Kentucky Involuntary Petition Against a Non-Individual

Description

How to fill out Involuntary Petition Against A Non-Individual?

If you want to full, down load, or printing authorized document web templates, use US Legal Forms, the largest assortment of authorized kinds, that can be found on-line. Take advantage of the site`s simple and easy practical look for to discover the documents you want. Different web templates for business and specific uses are categorized by types and says, or key phrases. Use US Legal Forms to discover the Kentucky Notice to Creditors and Other Parties in Interest - B 205 with a couple of click throughs.

Should you be previously a US Legal Forms client, log in to your account and then click the Down load option to get the Kentucky Notice to Creditors and Other Parties in Interest - B 205. You may also access kinds you in the past delivered electronically from the My Forms tab of the account.

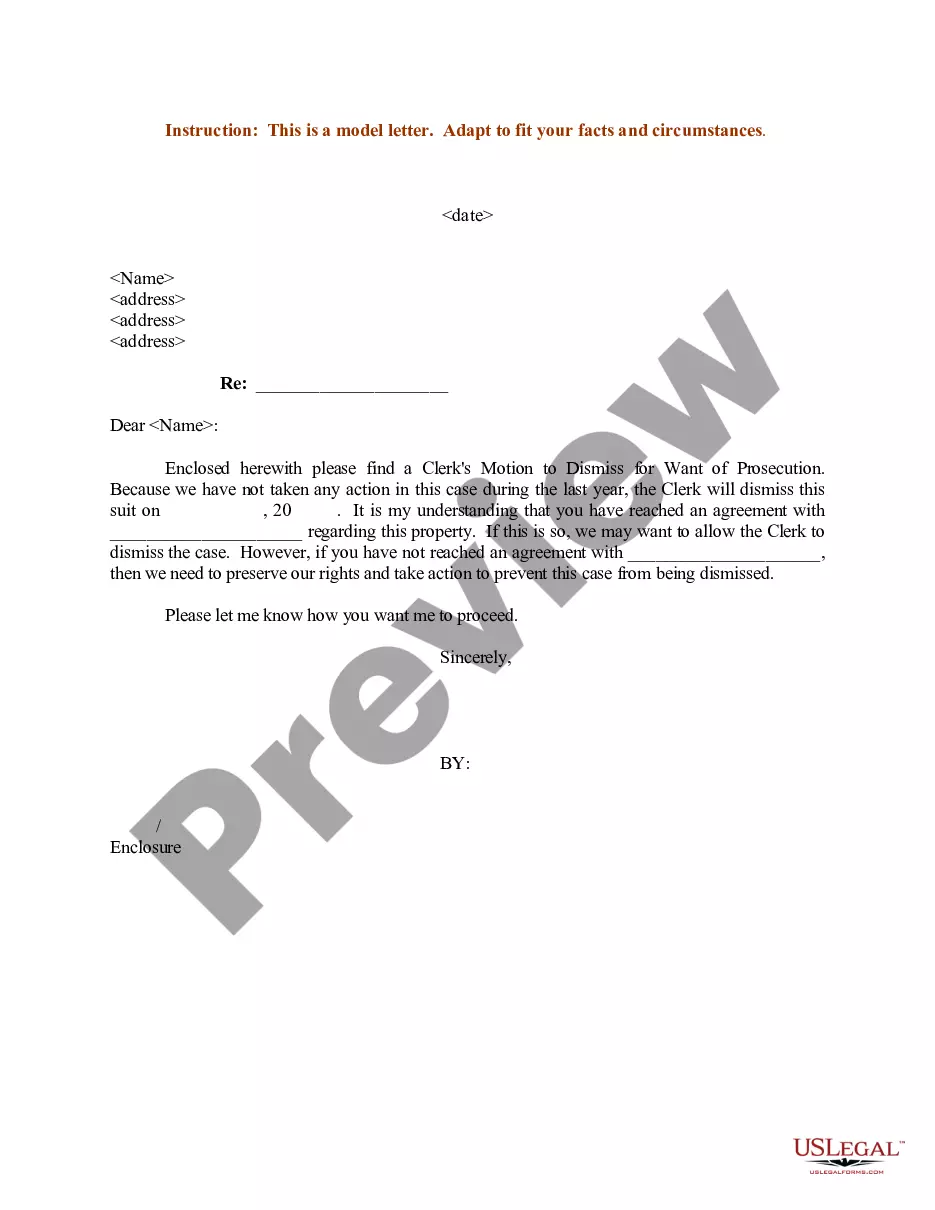

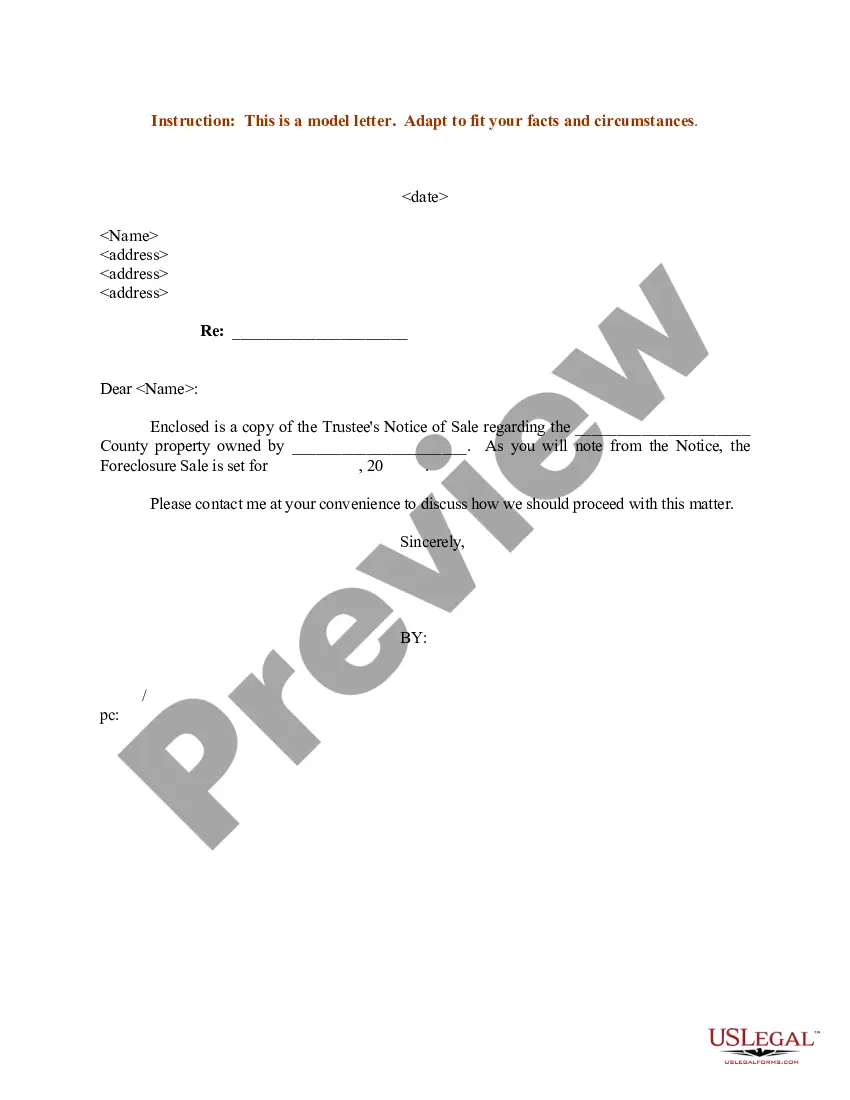

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for the right city/country.

- Step 2. Make use of the Preview choice to check out the form`s content. Never forget to learn the outline.

- Step 3. Should you be not satisfied together with the type, use the Search discipline at the top of the display screen to get other versions of the authorized type design.

- Step 4. Upon having located the form you want, click the Acquire now option. Choose the prices plan you choose and include your qualifications to sign up for an account.

- Step 5. Method the transaction. You should use your charge card or PayPal account to finish the transaction.

- Step 6. Find the format of the authorized type and down load it on your product.

- Step 7. Full, change and printing or indicator the Kentucky Notice to Creditors and Other Parties in Interest - B 205.

Every authorized document design you get is yours eternally. You may have acces to each and every type you delivered electronically in your acccount. Select the My Forms segment and pick a type to printing or down load once more.

Compete and down load, and printing the Kentucky Notice to Creditors and Other Parties in Interest - B 205 with US Legal Forms. There are millions of skilled and status-particular kinds you can use for your business or specific demands.

Form popularity

FAQ

Debts have different degrees of priority. The debts that must be repaid in Chapter 13 are priority debts including child support, alimony, certain taxes, and wages owed to employees. Your plan must also address your secured debts. Secured debts are those that are secured by collateral, such as a mortgage or car loan.

Debts dischargeable in a chapter 13, but not in chapter 7, include debts for willful and malicious injury to property (as opposed to a person), debts incurred to pay nondischargeable tax obligations, and debts arising from property settlements in divorce or separation proceedings.

Unsecured priority debts include recent income tax debts, past due child support, past due spousal support and other past due domestic support obligations. Also included are administrative expenses.

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

Absolute Priority Rule (APR) in Bankruptcy Code Therefore, lower priority claim holders are not entitled to any recovery unless each class of higher ranking received full recovery ? the remaining creditors receive either partial or no recoveries.

What are priority debts? Priority debts are those that carry the most serious consequences if you don't pay them. These don't have to be the largest or debts with the most expensive interest rates, but if you don't pay them it could lead to serious problems. Priority debts include: court fines.