Kentucky Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

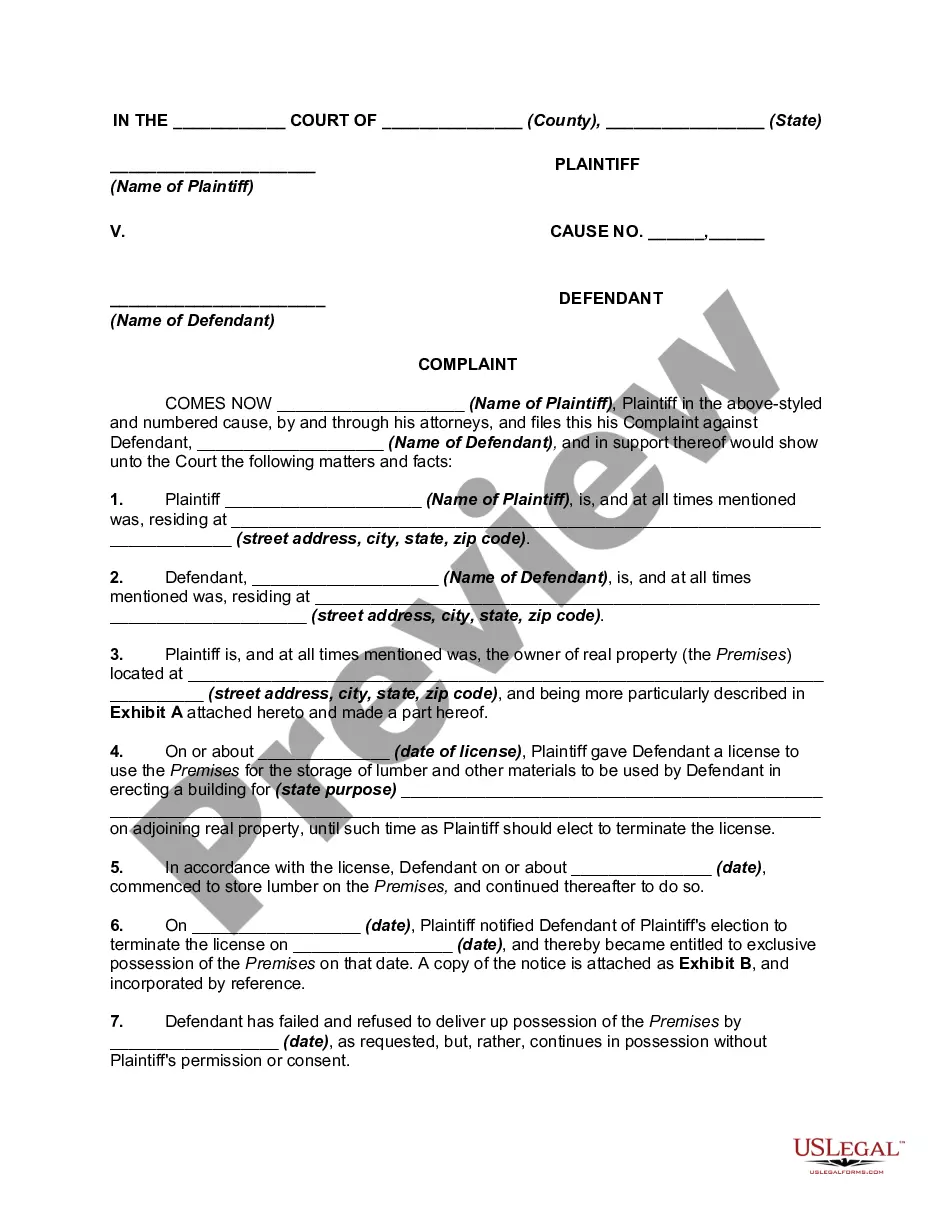

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

US Legal Forms - one of several greatest libraries of legal kinds in America - offers a variety of legal file templates it is possible to obtain or print out. Using the internet site, you may get 1000s of kinds for organization and person purposes, sorted by categories, suggests, or search phrases.You can get the newest types of kinds just like the Kentucky Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse in seconds.

If you currently have a monthly subscription, log in and obtain Kentucky Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse from your US Legal Forms local library. The Acquire option will appear on every single develop you look at. You have access to all previously acquired kinds inside the My Forms tab of the profile.

If you want to use US Legal Forms initially, allow me to share straightforward guidelines to get you started out:

- Ensure you have selected the proper develop for your personal area/state. Select the Review option to check the form`s content. Browse the develop explanation to ensure that you have selected the appropriate develop.

- When the develop doesn`t match your specifications, use the Look for industry on top of the display screen to discover the one that does.

- If you are content with the form, affirm your decision by visiting the Purchase now option. Then, pick the rates prepare you want and provide your accreditations to sign up for the profile.

- Process the purchase. Make use of bank card or PayPal profile to accomplish the purchase.

- Pick the formatting and obtain the form in your product.

- Make changes. Load, change and print out and indication the acquired Kentucky Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Every single format you included in your account lacks an expiration day and is your own property permanently. So, if you would like obtain or print out one more version, just visit the My Forms segment and click in the develop you require.

Obtain access to the Kentucky Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms, probably the most considerable local library of legal file templates. Use 1000s of expert and express-particular templates that satisfy your organization or person requires and specifications.

Form popularity

FAQ

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

TESTAMENTARY TRUST These trusts can have many names including: Bypass Trust, Family Trust, Children's Trust, Residuary Trust or QTIP (Second Marriage Trust). Testamentary Trusts are typically created to provide support for surviving spouses, children or family groups.

The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction. This interspousal transfer can occur during the couple's lifetime or after one spouse's death, ing to a will.

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.