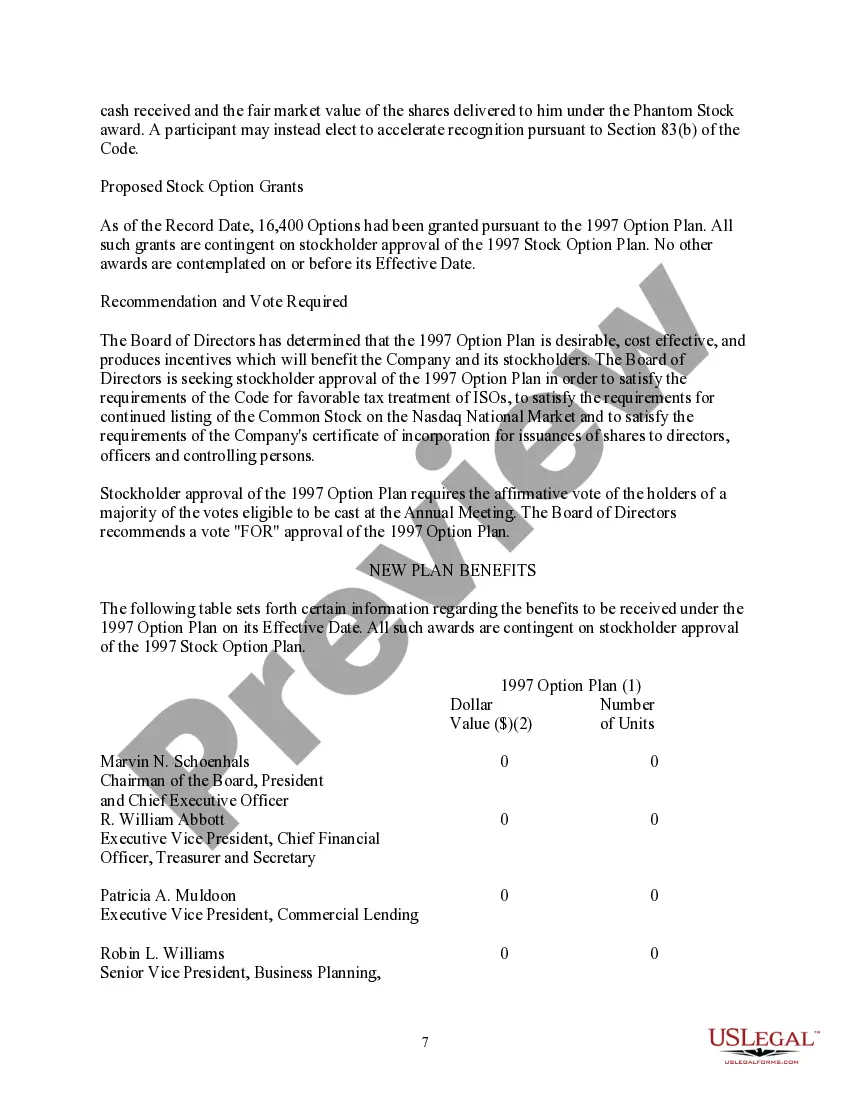

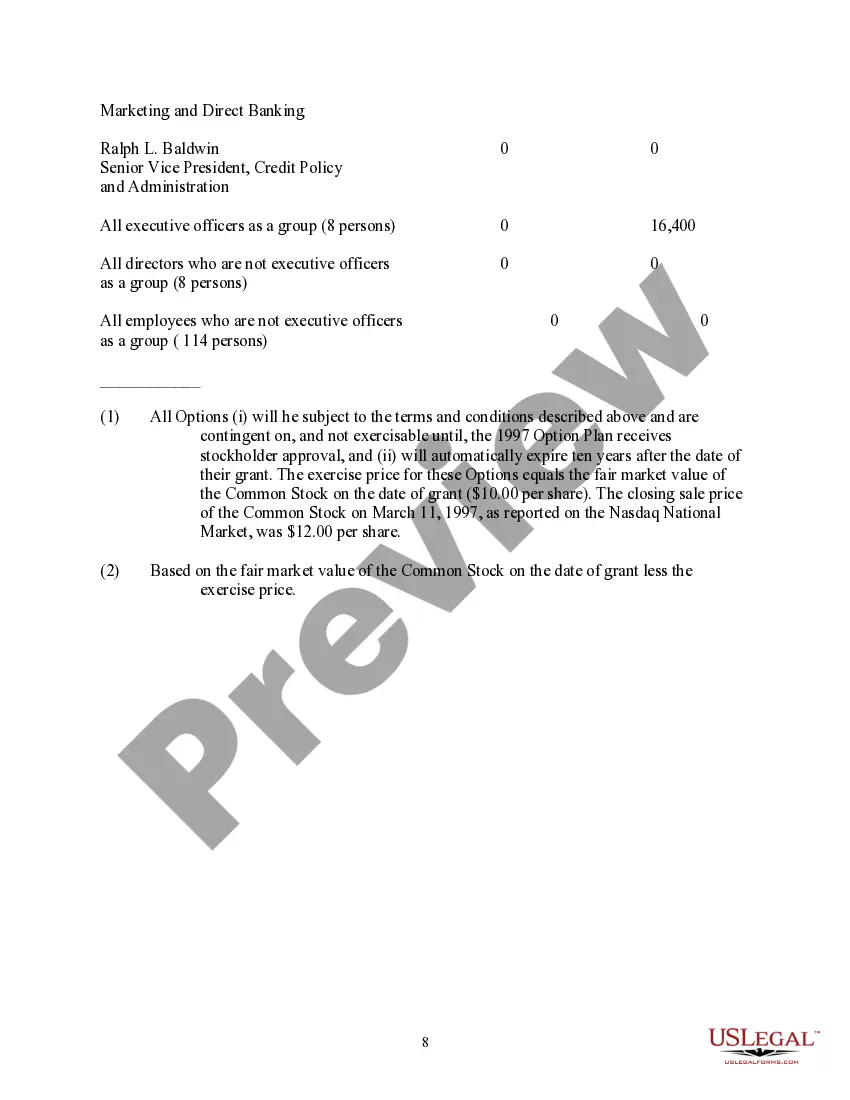

The Kentucky Adoption of Stock Option Plan is a program implemented by WSFS Financial Corporation to provide employees with an opportunity to own a portion of the company's stock at a predetermined price. This plan aims to motivate and retain employees by offering them a sense of ownership and aligning their interests with the corporation's long-term success. Under the Kentucky Adoption of Stock Option Plan, employees are granted the right to purchase a specified number of shares at a predetermined exercise price within a set period. This exercise price is typically set at or near the market value of the corporation's stock on the date of grant. Employees can then exercise their options and purchase the shares at the exercise price after satisfying certain vesting requirements. The Kentucky Adoption of Stock Option Plan offered by WSFS Financial Corporation can be categorized into several types, including: 1. Incentive Stock Options (SOS): These plan options are granted to employees and offer certain tax advantages. SOS are subject to special tax rules, such as a required holding period after exercise to receive favorable tax treatment. 2. Non-Qualified Stock Options (Nests): These plan options are more flexible than SOS and do not have to meet specific tax requirements. However, they lack some tax advantages associated with SOS. 3. Restricted Stock Units (RSS): Instead of granting options, RSS provide employees with a right to receive a specified number of shares at a future date, typically upon vesting. RSS do not require any upfront payment from employees, but they are subject to income tax when the shares are received. 4. Performance Stock Units (Plus): Similar to RSS, Plus grant employees the right to receive a certain number of shares at a future date. However, the vesting and ultimate payout of these units are contingent upon achieving predetermined performance goals. It is important for employees participating in the Kentucky Adoption of Stock Option Plan to carefully review the plan documents, including the terms and conditions of each grant, as well as any applicable tax implications. Additionally, it is advisable for employees to consult with a financial advisor or tax professional to fully understand the potential benefits and risks associated with participating in the plan.

Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation

Description

How to fill out Kentucky Adoption Of Stock Option Plan Of WSFS Financial Corporation?

You are able to spend time online searching for the authorized file template that suits the federal and state demands you will need. US Legal Forms supplies a huge number of authorized kinds which are analyzed by pros. It is possible to acquire or print out the Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation from the assistance.

If you already have a US Legal Forms account, you can log in and click on the Download switch. After that, you can full, edit, print out, or sign the Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation. Every single authorized file template you get is the one you have eternally. To have another copy for any bought form, visit the My Forms tab and click on the related switch.

If you work with the US Legal Forms website for the first time, follow the easy guidelines beneath:

- Initially, be sure that you have selected the right file template for that state/city of your liking. Read the form information to make sure you have picked the appropriate form. If offered, take advantage of the Review switch to check through the file template as well.

- If you wish to locate another model from the form, take advantage of the Research industry to discover the template that fits your needs and demands.

- After you have discovered the template you want, click on Purchase now to move forward.

- Pick the costs program you want, enter your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your credit card or PayPal account to pay for the authorized form.

- Pick the format from the file and acquire it in your device.

- Make alterations in your file if possible. You are able to full, edit and sign and print out Kentucky Adoption of Stock Option Plan of WSFS Financial Corporation.

Download and print out a huge number of file themes utilizing the US Legal Forms website, which offers the largest variety of authorized kinds. Use skilled and express-specific themes to deal with your organization or person requires.