Kentucky Resolution of Meeting of LLC Members to Increase the Number of Members and Specify the Conditions of Membership

Description

How to fill out Resolution Of Meeting Of LLC Members To Increase The Number Of Members And Specify The Conditions Of Membership?

Finding the right legitimate file web template could be a struggle. Needless to say, there are a lot of themes available on the Internet, but how would you find the legitimate type you need? Utilize the US Legal Forms site. The service provides a large number of themes, like the Kentucky Resolution of Meeting of LLC Members to Increase the Number of Members and Specify the Conditions of Membership, that you can use for business and private needs. All of the varieties are checked by professionals and satisfy state and federal requirements.

If you are currently signed up, log in to the accounts and click on the Download button to get the Kentucky Resolution of Meeting of LLC Members to Increase the Number of Members and Specify the Conditions of Membership. Use your accounts to check from the legitimate varieties you possess acquired in the past. Go to the My Forms tab of the accounts and have another duplicate in the file you need.

If you are a brand new customer of US Legal Forms, allow me to share simple instructions so that you can adhere to:

- Initial, be sure you have selected the correct type to your town/county. You may examine the form using the Review button and look at the form outline to make certain it will be the right one for you.

- In case the type will not satisfy your needs, utilize the Seach discipline to get the proper type.

- When you are sure that the form is proper, select the Acquire now button to get the type.

- Pick the rates plan you want and type in the necessary info. Design your accounts and pay money for your order using your PayPal accounts or bank card.

- Choose the data file formatting and download the legitimate file web template to the product.

- Complete, edit and print and indicator the acquired Kentucky Resolution of Meeting of LLC Members to Increase the Number of Members and Specify the Conditions of Membership.

US Legal Forms is the biggest local library of legitimate varieties in which you can see different file themes. Utilize the company to download skillfully-created paperwork that adhere to condition requirements.

Form popularity

FAQ

A single member LLC whose single member is an individual, estate, trust, or general partnership must file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ) to report and pay any LLET that is due.

Do I need to file a Kentucky tax return? A. No, you do not have a filing requirement with Kentucky because your modified gross income is not greater than $12,880; however, you will need to file a return to claim a refund of any Kentucky income tax withheld.

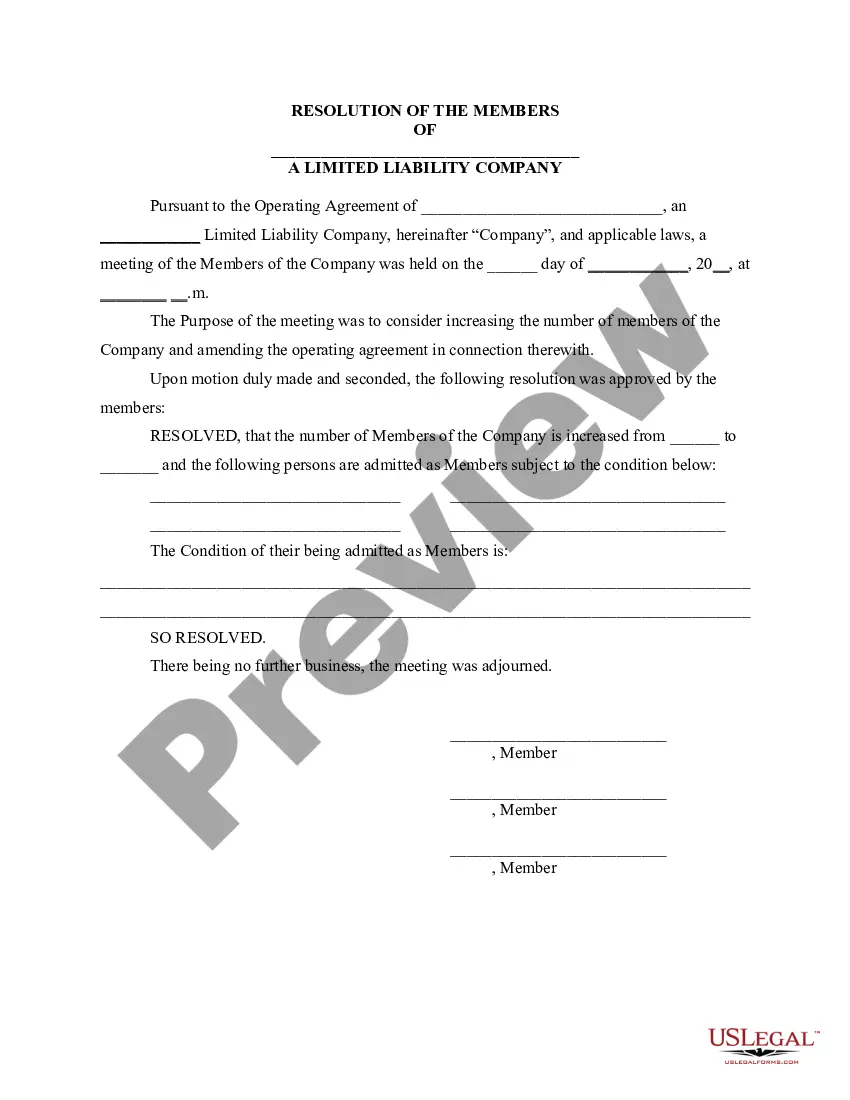

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Kentucky's limited liability entity tax applies to traditional corporations, S corporations, LLCs, limited partnerships (LPs), and limited liability partnerships (LLPs). The tax is based on a business's annual gross receipts. For businesses with gross receipts less than $3 million, there is a minimum LLET of $175.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

By default, LLCs themselves do not pay federal income taxes, only their members do. Kentucky, however, imposes a Limited Liability Entity Tax (LLET) on LLCs that have more than $3 million in gross receipts or profits.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

The LLET may be calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. A minimum tax of $175 applies regardless of the method used. Sole proprietorships and pass-through entities are exempt from state corporate income taxes.

When you add a new member to a single-member LLC, the LLC becomes a partnership for federal tax rules. This event occurs automatically under federal tax rules. Many people mistakenly file a Form 8832 to elect a partnership classification, which is an incorrect filing and unnecessary.

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.