The Kentucky Agreement for Sale of Cattle is a legally binding document that serves as a contract between the buyers and sellers of cattle in the state of Kentucky. It outlines the terms and conditions that both parties agree upon regarding the sale, purchase, and delivery of cattle. This agreement is commonly used in the agricultural industry, particularly among cattle farmers, ranchers, and livestock traders. It acts as a safeguard to ensure a smooth transaction and to protect the rights and responsibilities of both parties involved. The key elements typically included in a Kentucky Agreement for Sale of Cattle are: 1. Identification of Parties: The agreement will start by clearly identifying the buyer and seller involved in the transaction. This includes their full legal names, addresses, and contact information. 2. Description of Cattle: Accurate details regarding the cattle being sold are crucial. This includes specifications such as the breed, age, sex, registration numbers (if applicable), and any unique markings or characteristics that distinguish the animals. 3. Purchase Price: The agreement should state the agreed-upon purchase price for the cattle. This includes whether it is a lump sum or a per-head price. It may also mention any additional costs or expenses that will be the responsibility of either party. 4. Payment Terms: This section outlines the payment method, due date, and any additional conditions related to the transfer of funds. It is important to specify whether payment will be made in full or with partial payments at specific intervals. 5. Delivery, Inspection, and Risk of Loss: The agreement should indicate the location, date, and method of delivery for the cattle. It may also address the responsibility for transportation costs and who will bear the risk of loss during transit. Additionally, it may include provisions for the buyer to inspect the cattle upon arrival to ensure they meet the agreed-upon criteria. 6. Warranties and Representations: Both parties may include warranties and representations pertaining to the health, vaccinations, freedom from diseases, or temperament of the cattle. These clauses protect the buyer if the cattle do not meet the agreed-upon standards or if any misrepresentation occurs. 7. Governing Law and Venue: This section specifies the legal jurisdiction that will be applicable to the agreement. In the case of a dispute, the agreement may identify the specific county or state where legal proceedings will be held. Different types of Kentucky Agreement for Sale of Cattle may include variations depending on the specific circumstances or preferences of the parties involved. For example: — Kentucky Agreement for Sale of Registered Cattle: This type of agreement is used when dealing specifically with registered or purebred cattle, where registration details become more essential. — Kentucky Agreement for Sale of Calves: This variation pertains to the purchase and sale of young cattle, typically those less than a year old, focusing on specific considerations and care. — Kentucky Agreement for Consignment Sale of Cattle: This type of agreement is used when a third party (consignor) sells cattle on behalf of the owner (consignee), outlining the terms and responsibilities of all parties involved. It is essential for both buyers and sellers to carefully review and understand the terms of any Kentucky Agreement for Sale of Cattle before entering into the transaction. It is recommended to consult legal professionals to ensure compliance with relevant laws and regulations in Kentucky.

Kentucky Agreement for Sale of Cattle

Description

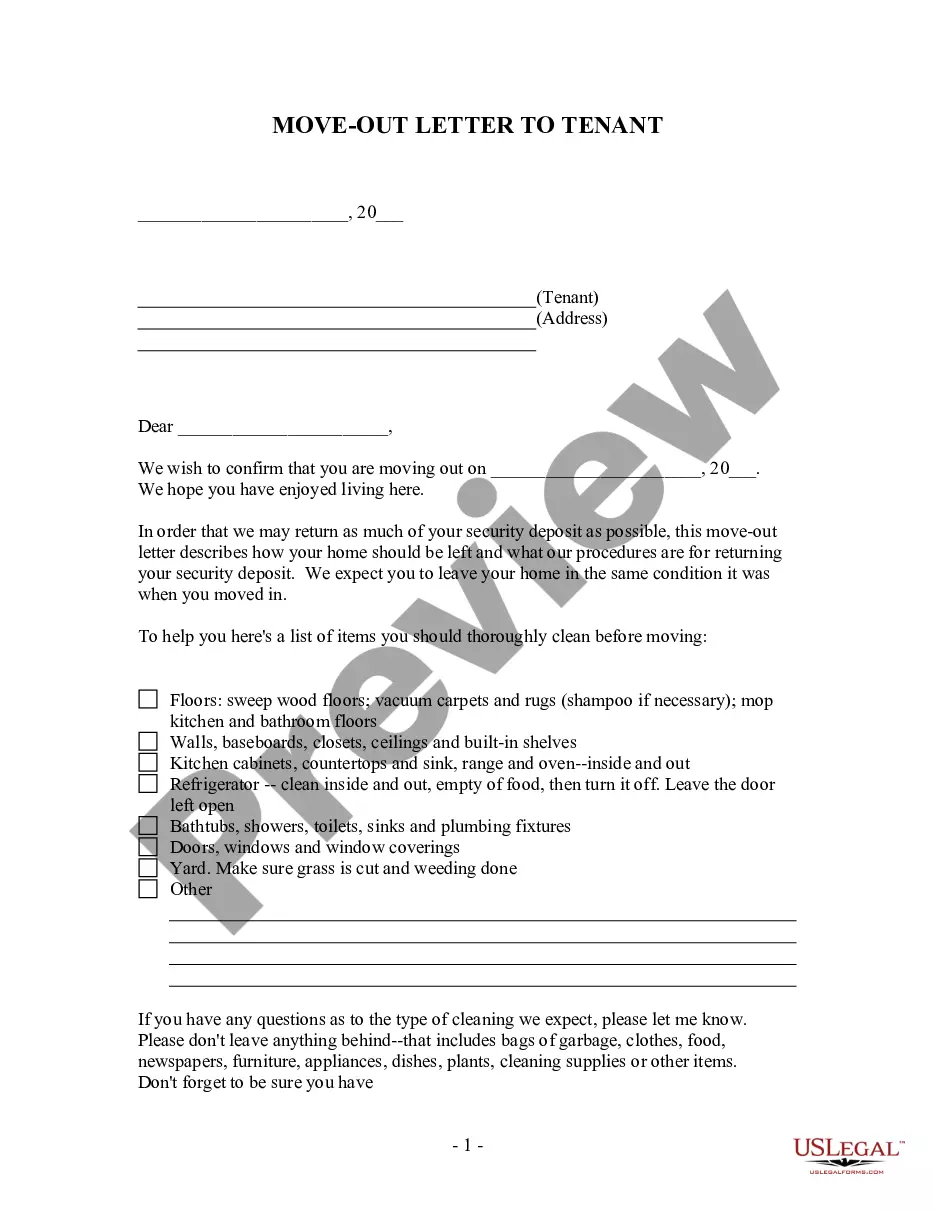

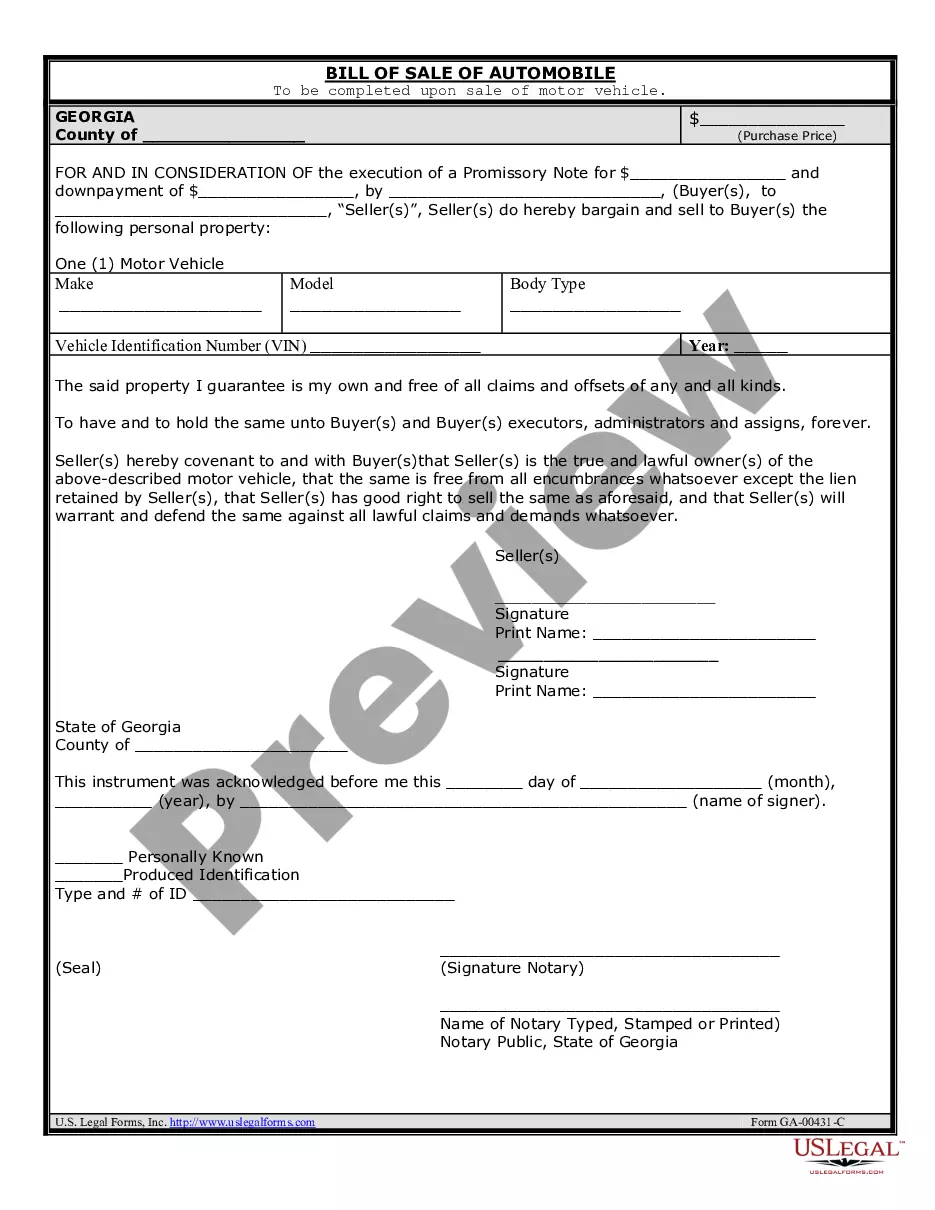

How to fill out Kentucky Agreement For Sale Of Cattle?

If you wish to comprehensive, obtain, or print out legal file themes, use US Legal Forms, the biggest assortment of legal varieties, that can be found on the Internet. Use the site`s simple and easy practical search to find the files you require. Numerous themes for company and specific uses are categorized by groups and says, or key phrases. Use US Legal Forms to find the Kentucky Agreement for Sale of Cattle in just a couple of clicks.

When you are previously a US Legal Forms buyer, log in for your bank account and then click the Down load switch to find the Kentucky Agreement for Sale of Cattle. You can even entry varieties you earlier acquired from the My Forms tab of the bank account.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that proper area/region.

- Step 2. Utilize the Review method to check out the form`s content. Do not forget to read through the description.

- Step 3. When you are unhappy with the type, take advantage of the Lookup area on top of the display to discover other types from the legal type web template.

- Step 4. Once you have identified the shape you require, click on the Acquire now switch. Choose the prices strategy you like and add your credentials to register for an bank account.

- Step 5. Procedure the financial transaction. You can use your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Pick the format from the legal type and obtain it on your own device.

- Step 7. Comprehensive, revise and print out or indication the Kentucky Agreement for Sale of Cattle.

Every single legal file web template you get is yours forever. You might have acces to every type you acquired within your acccount. Click on the My Forms segment and pick a type to print out or obtain once more.

Compete and obtain, and print out the Kentucky Agreement for Sale of Cattle with US Legal Forms. There are millions of expert and state-specific varieties you can utilize for your company or specific needs.

Form popularity

FAQ

??In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead exemption.

The list provided in this subsection shall serve as examples of items the sale or purchase of which shall be exempt from sales and use tax: (a) Batteries; Page 5 Legislative Research Commission PDF Version Page: 5 (b) Bolts; (c) Chain saw repair parts; (d) Cutting parts; (e) Fan belts; (f) Farm machinery filters; (g) ...

?Yes, effective July 1, 2018, both parts and labor are subject to the 6% Kentucky sales tax.

The application Form 51A800 is currently available on the Department of Revenue website here: (4-21)_fill-in.pdf. The application requires verification of agricultural activity.

Ing to KRS 132.010 (9) "Agricultural land" means: Any tract of land, including all income-producing improvements, of at least ten contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or other crops including timber.

Promoting a Strong Agricultural Base in Kentucky Farmers wanting to sell agricultural land and assets may be eligible for a Kentucky income tax credit up to 5% of the purchase price of qualifying agricultural assets, subject to a $25,000 calendar year cap and a $100,000 lifetime cap.

Tax-exempt customers Some customers are exempt from paying sales tax under Kentucky law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Any tract of land, including all income-producing improvements, of at least ten contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or other crops including timber.