The Kentucky Eligible Director Nonqualified Stock Option Agreement is a legal contract established by Kyle Electronics to grant eligible directors the opportunity to purchase company stock at a predetermined price within a specified timeframe. This agreement provides directors with a nonqualified stock option, which means it does not meet certain requirements of the Internal Revenue Code to be considered an incentive stock option. Under this agreement, eligible directors of Kyle Electronics have the option to purchase a specific number of company stocks at a predetermined exercise price. The exercise price is typically set at the fair market value of the stock on the date of grant or at a discounted rate, depending on the terms specified in the agreement. Directors can exercise their stock options at any time during the predetermined exercise period, which is also mentioned in the agreement. One important aspect of the Kentucky Eligible Director Nonqualified Stock Option Agreement is the vesting schedule. This determines the time period during which directors must wait before they can exercise their stock options. Typically, a vesting period of several years is set, with a portion of the options becoming exercisable each year. It helps incentivize directors to stay with the company and align their interests with the shareholders. It is worth mentioning that there may be different types of Kentucky Eligible Director Nonqualified Stock Option Agreements offered by Kyle Electronics, tailored to specific circumstances or needs. These variations could include different vesting schedules, exercise prices, or terms and conditions unique to individual directors or groups of directors. In conclusion, the Kentucky Eligible Director Nonqualified Stock Option Agreement of Kyle Electronics provides eligible directors with an opportunity to purchase company stocks at a predetermined price within a specific timeframe. This agreement helps align the interests of directors with shareholders and encourages long-term commitment to the company.

Kentucky Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics

Description

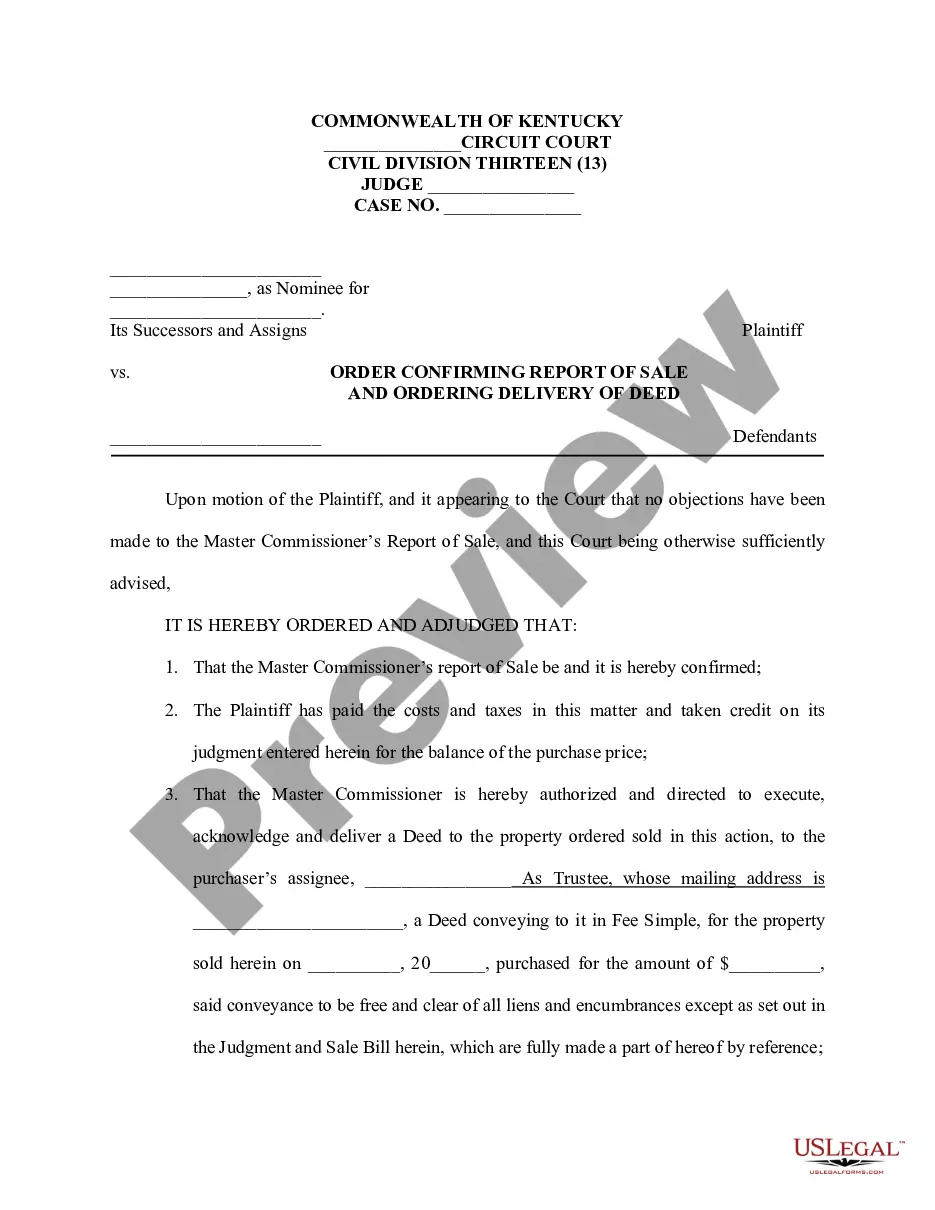

How to fill out Kentucky Eligible Director Nonqualified Stock Option Agreement Of Wyle Electronics?

Are you currently within a place in which you need to have paperwork for sometimes enterprise or personal reasons almost every working day? There are a variety of lawful document layouts available online, but finding versions you can rely on isn`t simple. US Legal Forms offers thousands of type layouts, such as the Kentucky Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics, that are composed to meet federal and state specifications.

If you are currently familiar with US Legal Forms website and have an account, merely log in. Afterward, it is possible to acquire the Kentucky Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics template.

If you do not provide an profile and need to begin to use US Legal Forms, follow these steps:

- Discover the type you need and make sure it is for your proper area/area.

- Use the Preview button to review the form.

- Look at the information to actually have chosen the right type.

- In the event the type isn`t what you`re looking for, take advantage of the Lookup field to get the type that fits your needs and specifications.

- Whenever you get the proper type, click on Get now.

- Opt for the pricing plan you want, fill out the necessary info to generate your bank account, and purchase an order using your PayPal or Visa or Mastercard.

- Choose a practical file file format and acquire your duplicate.

Get each of the document layouts you possess purchased in the My Forms food selection. You may get a more duplicate of Kentucky Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics any time, if required. Just click the necessary type to acquire or printing the document template.

Use US Legal Forms, by far the most considerable selection of lawful varieties, in order to save efforts and steer clear of faults. The service offers skillfully produced lawful document layouts that can be used for a range of reasons. Make an account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Key Points: Exercising your non-qualified stock options is what creates a taxable event. Earned income is taxed as ordinary income and is subject to Social Security and Medicare wage taxes.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

In 2023, you can give annual tax-free gifts of $17,000 a year ($34,000 for a married couple). Transferable options are nonqualified stock options (NQSOs) that you can give to certain permitted individuals or entities if your company's stock plan allows such transfers.