Title: Understanding Kentucky's Proposal to Approve Annual Incentive Compensation Plan Introduction: In Kentucky, the proposal to approve an annual incentive compensation plan is an essential step towards motivating and rewarding employees for their exceptional performance. This comprehensive plan aims to enhance employee engagement, productivity, and overall business success. This article will delve into the importance of such proposals and explore various types that may exist. 1. Key Benefits of a Kentucky Proposal to Approve Annual Incentive Compensation Plan: — Motivational tool: An incentive compensation plan incentivizes employees to achieve specific goals and targets, ultimately encouraging them to go above and beyond their regular duties. — Retention and attraction: A well-designed plan helps retain top talent within the company and also attracts potential candidates by showcasing the organization's commitment to rewarding high performance. — Alignment with organizational goals: The plan aligns individual employee objectives with the company's overall objectives, fostering a sense of unity and shared purpose. — Performance measurement and transparency: By establishing clear performance metrics and targets, the plan brings transparency to the evaluation and rewards process, ensuring fairness and suitability. — Promotes a culture of excellence: Recognizing and rewarding outstanding performance promotes a culture of excellence, driving employees to consistently deliver exceptional work. 2. Types of Kentucky Proposals to Approve Annual Incentive Compensation Plans: — Performance-based plans: These plans tie incentives to individual or team performance, typically measured against specific quantitative or qualitative targets. — Profit-sharing plans: Profit-sharing plans distribute a portion of the company's profits among eligible employees as additional compensation, fostering a collective sense of ownership and aligning employee efforts with company profitability. — Commission-based plans: Often seen in sales-driven industries, commission-based plans provide employees with a percentage-based commission on the sales or revenue they generate. — Stock options or equity-based plans: Equity-based plans provide employees with the opportunity to acquire company shares or stock options, aligning their interests with long-term company growth and success. — Discretionary bonus plans: These plans offer flexibility to reward exceptional contributions beyond typical performance metrics, providing managers with discretion in granting bonuses based on subjective factors such as leadership, innovation, or exceptional effort. — Combination plans: Companies may choose to combine elements of different incentive compensation plans to create a tailored approach that suits their unique needs and objectives. Conclusion: Kentucky's proposal to approve an annual incentive compensation plan showcases the state's commitment to fostering a motivated and engaged workforce. By implementing such proposals, companies can align employee efforts with organizational objectives, promote excellence, attract top talent, and ensure fair and transparent rewards systems. Choosing the right type of incentive compensation plan, whether performance-based, profit-sharing, equity-based, or a combination, is crucial for maximizing the plan's impact and achieving long-term business success.

Kentucky Proposal to approve annual incentive compensation plan

Description

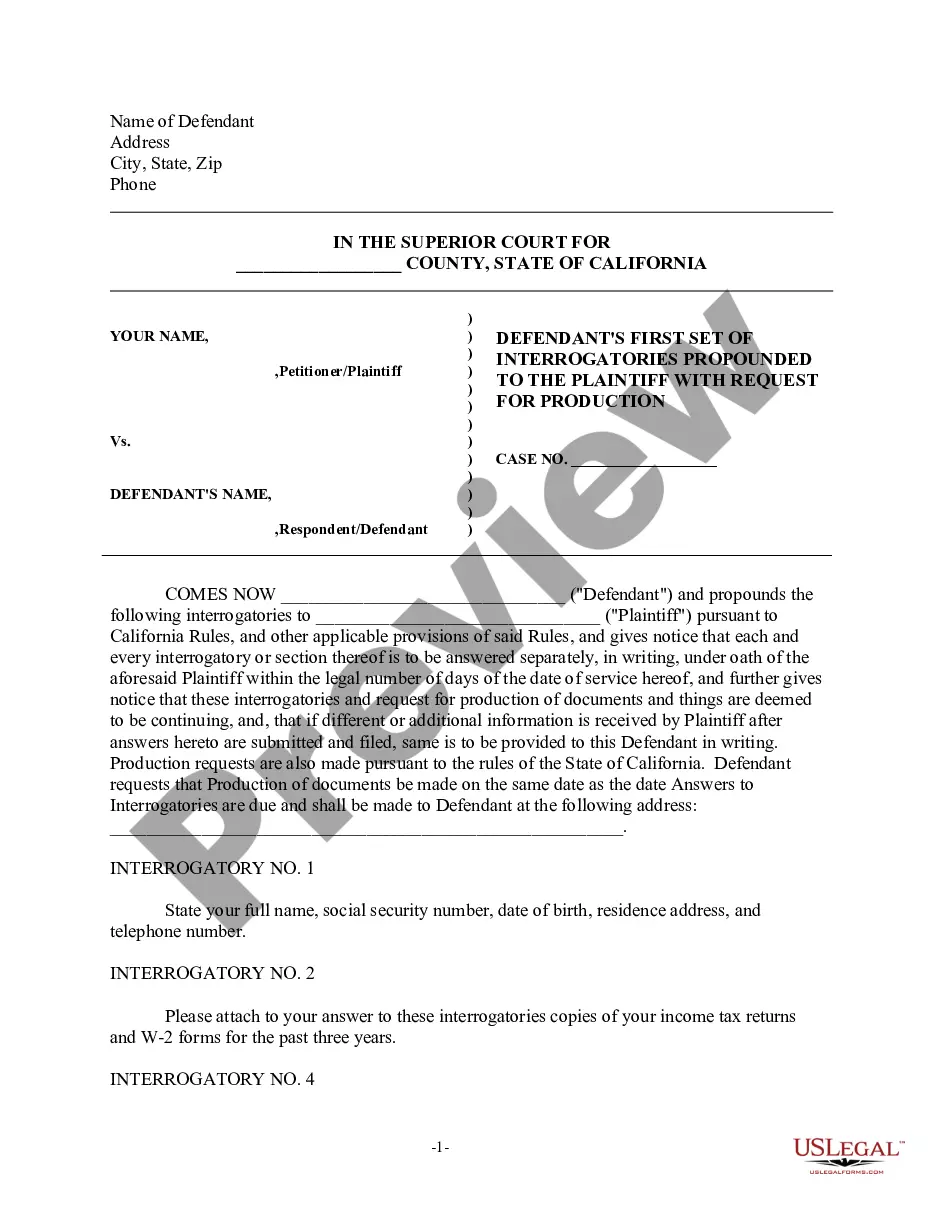

How to fill out Kentucky Proposal To Approve Annual Incentive Compensation Plan?

If you wish to full, acquire, or print authorized record themes, use US Legal Forms, the biggest collection of authorized kinds, which can be found on-line. Utilize the site`s basic and convenient lookup to find the files you require. Various themes for business and specific purposes are categorized by groups and suggests, or keywords. Use US Legal Forms to find the Kentucky Proposal to approve annual incentive compensation plan in just a few mouse clicks.

Should you be previously a US Legal Forms client, log in in your account and click on the Download button to obtain the Kentucky Proposal to approve annual incentive compensation plan. Also you can gain access to kinds you in the past downloaded within the My Forms tab of your account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the form to the right city/region.

- Step 2. Take advantage of the Review method to look over the form`s content material. Don`t forget to learn the outline.

- Step 3. Should you be not satisfied together with the develop, utilize the Lookup discipline on top of the display to discover other models of the authorized develop template.

- Step 4. When you have found the form you require, click on the Purchase now button. Select the costs prepare you choose and put your accreditations to register for an account.

- Step 5. Process the financial transaction. You can use your credit card or PayPal account to perform the financial transaction.

- Step 6. Pick the formatting of the authorized develop and acquire it in your product.

- Step 7. Complete, revise and print or indicator the Kentucky Proposal to approve annual incentive compensation plan.

Each and every authorized record template you buy is the one you have eternally. You might have acces to every develop you downloaded within your acccount. Go through the My Forms area and choose a develop to print or acquire once more.

Remain competitive and acquire, and print the Kentucky Proposal to approve annual incentive compensation plan with US Legal Forms. There are many expert and state-certain kinds you may use for the business or specific needs.

Form popularity

FAQ

US companies raised their budgets for employee salary increases by an average of 4.4 percent in 2023. That's the highest year-over-year growth since 2001.

The biennial budget bill passed by the legislature in 2022 gave all state workers an 8% raise in the 2023 fiscal year, with another $200 million to be allocated in the current fiscal year, contingent on a comprehensive salary and classification study by the Personnel Cabinet.

State government has a semi-monthly pay schedule, which means employees are paid twice per month. As an employee of the state, you will receive your pay on the 15th and the 30th of each month unless the payday falls on a weekend or holiday.

The Back to Work Incentive Program provides a one-time payment of $1,500 to eligible applicants who re-enter the workforce between June 24, 2021 and July 30, 2021, and have an active (non-fraud) unemployment claim and has requested weekly payments as of June 23, 2021.

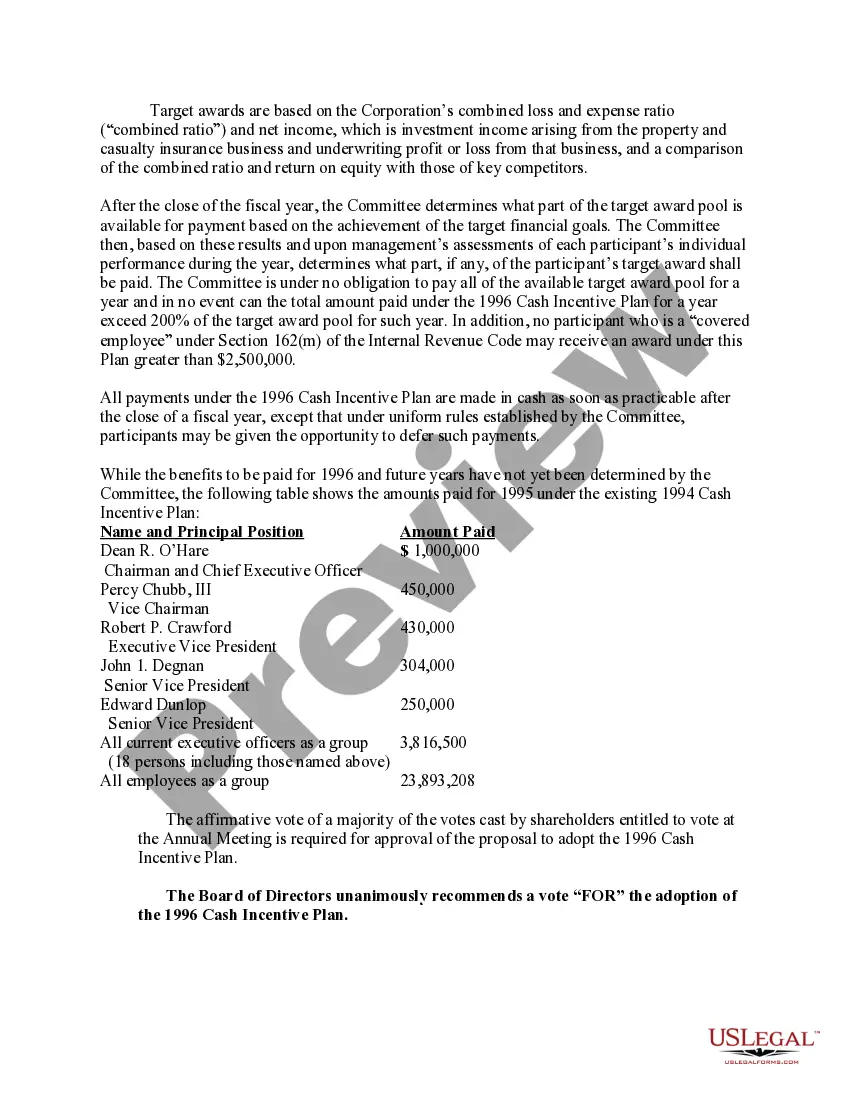

Annual incentive compensation for AEP executives was based on performance metrics weighted as follows in 2019: operating EPS at 70%, strategic initiatives at 20%, and safety and compliance at 10%.