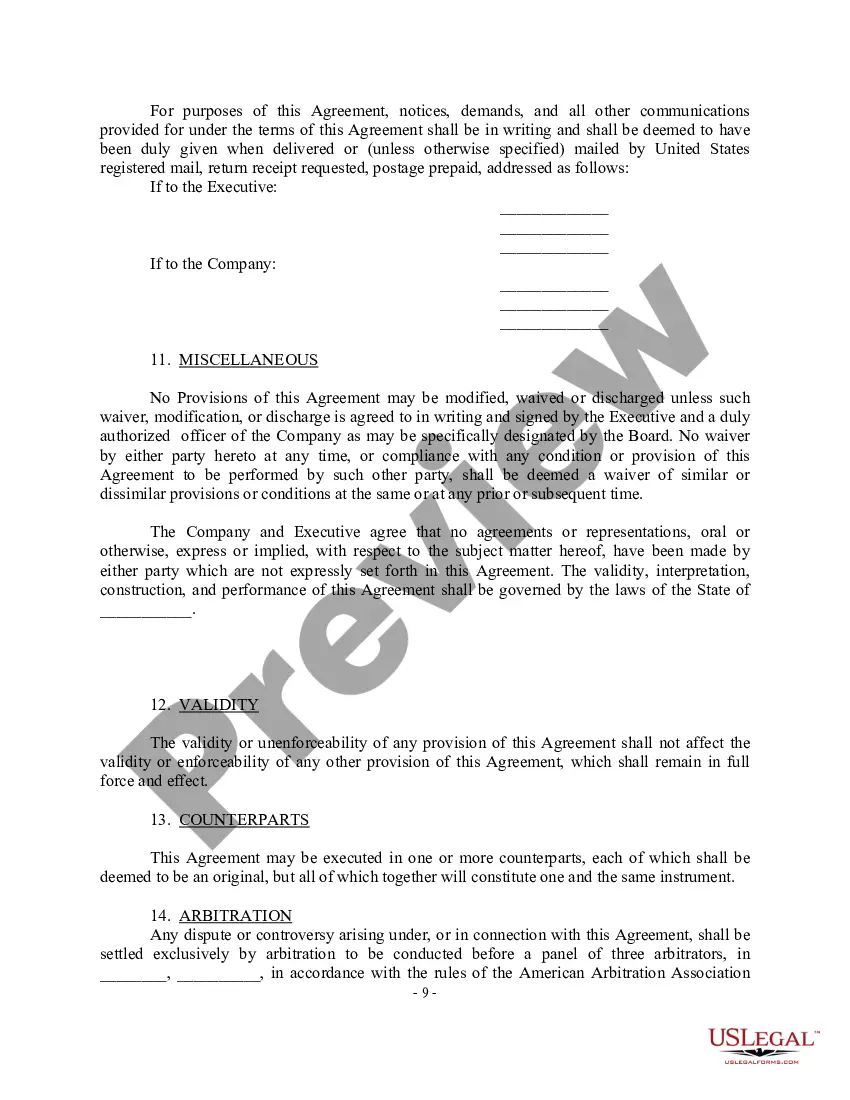

Kentucky Amendment to Section 5(c) of Employment Agreement with copy of Agreement - Blank

Description

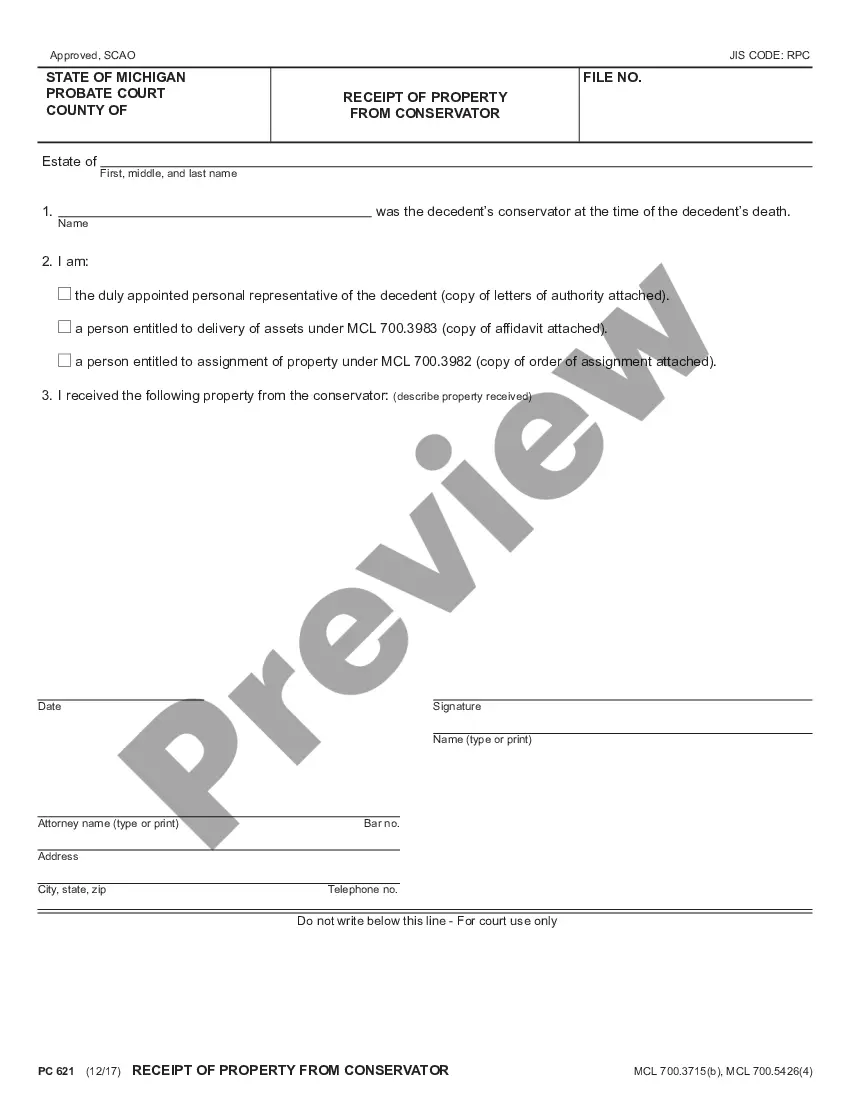

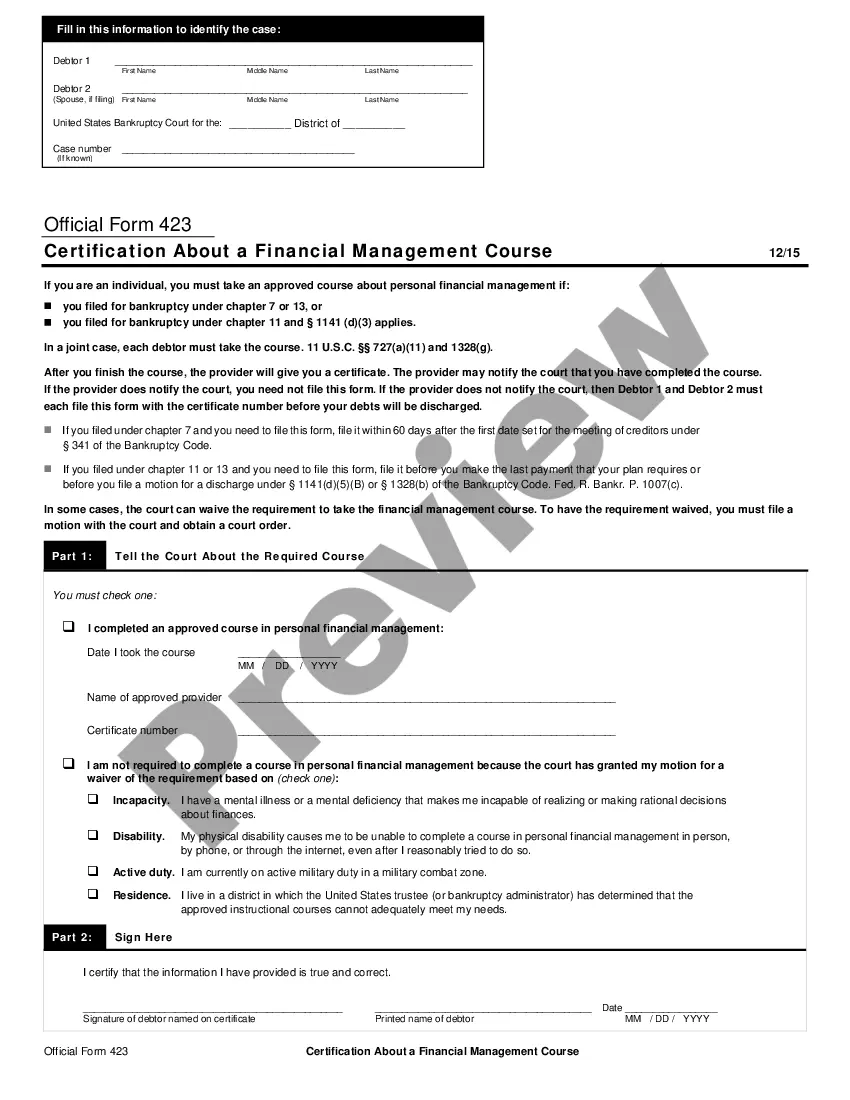

How to fill out Kentucky Amendment To Section 5(c) Of Employment Agreement With Copy Of Agreement - Blank?

If you have to complete, obtain, or print out lawful file layouts, use US Legal Forms, the most important collection of lawful kinds, that can be found online. Use the site`s simple and practical look for to obtain the paperwork you require. Numerous layouts for business and specific functions are categorized by categories and claims, or key phrases. Use US Legal Forms to obtain the Kentucky Amendment to Section 5(c) of Employment Agreement with copy of Agreement - Blank with a couple of click throughs.

In case you are previously a US Legal Forms consumer, log in to your account and then click the Download switch to find the Kentucky Amendment to Section 5(c) of Employment Agreement with copy of Agreement - Blank. You can even access kinds you in the past acquired from the My Forms tab of your account.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that correct area/region.

- Step 2. Make use of the Preview choice to look over the form`s articles. Don`t neglect to learn the information.

- Step 3. In case you are not satisfied with the type, take advantage of the Look for area towards the top of the screen to discover other models in the lawful type format.

- Step 4. Once you have discovered the form you require, click on the Acquire now switch. Select the pricing strategy you prefer and add your qualifications to sign up for the account.

- Step 5. Method the transaction. You may use your bank card or PayPal account to finish the transaction.

- Step 6. Find the file format in the lawful type and obtain it on your own product.

- Step 7. Comprehensive, edit and print out or indication the Kentucky Amendment to Section 5(c) of Employment Agreement with copy of Agreement - Blank.

Each lawful file format you purchase is your own eternally. You may have acces to each and every type you acquired within your acccount. Click on the My Forms segment and decide on a type to print out or obtain again.

Compete and obtain, and print out the Kentucky Amendment to Section 5(c) of Employment Agreement with copy of Agreement - Blank with US Legal Forms. There are many professional and express-distinct kinds you can use to your business or specific requires.

Form popularity

FAQ

10A100(P) (06-21) Employer's Withholding Tax Account. Sales and Use Tax Account/Permit. Transient Room Tax Account. Motor Vehicle Tire Fee Account.

The withholding rate is at the maximum rate provided in KRS 141.020 or KRS 141.040. A partner, member, or shareholder may be exempt from withholding if an appropriate tax return was filed for the prior year.

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.

A sales tax permit can be obtained by filling out the Kentucky Tax Registration Application online through the Kentucky Business One Stop or by mailing in the 10A100 Form. Information needed to register includes: Effective date of a business starting, hiring employees or selling products, or offering taxable services.

200bThe best way to access company account numbers is via Kentucky One Stop Business Portal. Another way would be if the interested party is listed on form 20A100 (Power of Attorney/Declaration of Representative) on file with the Department of Revenue.

You can register for your Kentucky sales tax license online at the Kentucky Business One Stop Portal. Or file by paper using the Kentucky 10A100 form. You can also register for a sales tax permit when you register your business.

The KY ID in box 15 where it states State employer ID is 6 digits for KY. But, there are KY companies that only print out five digits on the W-2. Check to see if your entry is 5 digits instead of 6. If on the W-2 you only see five digits, then add a zero in front of the number in TurboTax.

You may be exempt from withholding for 2021 if both the following apply: 20, you had a right to a refund of all Kentucky income tax withheld because you had no Kentucky income tax. liability, and. 20, you expect a refund of all your Kentucky income tax withheld.

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck. The Internal Revenue Service (IRS) Form W-4 is used to calculate and claim withholding allowances.