Kentucky Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

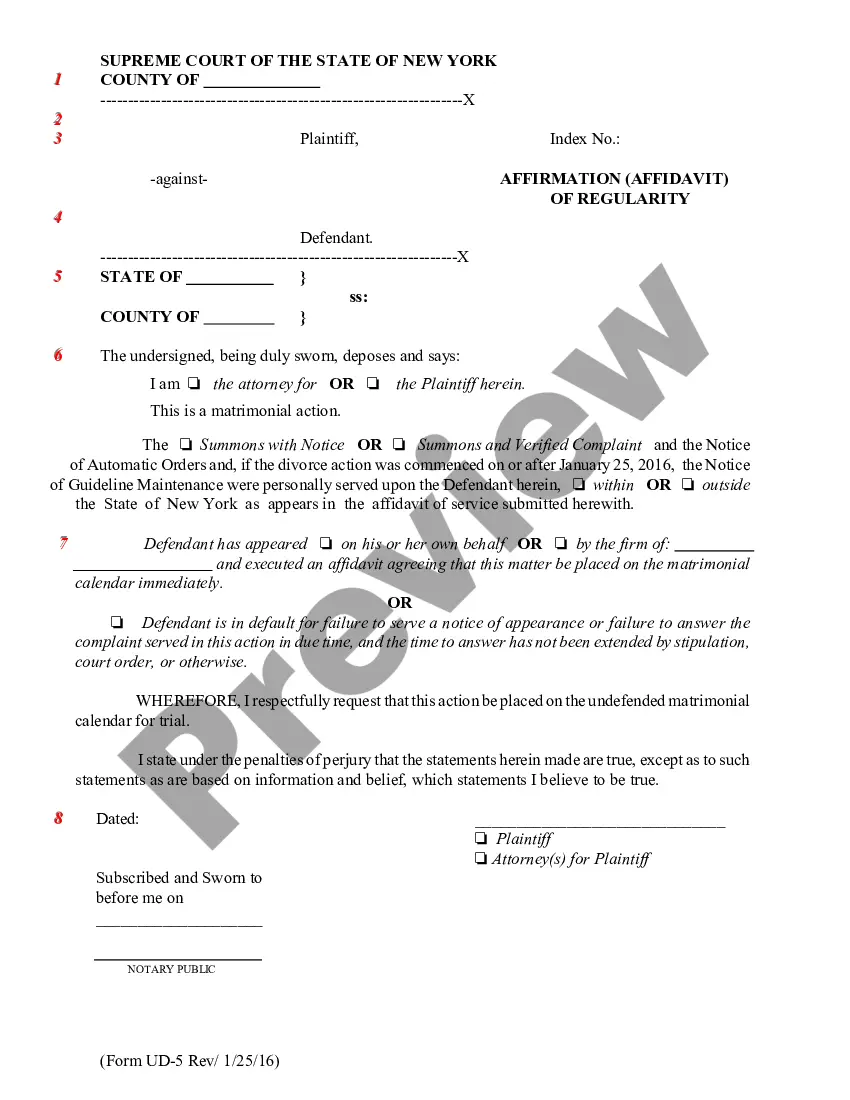

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

You are able to spend several hours on-line looking for the legitimate document web template that suits the state and federal specifications you need. US Legal Forms supplies a huge number of legitimate types which can be examined by specialists. It is simple to acquire or print the Kentucky Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan from the service.

If you already have a US Legal Forms profile, you are able to log in and click the Download button. After that, you are able to complete, edit, print, or indication the Kentucky Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan. Every single legitimate document web template you purchase is your own forever. To obtain another backup of any bought form, go to the My Forms tab and click the related button.

If you are using the US Legal Forms internet site initially, keep to the easy instructions listed below:

- Initial, make certain you have chosen the proper document web template for the county/town of your choosing. Browse the form description to ensure you have chosen the right form. If available, take advantage of the Review button to look through the document web template at the same time.

- If you want to locate another variation in the form, take advantage of the Search area to find the web template that meets your needs and specifications.

- Upon having located the web template you want, click Purchase now to move forward.

- Pick the costs strategy you want, key in your accreditations, and register for a free account on US Legal Forms.

- Full the financial transaction. You may use your bank card or PayPal profile to fund the legitimate form.

- Pick the format in the document and acquire it in your gadget.

- Make changes in your document if necessary. You are able to complete, edit and indication and print Kentucky Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

Download and print a huge number of document web templates while using US Legal Forms web site, which provides the biggest variety of legitimate types. Use skilled and status-distinct web templates to deal with your organization or personal requirements.

Form popularity

FAQ

Below are the primary methods for perfecting a security interest: Filing a financing statement in the appropriate public office; Take or retain possession of the collateral; Obtain or retain control of the collateral over the collateral; or.

A security interest is retained in or taken by the seller of the collateral to secure part or all of its price. A security interest is taken by a person who, by making advances or incurring an obligation, gives something of value that enables the debtor to acquire the rights in the collateral or to use it.

A security interest is not enforceable unless it has attached. Attachment of a security interest generally requires a written security agreement, description of collateral, secured party's giving value, and the debtor having rights in collateral.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

Below are common types of security interests that apply to land. Mortgage. This is a loan instrument where an individual acquires a loan to buy a house. ... Deed of Trust. In the US, a deed of trust is a legal instrument used to create security interests. ... A contract for the sale of land.

In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest. Once the security interest has ?attached,? it is effective between the debtor and the creditor.

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.