proceeds received and the partner's tax basis in the interest at the time of the sale.

A transfer of interest is when title to property or assets switch from one individual to another. This is usually achieved through a sale, though it can also happen through a gift. Transfers of interest typically refer to the exchange of real property, such as a house or apartment complex.

According to the provisions of the Indian Partnership Act, 1932, all the partners are obliged to follow certain rules and regulations and one such rule is that a partner is not allowed to transfer his share to an outsider without the consent of other partners.

How to Sell Limited Partnership InterestRealize the interest's value immediately.Convert a non-functioning tax shelter into cash.Eliminate future k-1 reporting.Avoid ongoing annual payment of income tax on the investment in question.Simplify your tax return and estate planning.More items...?

According to state laws, partnership interests are free to transfer, so the only way a partner might run into difficulties is if there are restrictions in the partnership agreement.

When a partnership interest is sold, gain or loss is determined by the amount of the sale minus the partner's interest, often called the partner's outside basis.

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.

Here's an overview of what those steps entail:Review your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.