Kentucky Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

US Legal Forms - one of many biggest libraries of authorized types in the States - gives a variety of authorized record web templates you are able to acquire or print. While using web site, you can find a large number of types for business and person reasons, categorized by categories, claims, or search phrases.You will discover the most recent versions of types such as the Kentucky Split-Dollar Life Insurance in seconds.

If you have a subscription, log in and acquire Kentucky Split-Dollar Life Insurance from the US Legal Forms library. The Obtain option can look on each and every develop you see. You have access to all formerly saved types within the My Forms tab of your profile.

If you would like use US Legal Forms the very first time, allow me to share simple instructions to help you get started:

- Make sure you have selected the best develop for your personal city/region. Go through the Preview option to review the form`s articles. Look at the develop description to ensure that you have chosen the correct develop.

- If the develop doesn`t fit your specifications, utilize the Look for area at the top of the monitor to obtain the one that does.

- In case you are satisfied with the shape, verify your choice by visiting the Buy now option. Then, select the rates strategy you prefer and give your references to sign up to have an profile.

- Approach the deal. Use your bank card or PayPal profile to perform the deal.

- Pick the formatting and acquire the shape in your product.

- Make alterations. Fill out, edit and print and indicator the saved Kentucky Split-Dollar Life Insurance.

Each web template you included in your account lacks an expiration date and it is the one you have permanently. So, in order to acquire or print yet another version, just go to the My Forms segment and click about the develop you need.

Get access to the Kentucky Split-Dollar Life Insurance with US Legal Forms, probably the most comprehensive library of authorized record web templates. Use a large number of professional and state-distinct web templates that fulfill your business or person needs and specifications.

Form popularity

FAQ

?Economic benefit? refers to how the IRS treats this type of split-dollar insurance agreement. It means your employer is giving you some benefit but not a loan. That means you'll be taxed on the value of the life insurance provided, and that value is determined by the IRS or the insurance company.

Split-limit car insurance is defined as a policy that divides liability coverage into three separate limits for bodily injury per person, bodily injury per accident, and property damage per accident. Insurance companies often write these limits as three separate numbers.

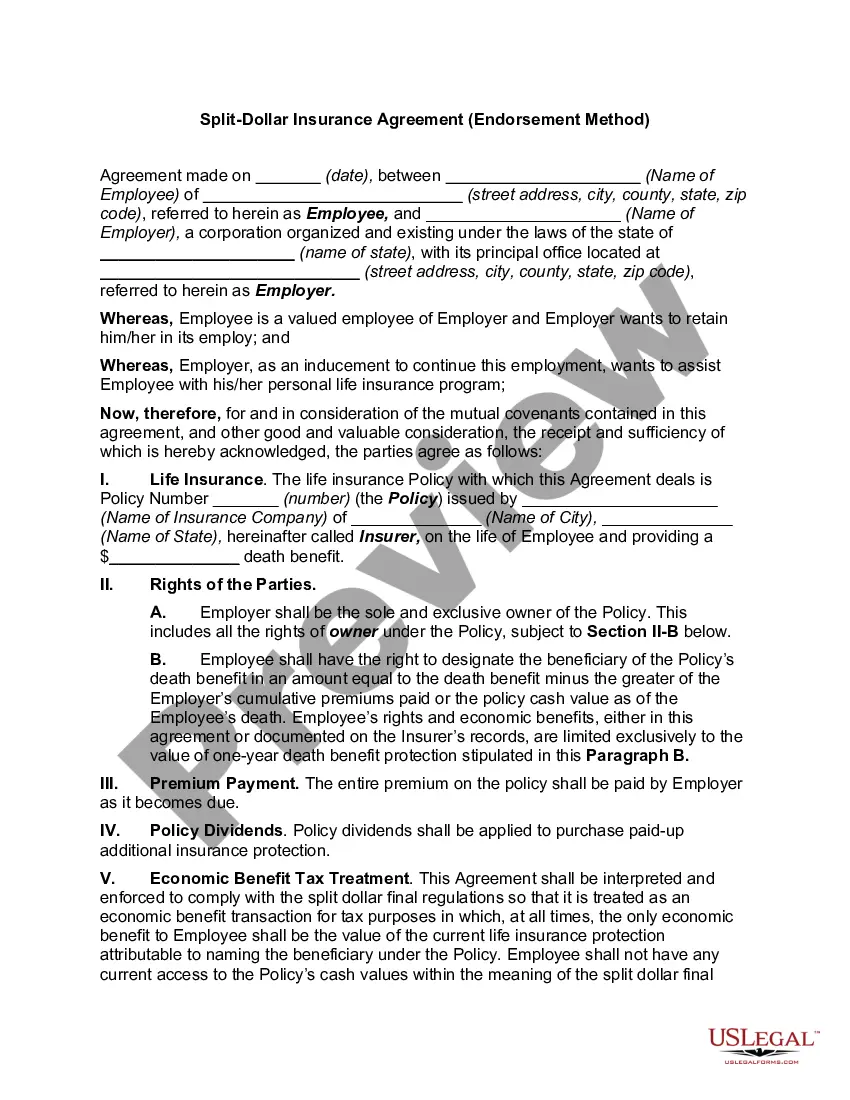

dollar life insurance agreement (or ?splitdollar plan?) is a strategy generally used as an employer benefit or for estate planning involving life insurance. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life.

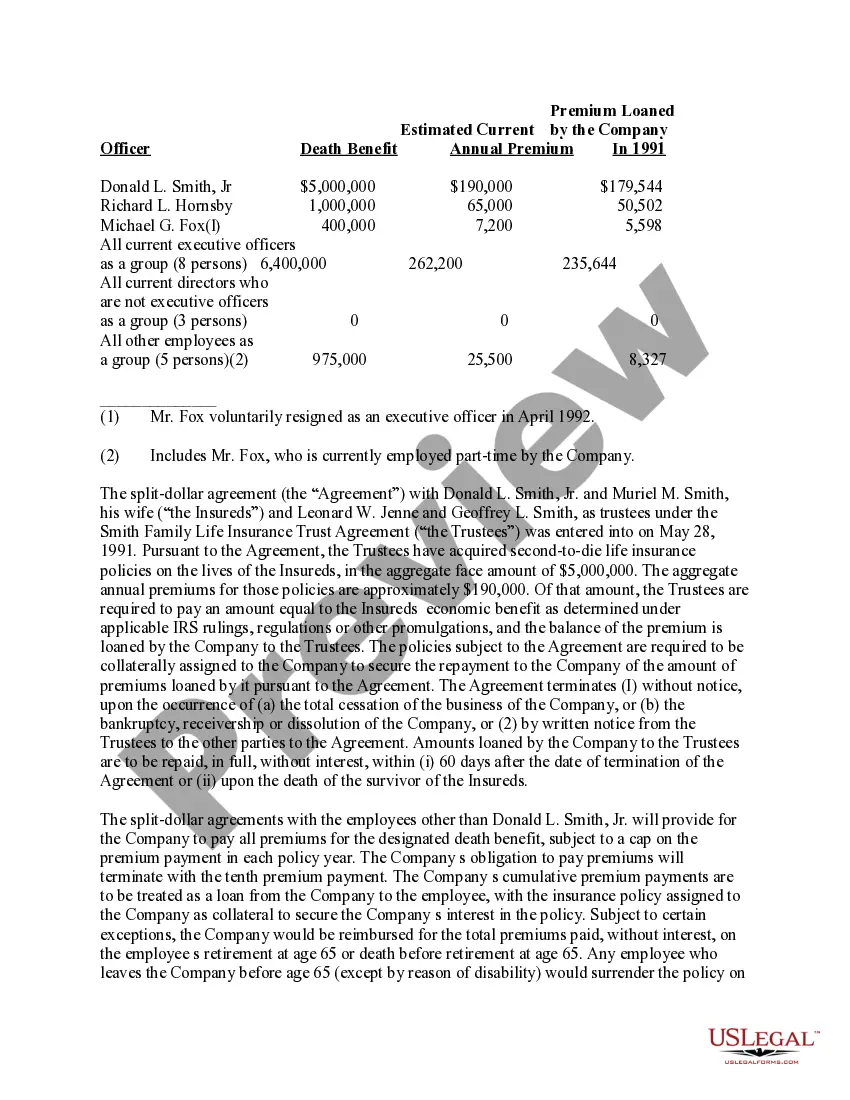

Split Dollar Loan Regime Agreement & Contract Generally, at the employee's death, the employer receives a portion of the death benefit (usually equal to the total premiums plus interest from the loan) and the employee's beneficiary receives the balance.

In a split-dollar plan, an employer and employee execute a written agreement that outlines how they will share the premium cost, cash value, and death benefit of a life insurance policy. Split-dollar plans are frequently used by employers to provide supplemental benefits for executives and to help retain key employees.

While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability. Both employers and employees must carefully weigh the benefits and disadvantages of this type of arrangement before deciding to pursue it.

Split-dollar payment arrangements generally take one of two forms: The employer pays the premiums and owns the contract. The employer receives reimbursement of the premiums upon the employee's death, and the employee's beneficiary then receives the balance of the insurance proceeds.