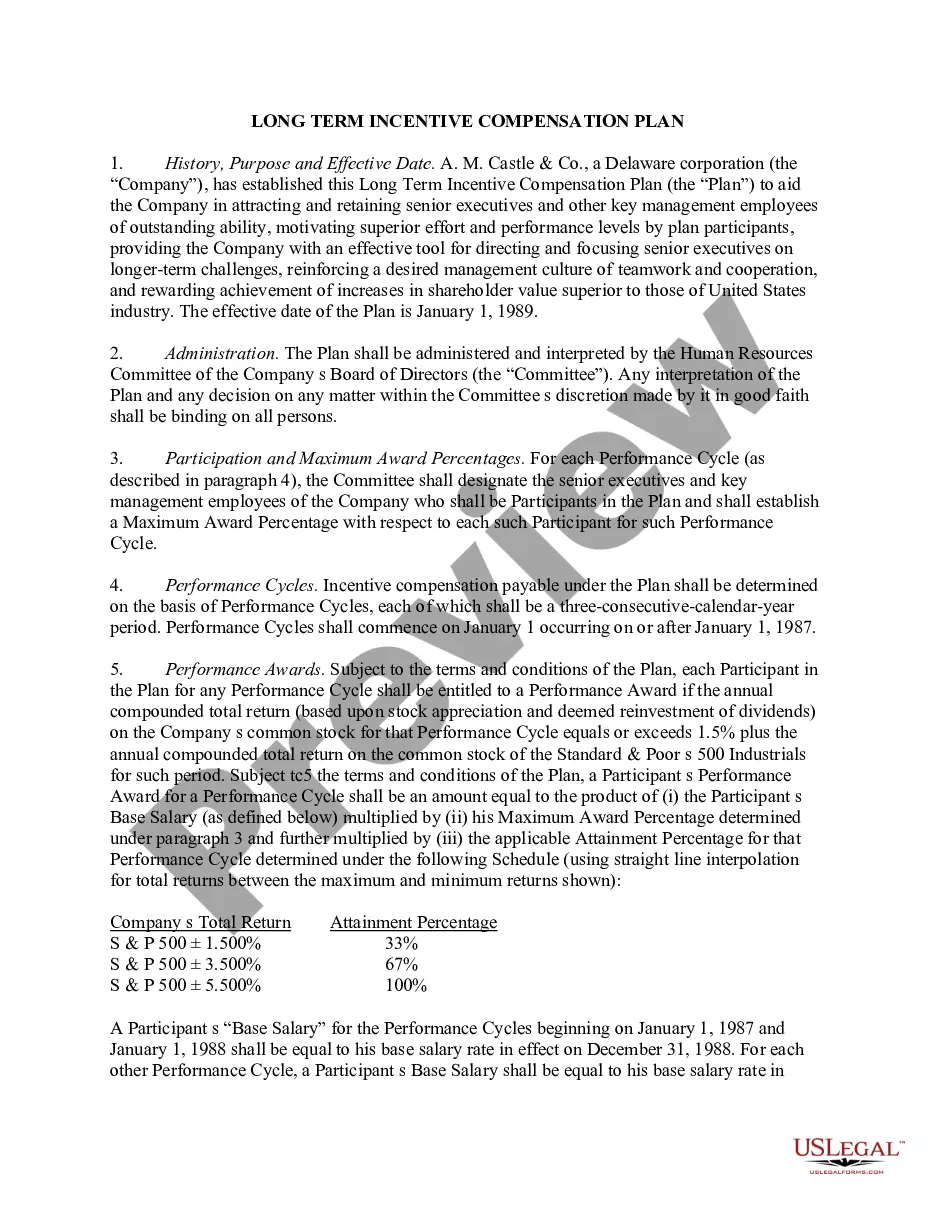

Kentucky Long Term Incentive Plan of Life Re Corp.

Description

How to fill out Long Term Incentive Plan Of Life Re Corp.?

Are you currently within a place in which you need to have papers for both enterprise or personal uses almost every day? There are tons of legal document themes available online, but finding ones you can depend on is not effortless. US Legal Forms gives a large number of kind themes, much like the Kentucky Long Term Incentive Plan of Life Re Corp., which are created to satisfy federal and state demands.

If you are already familiar with US Legal Forms site and have a merchant account, merely log in. Following that, you can obtain the Kentucky Long Term Incentive Plan of Life Re Corp. web template.

If you do not offer an bank account and need to begin to use US Legal Forms, adopt these measures:

- Discover the kind you want and make sure it is for that correct city/region.

- Make use of the Review option to review the form.

- Browse the outline to actually have selected the proper kind.

- When the kind is not what you are searching for, take advantage of the Search field to discover the kind that fits your needs and demands.

- When you discover the correct kind, click on Purchase now.

- Choose the pricing program you would like, fill in the specified information to generate your bank account, and pay for an order with your PayPal or bank card.

- Choose a convenient data file formatting and obtain your version.

Locate all of the document themes you may have purchased in the My Forms menus. You can obtain a additional version of Kentucky Long Term Incentive Plan of Life Re Corp. any time, if possible. Just select the needed kind to obtain or print out the document web template.

Use US Legal Forms, one of the most substantial selection of legal varieties, to save efforts and avoid blunders. The service gives skillfully produced legal document themes which you can use for a selection of uses. Create a merchant account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

To make payments, the FEIN is required along with the Kentucky Corporate/LLET 6-digit account number.

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306.

In Kentucky, a taxpayer may deduct amounts paid during the tax year for long-term care insurance. Consult with your tax consultant or legal advisor regarding the tax consequences of your situation.

The Back to Work Incentive Program provides a one-time payment of $1,500 to eligible applicants who re-enter the workforce between June 24, 2021 and July 30, 2021, and have an active (non-fraud) unemployment claim and has requested weekly payments as of June 23, 2021.

Withholding (income) tax account number from the Department of Revenue. Your KY DOR account number will be 6 digits and can be found on any return (K-1, K-1E, K-3 and K-3E) sent from the Kentucky Department of Revenue. If you have a 9-digit number with 3 leading zeroes, leave the zeroes off.

The LLET may be calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. A minimum tax of $175 applies regardless of the method used. Sole proprietorships and pass-through entities are exempt from state corporate income taxes.

If you already have a KY Withholding Tax Account Number and an assigned deposit frequency, you can find this online, or on any previous Form K-1 or K-3, or on correspondence from the KY Department of Revenue. If you are unsure, you can contact the KY Department of Revenue at 502-564-3306 or 502-564-7287.

Kentucky Central Life Insurance Company (Kentucky Central) was started in 1902 and placed in liquidation in 1994.