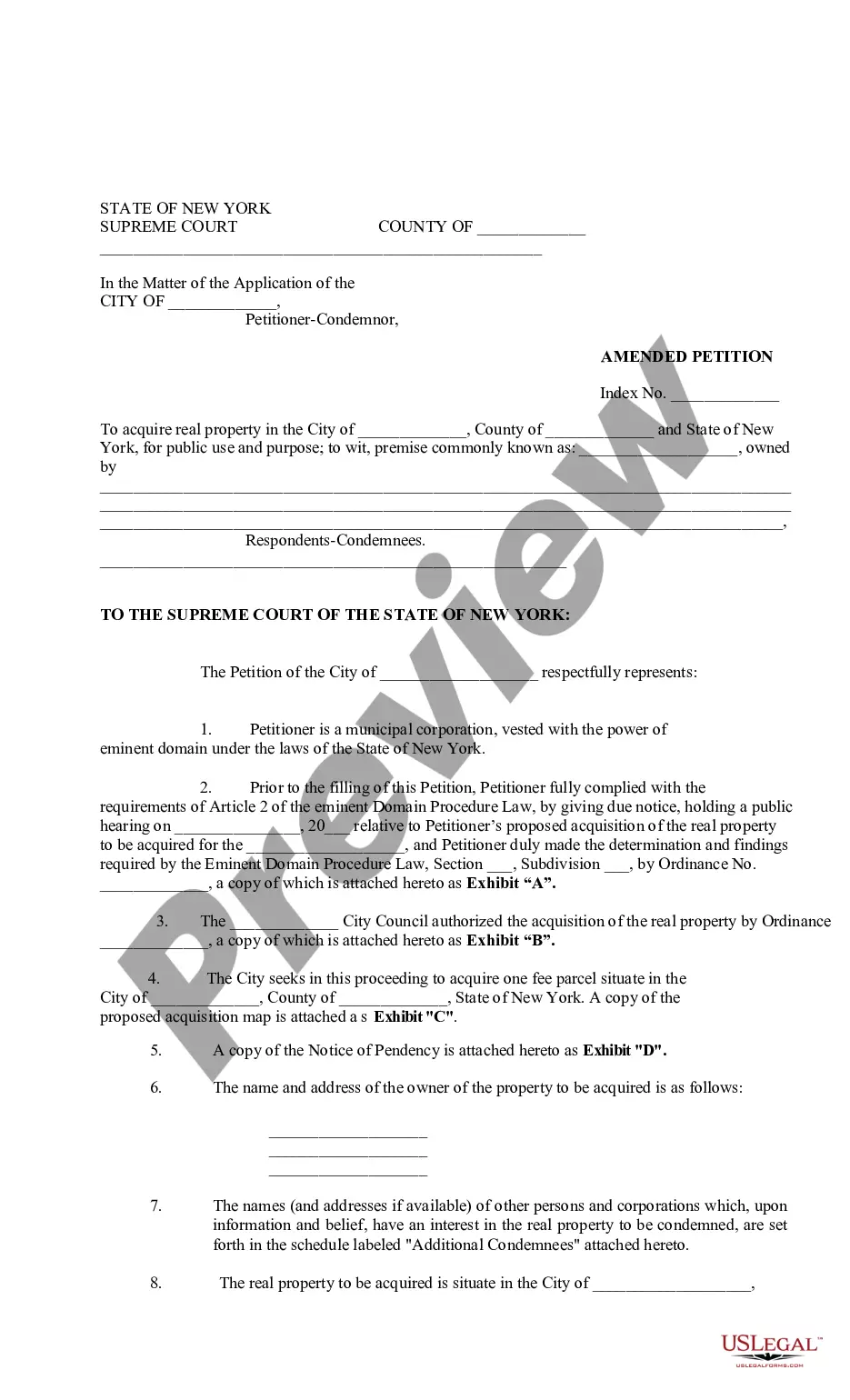

Kentucky Agreement and Plan of Merger by General Homes Corp and General Homes Management Corp

Description

How to fill out Agreement And Plan Of Merger By General Homes Corp And General Homes Management Corp?

Choosing the best authorized file format could be a struggle. Needless to say, there are plenty of web templates available online, but how will you discover the authorized develop you need? Use the US Legal Forms internet site. The service delivers a large number of web templates, such as the Kentucky Agreement and Plan of Merger by General Homes Corp and General Homes Management Corp, that can be used for business and private requirements. Every one of the forms are inspected by experts and meet federal and state requirements.

Should you be already authorized, log in to the account and click the Obtain switch to find the Kentucky Agreement and Plan of Merger by General Homes Corp and General Homes Management Corp. Utilize your account to check through the authorized forms you might have purchased earlier. Go to the My Forms tab of your respective account and have yet another duplicate from the file you need.

Should you be a whole new end user of US Legal Forms, allow me to share simple directions so that you can follow:

- Initial, make certain you have selected the correct develop for your area/state. You may look through the form using the Review switch and read the form information to make sure this is basically the right one for you.

- In case the develop fails to meet your needs, make use of the Seach industry to find the appropriate develop.

- When you are positive that the form is suitable, click on the Acquire now switch to find the develop.

- Select the rates prepare you want and enter the required details. Build your account and buy your order utilizing your PayPal account or credit card.

- Choose the submit format and obtain the authorized file format to the product.

- Complete, revise and produce and sign the acquired Kentucky Agreement and Plan of Merger by General Homes Corp and General Homes Management Corp.

US Legal Forms is the largest library of authorized forms in which you will find numerous file web templates. Use the company to obtain professionally-produced documents that follow condition requirements.

Form popularity

FAQ

In a merger, the target entity merges into the acquiring party in a deal effectuated under the general merger statutes. This merger type is general in the sense that it is not specific and can potentially apply to all mergers.

Understanding Mergers and Acquisitions A purchase deal will also be called a merger when both CEOs agree that joining together is in the best interest of both of their companies. Unfriendly or hostile takeover deals, in which target companies do not wish to be purchased, are always regarded as acquisitions.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.

A merger is an agreement that unites two existing companies into one new company.