Kentucky Certificate of designation, preferences and rights of Series A junior cumulative preference stock of Oryx Energy Company

Description

How to fill out Certificate Of Designation, Preferences And Rights Of Series A Junior Cumulative Preference Stock Of Oryx Energy Company?

Are you in the place the place you need to have paperwork for sometimes organization or person uses nearly every day? There are plenty of authorized record templates available online, but locating kinds you can rely isn`t straightforward. US Legal Forms provides 1000s of type templates, much like the Kentucky Certificate of designation, preferences and rights of Series A junior cumulative preference stock of Oryx Energy Company, that are published to satisfy state and federal requirements.

If you are already acquainted with US Legal Forms internet site and get a merchant account, just log in. Next, you can acquire the Kentucky Certificate of designation, preferences and rights of Series A junior cumulative preference stock of Oryx Energy Company design.

Should you not provide an profile and would like to start using US Legal Forms, follow these steps:

- Get the type you want and make sure it is for that right town/state.

- Make use of the Preview key to check the shape.

- See the description to ensure that you have chosen the appropriate type.

- In case the type isn`t what you are searching for, take advantage of the Research industry to obtain the type that meets your requirements and requirements.

- If you get the right type, click on Get now.

- Pick the pricing plan you would like, fill in the required information and facts to generate your money, and pay money for your order with your PayPal or bank card.

- Select a practical file format and acquire your version.

Discover every one of the record templates you have bought in the My Forms menu. You may get a further version of Kentucky Certificate of designation, preferences and rights of Series A junior cumulative preference stock of Oryx Energy Company at any time, if possible. Just click on the essential type to acquire or produce the record design.

Use US Legal Forms, one of the most extensive assortment of authorized varieties, to conserve efforts and stay away from faults. The assistance provides expertly created authorized record templates which you can use for a selection of uses. Generate a merchant account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

With preferred stock, the dividend is fixed. It's paid out first, before dividends on common stock can be calculated. Dividends on common stock are paid second and depend on how they're set up by the corporation's board. They may be paid out quarterly or whenever the board of directors declares a dividend payout.

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.

If the company is no longer in existence, the share certificate itself might still have some value to a collector. Share certificates are collected by scripophily enthusiasts for their historical significance and/or for their artwork and intricate engraving.

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.

It certifies registered share ownership of a certain number of shares from the grant date and also acts as a receipt of share purchase. However, a share certificate merely contains details of the shareholder and the number of shares they own, it is not the stock itself.

Preferred Designation means the Certificate of Designation with respect to the Series D Preferred Stock, the Series E Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock and the Series I Preferred Stock adopted by the Board of Directors of the Company and duly filed ...

Stock Designation with respect to a share of Company Common Stock means a designation by the holder of such share, provided by the Company to Parent no later than the Designation Deadline, to the effect that such share is designated to receive the Stock Designation Consideration.

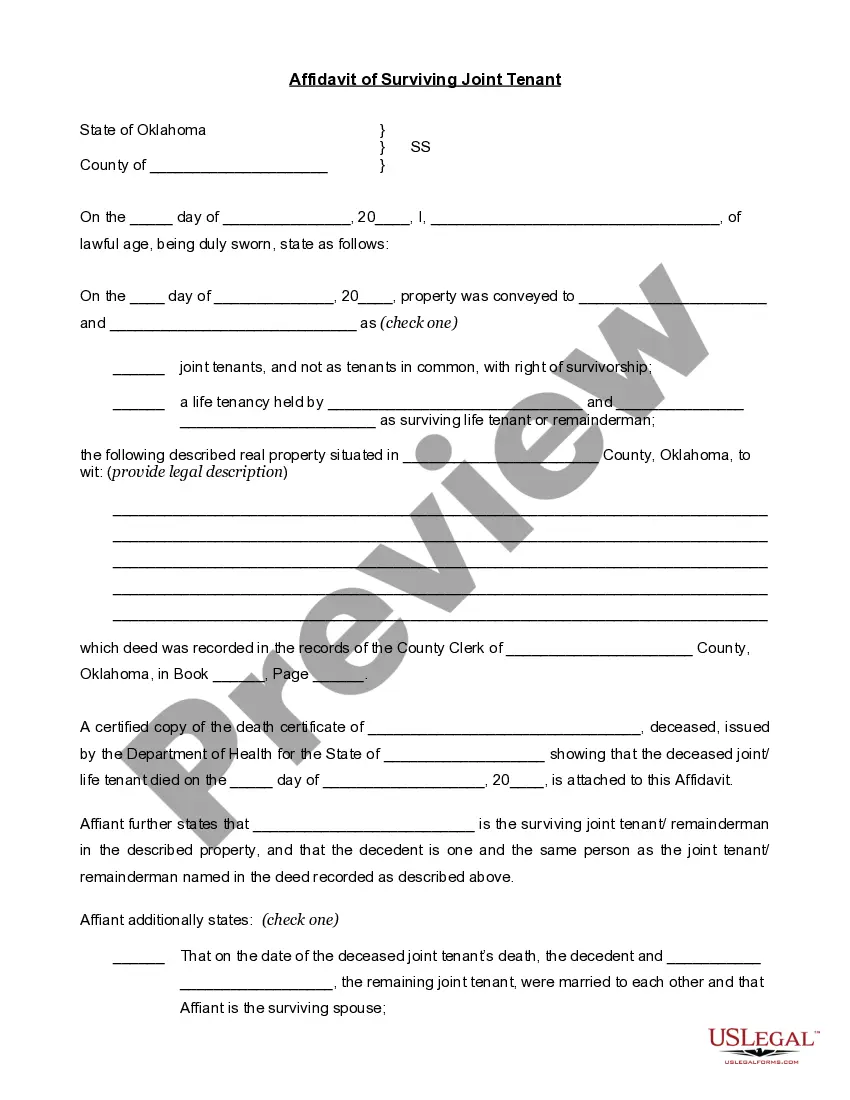

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

A stock certificate is a physical piece of paper that represents a shareholder's ownership of a company. Stock certificates include information like the number of shares owned, the date of purchase, an identification number, and relevant signatures.

An account designation is the name given to an investment account where shares cannot be directly held by the beneficial owner (e.g. a minor) and instead, are registered in the name of a trustee (e.g. a parent).