Kentucky Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

Are you presently in a placement the place you need paperwork for both organization or individual purposes virtually every working day? There are a variety of lawful papers templates available on the net, but finding kinds you can trust isn`t effortless. US Legal Forms provides thousands of form templates, just like the Kentucky Proposal to decrease authorized common and preferred stock, which are written to fulfill federal and state specifications.

When you are presently familiar with US Legal Forms website and get a free account, simply log in. Afterward, it is possible to acquire the Kentucky Proposal to decrease authorized common and preferred stock web template.

Unless you provide an account and wish to start using US Legal Forms, adopt these measures:

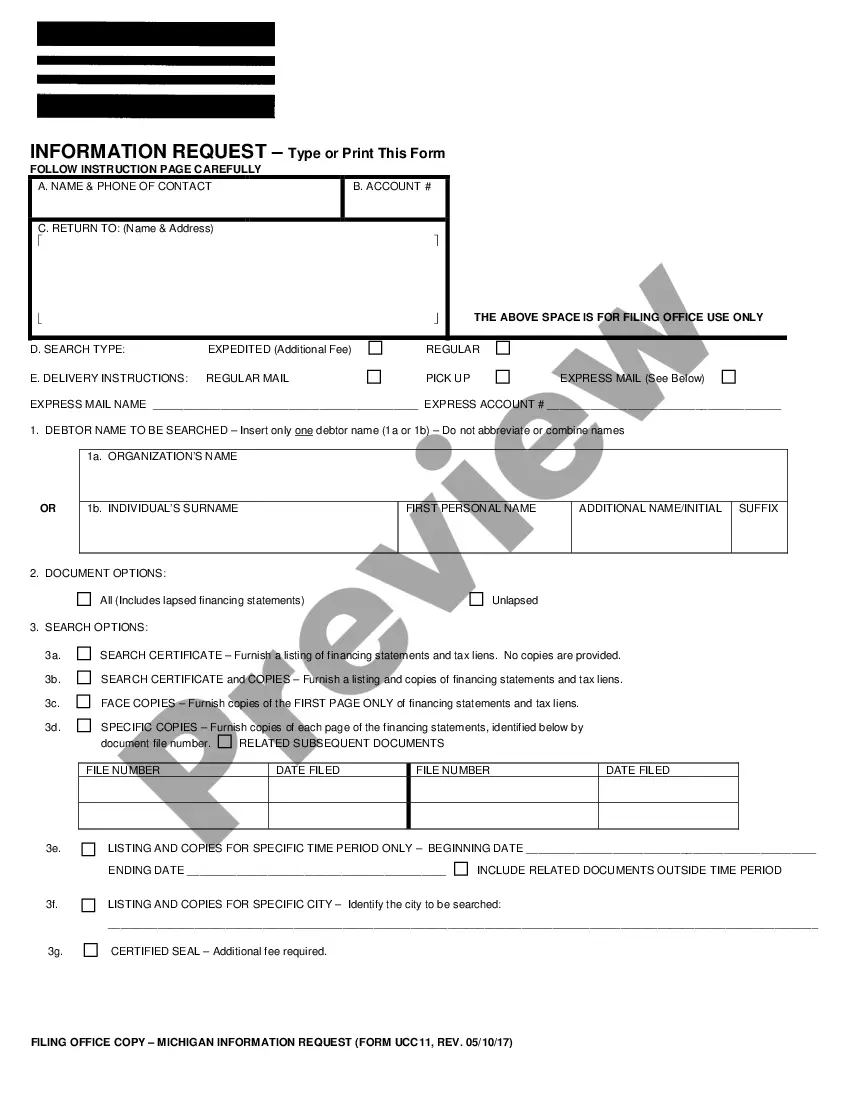

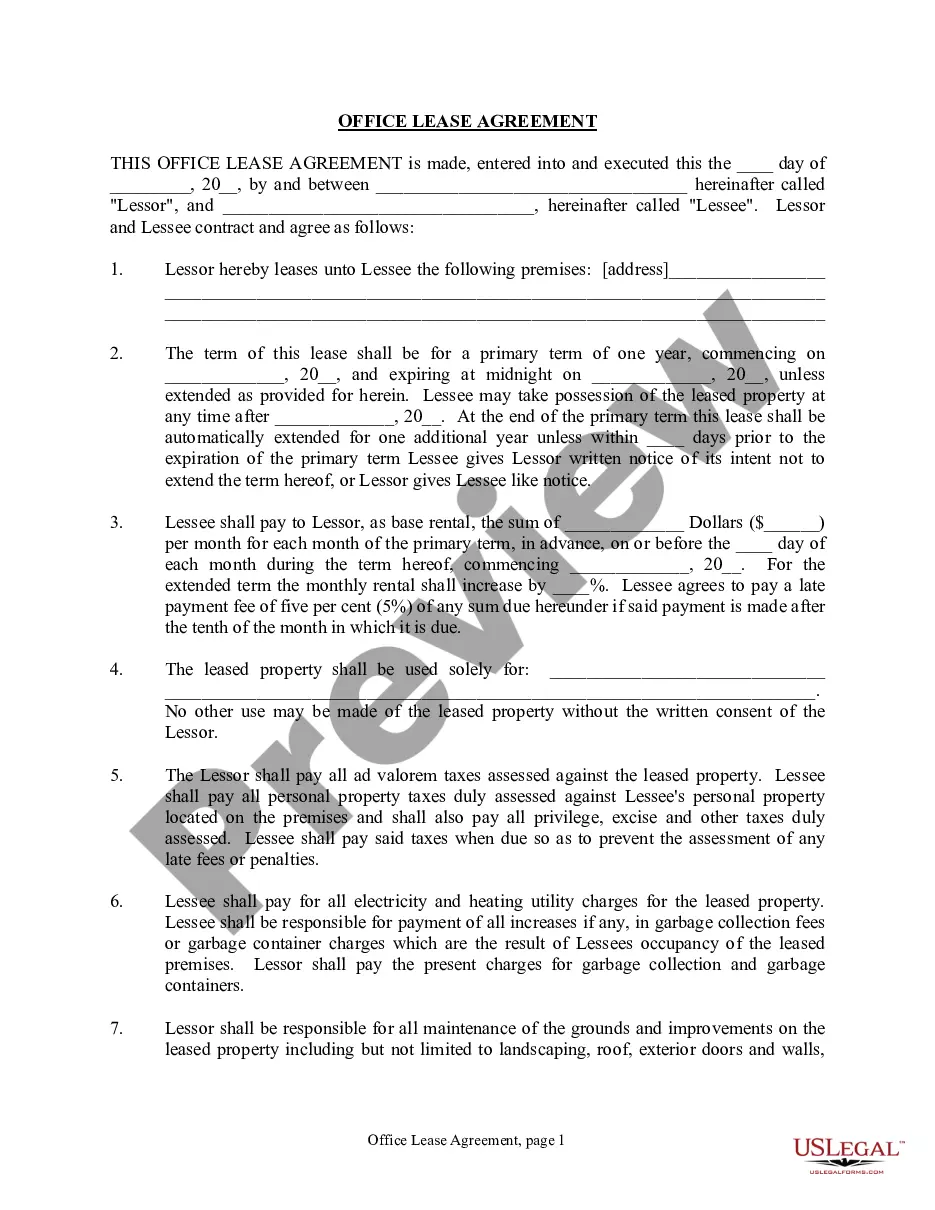

- Get the form you will need and ensure it is to the correct metropolis/area.

- Make use of the Review button to check the shape.

- Browse the outline to ensure that you have chosen the right form.

- If the form isn`t what you are searching for, take advantage of the Look for discipline to obtain the form that fits your needs and specifications.

- Whenever you discover the correct form, just click Buy now.

- Pick the prices strategy you need, fill out the necessary details to create your money, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a handy file format and acquire your copy.

Get all the papers templates you possess purchased in the My Forms food selection. You may get a additional copy of Kentucky Proposal to decrease authorized common and preferred stock whenever, if possible. Just click the necessary form to acquire or printing the papers web template.

Use US Legal Forms, one of the most extensive assortment of lawful forms, to conserve some time and stay away from mistakes. The assistance provides skillfully made lawful papers templates that can be used for a variety of purposes. Produce a free account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Preferreds technically have an unlimited life because they have no fixed maturity date, but they may be called by the issuer after a certain date. The motivation for the redemption is generally the same as for bonds?a company calls in securities that pay higher rates than what the market is currently offering.

Non-cumulative preferred stock doesn't accumulate and won't get paid if a firm doesn't declare dividends. In fact, these shareholders lose their rights to dividends for the year if a firm doesn't declare dividends in that year.

Advantages of Noncumulative Stock Issuing noncumulative stock assists corporations in times of financial distress. By canceling the company's obligation to pay unpaid dividends, noncumulative stock frees up cash flow and allows companies to utilize it when required.

Whether preferred stock is cumulative or straight (non-cumulative) will determine if the company must make up potentially skipped payments. If it's cumulative, the issuer is required to pay any skipped dividends to preferred stockholders at some point in the future.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Preferred stock can be cumulative preferred stock, where an investor is entitled to the current year's dividends, as well as all dividends in arrears, or outstanding dividends from previous years, or non-cumulative preferred stock, where a company does not pay dividends in arrears.

Noncumulative describes a type of preferred stock that does not entitle investors to reap any missed dividends. By contrast, "cumulative" indicates a class of preferred stock that indeed entitles an investor to dividends that were missed.

If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. This fixed dividend is not guaranteed in common shares. If you take these payments and calculate the sum of the present values into perpetuity, you will find the value of the stock.