The Kentucky Resolution of Meeting of LLC Members to Sell Assets is a legal document that outlines the process and decisions made by the members of a limited liability company (LLC) in Kentucky regarding the sale of the company's assets. This resolution serves as a formal agreement and record of the LLC members' decision-making process. Keywords: Kentucky, resolution, meeting, LLC members, sell assets There are different types of Kentucky Resolution of Meeting of LLC Members to Sell Assets based on various factors such as the type of assets being sold, the LLC's specific requirements, or the purpose of the sale. Here are a few common types: 1. Standard Resolution of Meeting of LLC Members to Sell Assets: This type of resolution is used when the LLC members decide to sell the company's assets to generate revenue, restructure the business, or liquidate the LLC's assets. 2. Resolution of Meeting of LLC Members to Sell Real Estate Assets: In cases where the LLC owns real estate properties, this specific resolution is drafted to address the sale of these properties. It may include provisions regarding property evaluations, listing agreements, buyer selection, and the distribution of proceeds among the LLC members. 3. Resolution of Meeting of LLC Members to Sell Intellectual Property Assets: CCS that hold valuable intellectual properties such as patents, trademarks, or copyrights may have a specialized resolution for the sale of these assets. This resolution may outline the valuation, transfer process, and any license agreements associated with the intellectual property. 4. Resolution of Meeting of LLC Members to Sell Business Assets: When an LLC intends to sell its entire business, including both tangible and intangible assets, a comprehensive resolution is formulated. This resolution addresses not only the sale of physical assets like inventory, equipment, or vehicles but also transfer of contracts, leases, goodwill, and other intangible business assets. 5. Resolution of Meeting of LLC Members to Sell Specific Assets: Sometimes, an LLC decides to sell only specific assets, such as a subsidiary, a division, or a particular investment. In such cases, a customized resolution is created that focuses solely on the sale and transfer of those specific assets. These different types of Kentucky Resolution of Meeting of LLC Members to Sell Assets cater to the specific needs and circumstances of the LLC, ensuring a clear and legally binding record of the members' agreement to sell assets. It is crucial to consult an attorney or legal expert to ensure compliance with all applicable laws and regulations during the drafting and execution process.

Kentucky Resolution of Meeting of LLC Members to Sell Assets

Description

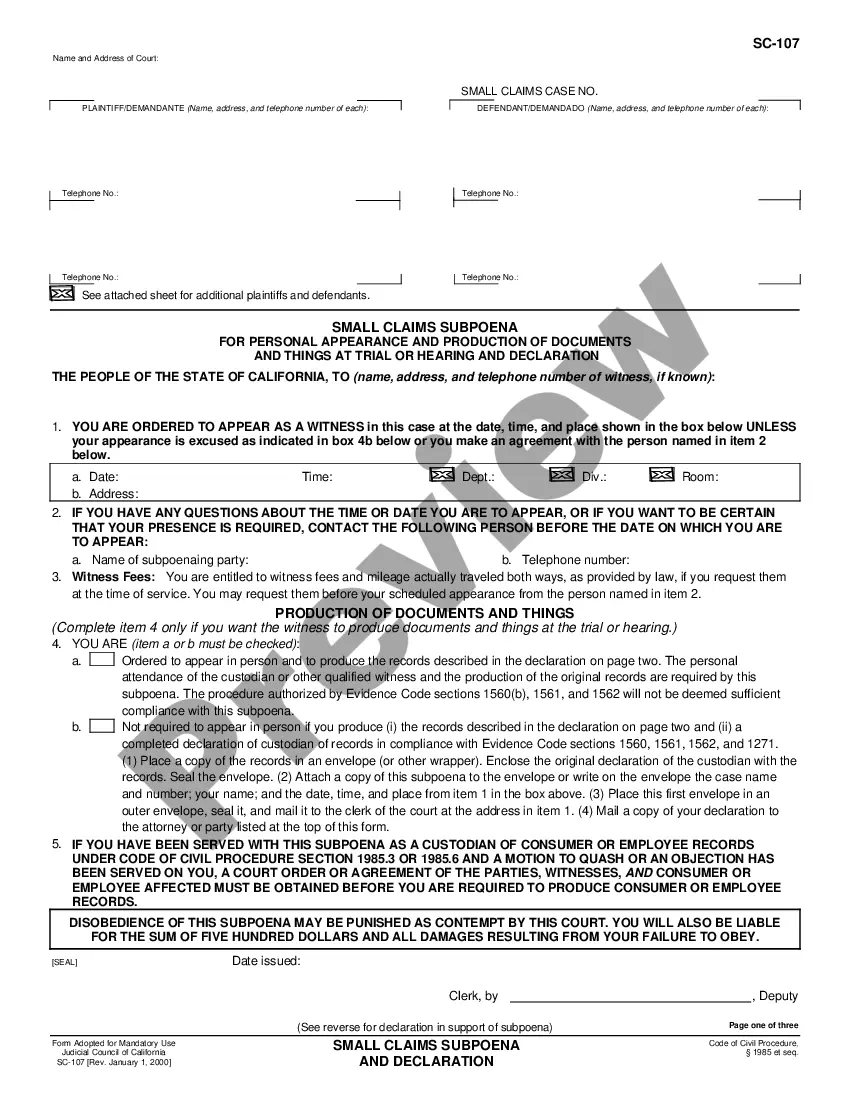

How to fill out Kentucky Resolution Of Meeting Of LLC Members To Sell Assets?

It is possible to commit hours on the web trying to find the legitimate file design which fits the federal and state needs you need. US Legal Forms supplies a huge number of legitimate types which can be examined by professionals. You can actually acquire or print the Kentucky Resolution of Meeting of LLC Members to Sell Assets from our assistance.

If you have a US Legal Forms bank account, you may log in and click on the Obtain key. Afterward, you may total, edit, print, or sign the Kentucky Resolution of Meeting of LLC Members to Sell Assets. Each legitimate file design you buy is your own for a long time. To have one more duplicate associated with a bought develop, check out the My Forms tab and click on the corresponding key.

If you use the US Legal Forms website the first time, keep to the easy directions below:

- Very first, make sure that you have selected the best file design to the state/metropolis that you pick. See the develop description to ensure you have picked the right develop. If accessible, use the Preview key to search throughout the file design also.

- If you want to get one more version in the develop, use the Look for discipline to obtain the design that fits your needs and needs.

- When you have identified the design you want, simply click Get now to proceed.

- Find the pricing prepare you want, type your qualifications, and register for an account on US Legal Forms.

- Comprehensive the deal. You should use your bank card or PayPal bank account to cover the legitimate develop.

- Find the structure in the file and acquire it to your product.

- Make changes to your file if required. It is possible to total, edit and sign and print Kentucky Resolution of Meeting of LLC Members to Sell Assets.

Obtain and print a huge number of file themes utilizing the US Legal Forms Internet site, which offers the most important assortment of legitimate types. Use skilled and state-particular themes to deal with your organization or specific needs.

Form popularity

FAQ

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

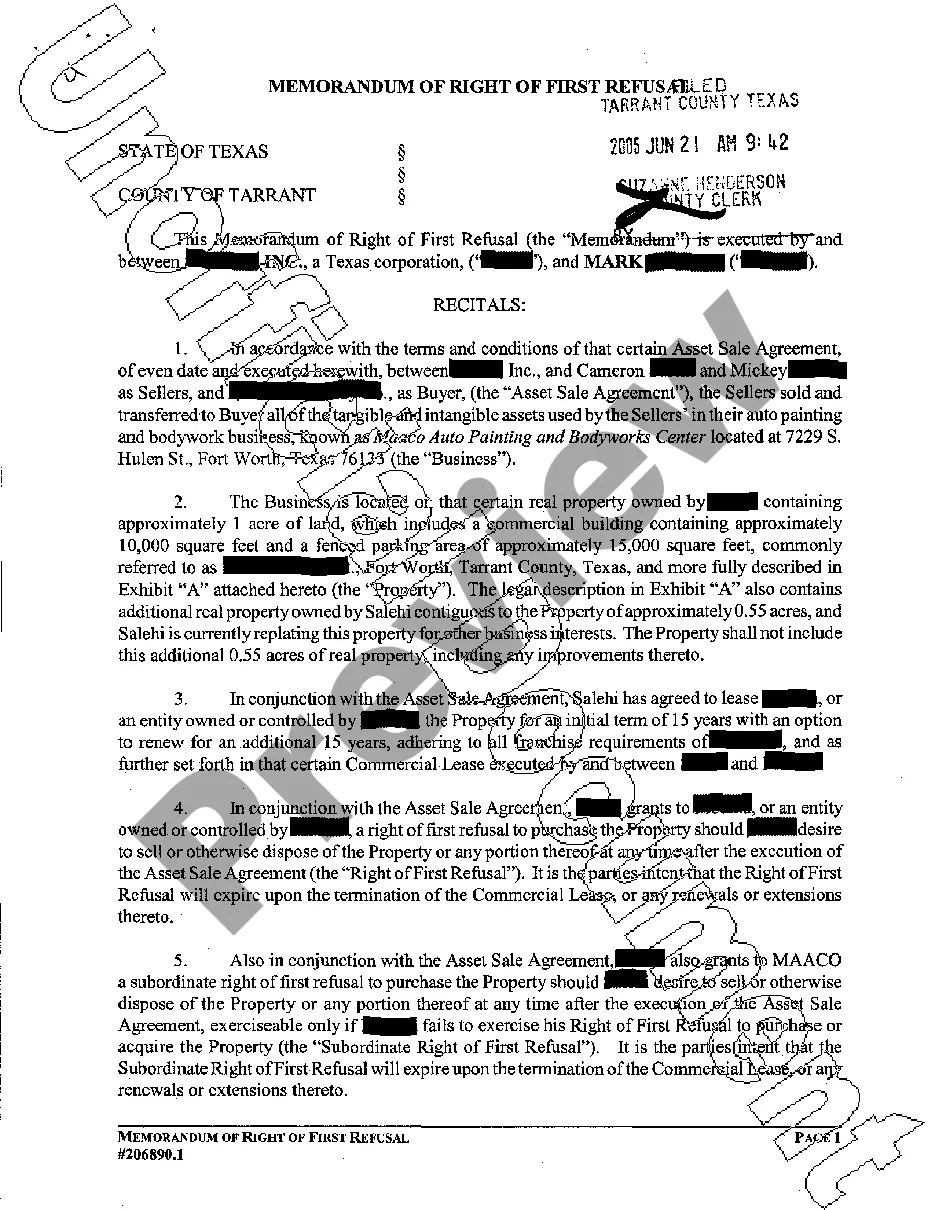

In the event that a company decides to sell its property, it will require a corporate resolution to sell real estate. This is a straightforward document that cites the name of the buyer and the location of the company's property. The location of the real estate sold may be at a street address, section, block, or lot.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

Elements of a Certified Board ResolutionExplanation of the action being taken by the board of directors and the reason for doing so. Name of the secretary. Legal name of the corporation and state of incorporation. Names of the board of directors voting for approval of the resolution.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

A corporate resolution form is used by a board of directors. Its purpose is to provide written documentation that a business is authorized to take specific action. This form is most often used by limited liability companies, s-corps, c-corps, and limited liability partnerships.