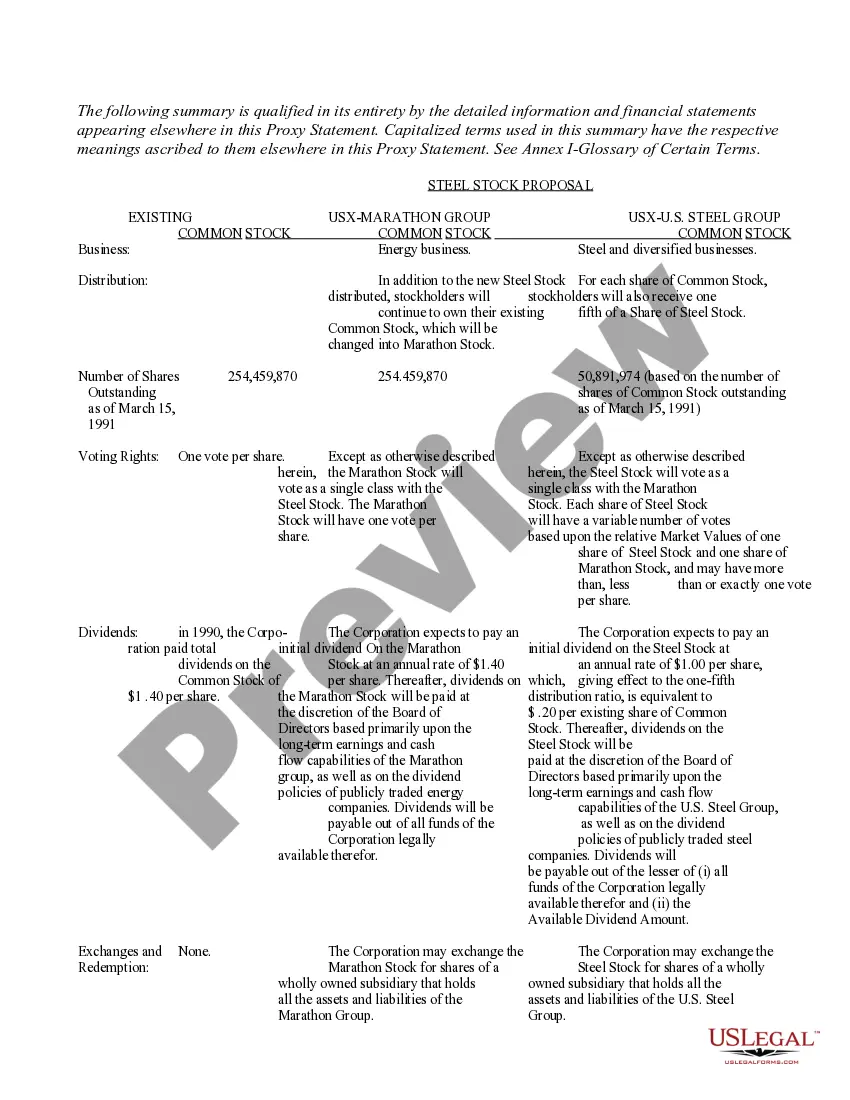

The Kentucky Proxy Statement and Prospectus of US Corporation are essential documents that provide investors with detailed information regarding the company's financial standing and important matters to be discussed at the annual general meeting. A proxy statement is a legal document filed with the Securities and Exchange Commission (SEC) that outlines proposals to be voted on by shareholders. On the other hand, a prospectus is a document required by the SEC to be provided to potential investors, offering detailed information about an investment opportunity. The Kentucky Proxy Statement and Prospectus of US Corporation cover various key aspects that investors should be aware of. These include the company's financial performance, executive compensation, proposed changes to the board of directors, governance policies, and any other important matters to be decided upon at the upcoming annual general meeting. These documents play a crucial role in helping shareholders make informed decisions regarding their investments and participate actively in the company's decision-making processes. The US Corporation may have different types of proxy statements and prospectuses, including: 1. Annual Meeting Proxy Statement: This type of proxy statement is filed annually before the company's annual general meeting. It provides details about the proposed agenda, any issues up for voting, instructions for proxy voting, and insights into the company's operations or strategies. 2. Special Meeting Proxy Statement: In instances where a special meeting is called to address specific matters, the corporation may issue a special meeting proxy statement. This document focuses solely on the issues or proposals to be addressed during the special meeting. 3. Merger or Acquisition Prospectus: When US Corporation is involved in a merger or acquisition, it may release a prospectus to potential investors detailing the terms of the transaction, financial projections, risks involved, and any regulatory approvals required. 4. Exchange Offer Prospectus: In cases where the corporation is conducting an exchange offer, allowing shareholders to swap their existing securities for new ones, an exchange offer prospectus is typically provided. This document outlines the terms of the offer, the securities being exchanged, and any pertinent details related to the transaction. Investors should carefully review the contents of the Kentucky Proxy Statement and Prospectus of US Corporation relevant to their investments before making any decisions. These documents aid in conducting thorough due diligence and promote transparency within the company to safeguard investor interests.

The Kentucky Proxy Statement and Prospectus of US Corporation are essential documents that provide investors with detailed information regarding the company's financial standing and important matters to be discussed at the annual general meeting. A proxy statement is a legal document filed with the Securities and Exchange Commission (SEC) that outlines proposals to be voted on by shareholders. On the other hand, a prospectus is a document required by the SEC to be provided to potential investors, offering detailed information about an investment opportunity. The Kentucky Proxy Statement and Prospectus of US Corporation cover various key aspects that investors should be aware of. These include the company's financial performance, executive compensation, proposed changes to the board of directors, governance policies, and any other important matters to be decided upon at the upcoming annual general meeting. These documents play a crucial role in helping shareholders make informed decisions regarding their investments and participate actively in the company's decision-making processes. The US Corporation may have different types of proxy statements and prospectuses, including: 1. Annual Meeting Proxy Statement: This type of proxy statement is filed annually before the company's annual general meeting. It provides details about the proposed agenda, any issues up for voting, instructions for proxy voting, and insights into the company's operations or strategies. 2. Special Meeting Proxy Statement: In instances where a special meeting is called to address specific matters, the corporation may issue a special meeting proxy statement. This document focuses solely on the issues or proposals to be addressed during the special meeting. 3. Merger or Acquisition Prospectus: When US Corporation is involved in a merger or acquisition, it may release a prospectus to potential investors detailing the terms of the transaction, financial projections, risks involved, and any regulatory approvals required. 4. Exchange Offer Prospectus: In cases where the corporation is conducting an exchange offer, allowing shareholders to swap their existing securities for new ones, an exchange offer prospectus is typically provided. This document outlines the terms of the offer, the securities being exchanged, and any pertinent details related to the transaction. Investors should carefully review the contents of the Kentucky Proxy Statement and Prospectus of US Corporation relevant to their investments before making any decisions. These documents aid in conducting thorough due diligence and promote transparency within the company to safeguard investor interests.