The Kentucky Amendment to the articles of incorporation to eliminate par value is a legal action taken by a corporation in Kentucky to remove par value associated with its shares. Par value is the nominal or face value of a share of stock that sets a minimum price below which the shares cannot be sold. By eliminating par value, a company can adjust the actual value of its shares based on market factors and corporate performance. The Kentucky Amendment to the articles of incorporation is an important legal document that must be filed with the Kentucky Secretary of State's office. The amendment provides specific details about the changes being made to the corporation's articles of incorporation, particularly concerning the removal of the par value. This process is commonly used by corporations to increase flexibility in setting the price and value of their shares. It allows the company to issue new shares at a price that reflects market demand and the company's current financial standing, rather than being artificially limited by a fixed par value. The Kentucky Amendment to the articles of incorporation to eliminate par value typically includes key information such as the company's name, its registered office address, the new amendment language, and any other modifications being made to the articles. It is important to ensure that the language of the amendment complies with Kentucky state laws and regulations. Some specific types of Kentucky Amendments to the articles of incorporation to eliminate par value are: 1. Amendment to Eliminate Par Value for Common Shares: This amendment specifically targets the common shares of a corporation and removes the par value associated with them. 2. Amendment to Eliminate Par Value for Preferred Shares: This type of amendment focuses on eliminating par value for preferred shares of a corporation. Preferred shares often hold certain rights and privileges, and removing the par value can increase their attractiveness to potential investors. 3. Comprehensive Amendment to Eliminate Par Value: In some cases, a corporation may choose to eliminate par value for both common and preferred shares simultaneously. This comprehensive amendment covers all types of shares issued by the company. It should be noted that before pursuing any amendments, corporations should consult with legal professionals familiar with Kentucky laws to ensure compliance with all relevant rules and regulations. Additionally, shareholders should be properly notified and given the opportunity to vote on the proposed amendment as required by state law.

Kentucky Amendment to the articles of incorporation to eliminate par value

Description

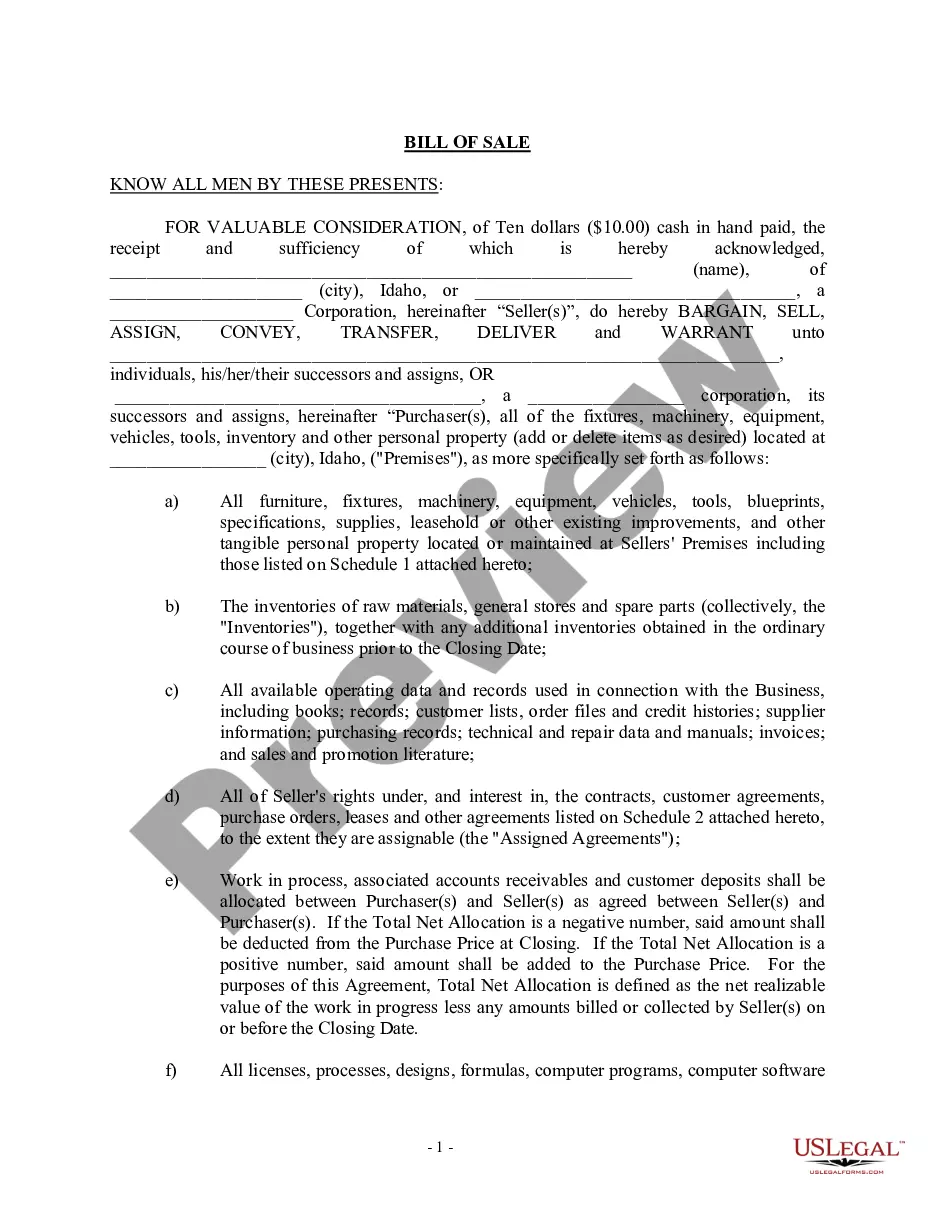

How to fill out Kentucky Amendment To The Articles Of Incorporation To Eliminate Par Value?

US Legal Forms - one of several greatest libraries of lawful varieties in the USA - provides a wide range of lawful file layouts you can download or print out. While using web site, you can find 1000s of varieties for company and person reasons, categorized by types, claims, or keywords.You can find the most up-to-date types of varieties much like the Kentucky Amendment to the articles of incorporation to eliminate par value within minutes.

If you already possess a monthly subscription, log in and download Kentucky Amendment to the articles of incorporation to eliminate par value from the US Legal Forms collection. The Download button will appear on each kind you see. You have access to all earlier acquired varieties within the My Forms tab of your profile.

In order to use US Legal Forms the first time, listed below are simple recommendations to help you began:

- Ensure you have picked the correct kind for the city/county. Go through the Preview button to check the form`s content material. Browse the kind description to actually have selected the correct kind.

- In case the kind doesn`t suit your specifications, take advantage of the Lookup industry near the top of the monitor to get the the one that does.

- Should you be happy with the shape, affirm your decision by clicking on the Get now button. Then, opt for the rates strategy you like and provide your accreditations to register to have an profile.

- Process the purchase. Make use of your credit card or PayPal profile to perform the purchase.

- Find the file format and download the shape on the product.

- Make adjustments. Load, edit and print out and signal the acquired Kentucky Amendment to the articles of incorporation to eliminate par value.

Each web template you added to your money does not have an expiration day and is your own property permanently. So, if you would like download or print out an additional duplicate, just check out the My Forms section and click on the kind you need.

Obtain access to the Kentucky Amendment to the articles of incorporation to eliminate par value with US Legal Forms, by far the most comprehensive collection of lawful file layouts. Use 1000s of specialist and express-certain layouts that meet your small business or person requirements and specifications.

Form popularity

FAQ

A corporation's business and affairs are managed by or under the direction of its board of directors. Although the board has the power to make all decisions on behalf of its corporation, many business decisions are actually made by the corporation's officers.

Chief Executive Officer (CEO): the highest-ranking executive of the corporation responsible for the corporation's operations at every level, the CEO reports directly to the Chairman of the Board.

The basic structure of a corporation includes shareholders who elect a team of directors (called the board of directors or simply the board) to manage the business. The directors appoint managers and officers to run the day-to-day affairs of the corporation.

What Are Kentucky Articles of Incorporation? Preparing and filing your articles of incorporation is the first step in starting your business corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation.

Essentially, it is the role of the board of directors to hire the CEO or general manager of the business and assess the overall direction and strategy of the business. The CEO or general manager is responsible for hiring all of the other employees and overseeing the day-to-day operation of the business.

A corporation is a specific type of business structure, created and regulated by state law. More specifically, a corporation can be defined as a legal entity that is separate from its owners, or, its shareholders. What this means is that only the corporation itself can be held liable for corporate obligations.