Kentucky Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

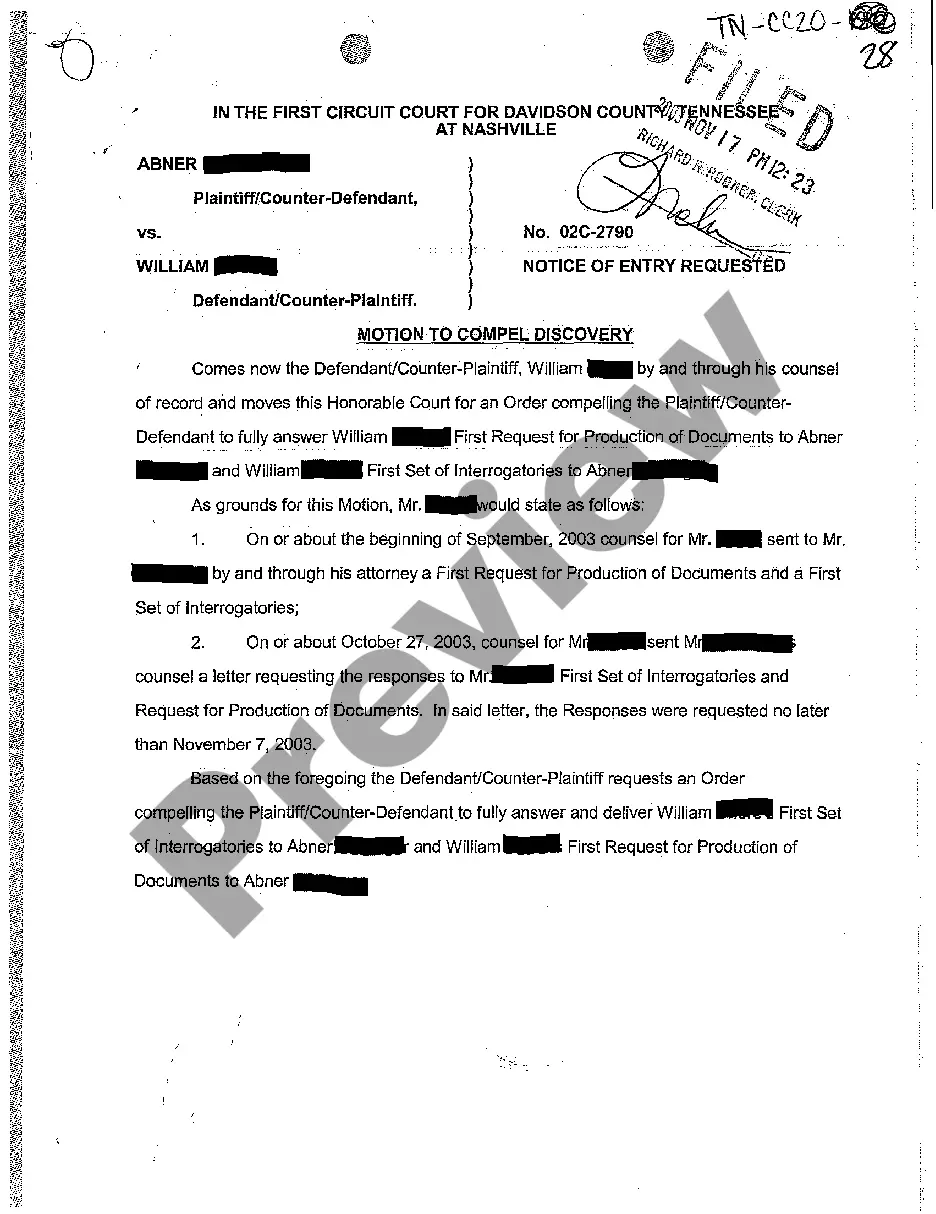

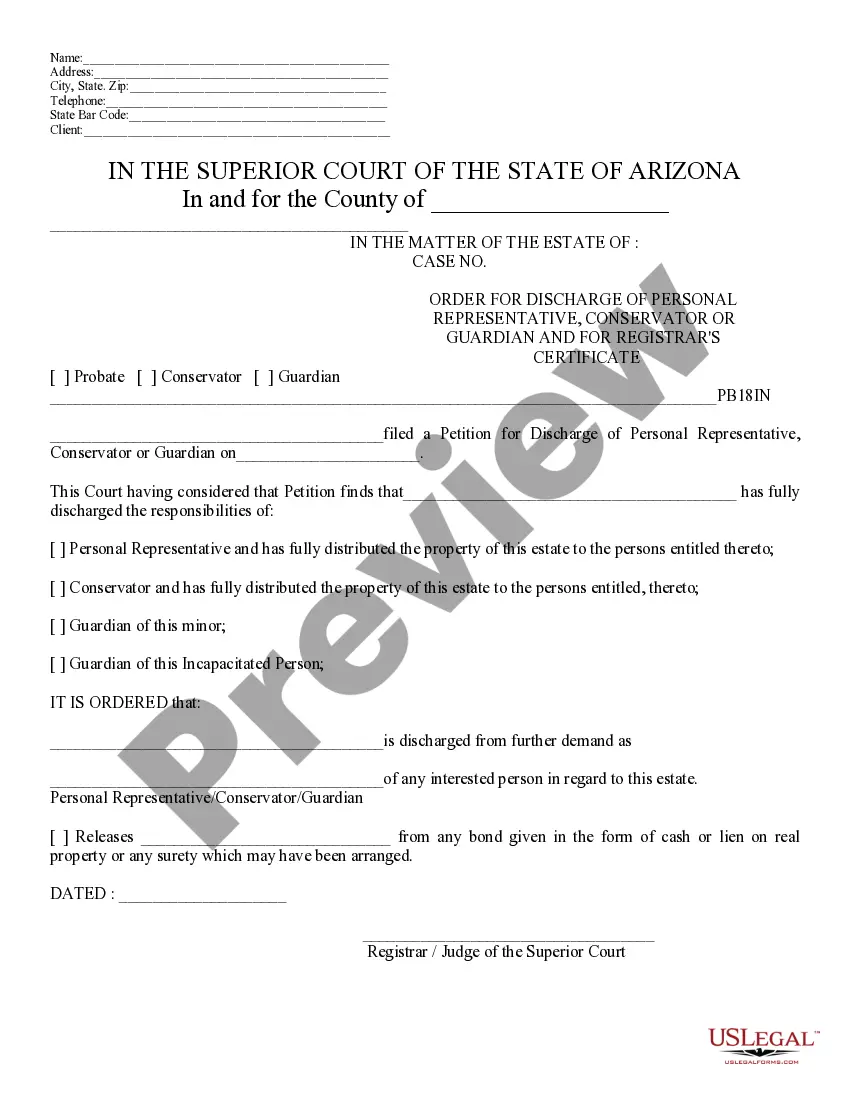

Choosing the right authorized papers template might be a struggle. Of course, there are tons of layouts accessible on the Internet, but how do you discover the authorized type you will need? Make use of the US Legal Forms web site. The support offers a large number of layouts, for example the Kentucky Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., which can be used for enterprise and personal demands. Each of the forms are examined by pros and meet federal and state specifications.

If you are previously signed up, log in to your profile and click on the Download option to get the Kentucky Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Make use of profile to appear through the authorized forms you possess acquired previously. Go to the My Forms tab of your respective profile and acquire yet another duplicate from the papers you will need.

If you are a new user of US Legal Forms, allow me to share straightforward recommendations that you can comply with:

- First, make sure you have chosen the right type for the area/state. You may look through the form making use of the Review option and read the form information to make sure it will be the best for you.

- If the type fails to meet your needs, use the Seach industry to obtain the appropriate type.

- Once you are certain the form is proper, click the Purchase now option to get the type.

- Pick the rates prepare you desire and type in the necessary info. Design your profile and purchase the transaction utilizing your PayPal profile or charge card.

- Pick the data file format and acquire the authorized papers template to your gadget.

- Full, change and printing and indication the acquired Kentucky Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

US Legal Forms is definitely the biggest catalogue of authorized forms in which you will find a variety of papers layouts. Make use of the service to acquire professionally-manufactured documents that comply with status specifications.