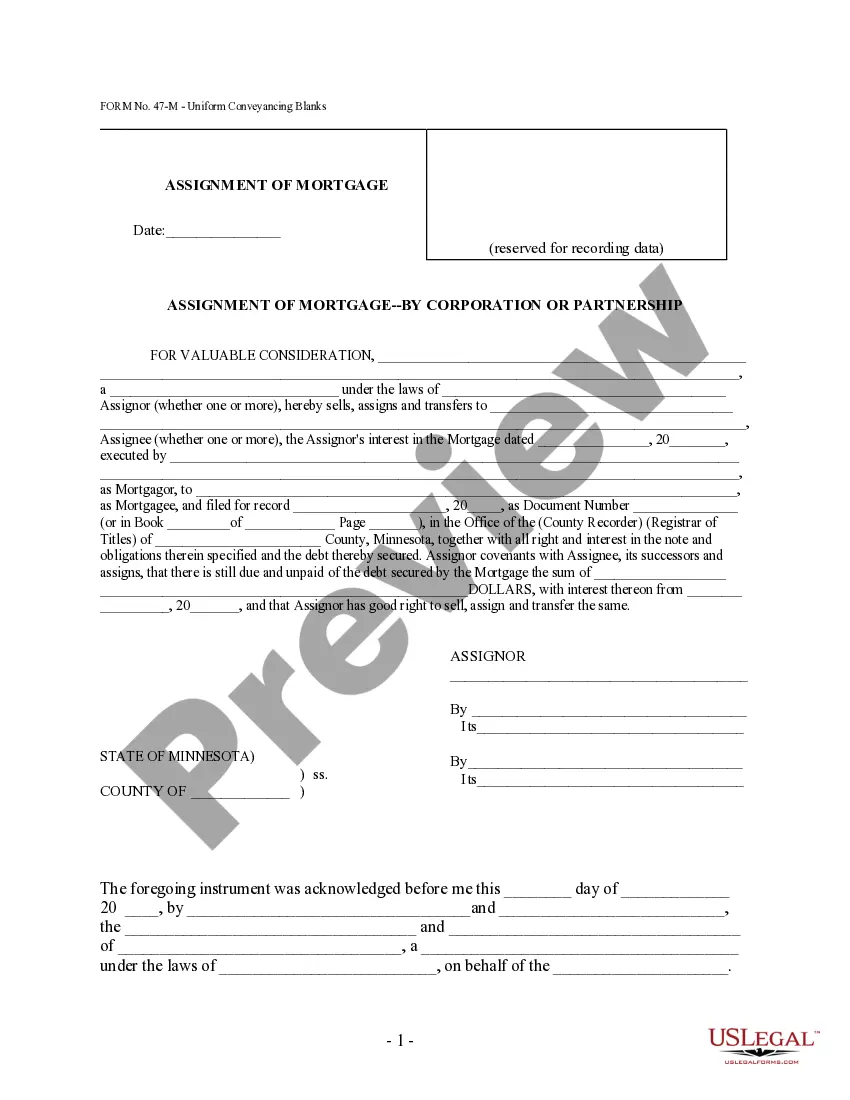

Kentucky Servicing Agreement refers to a legal contract specifically designed for the mortgage servicing industry within the state of Kentucky. This agreement establishes the terms and conditions between a mortgage service and the borrower or investor. It outlines the responsibilities, rights, and obligations of both parties involved in the loan servicing process, ensuring transparency and compliance with state regulations. The Kentucky Servicing Agreement typically includes key elements such as: 1. Parties involved: This section identifies the mortgage service, the borrower, and any other relevant entities participating in the agreement. 2. Loan details: The agreement specifies the loan details, including the loan amount, interest rate, loan term, and any specific information related to the mortgage. 3. Payment processing: It outlines the borrower's payment obligations, including the frequency, methods of payment, and due dates. Additionally, it details how payments are processed, credited, and allocated to different components of the loan, such as principal, interest, taxes, and insurance. 4. Escrow management: If the borrower has an escrow account, the agreement explains how the mortgage service handles and disburses funds for property taxes, insurance premiums, and other related expenses. 5. Loan modifications: In case the borrower encounters financial hardships, loan modification options may be available. The servicing agreement describes the procedures and conditions for requesting loan modifications, including eligibility criteria, documentation requirements, and potential impacts on the loan terms. 6. Default and foreclosure procedures: It clearly outlines the actions that occur in the event of loan default, including late payment penalties, notices of default, foreclosure procedures, and the borrower's rights to cure the default. 7. Communication and information exchange: This section delineates how the mortgage service and borrower communicate, emphasizing the requirement for timely and accurate information exchange. It may also detail the means of communication, such as electronic notifications, mailing addresses, or designated customer service channels. Different types of Kentucky Servicing Agreements may exist based on the mortgage arrangement and the parties involved. These may include: 1. Residential servicing agreement: This agreement pertains to mortgage loans secured by residential properties, such as single-family homes, condominiums, or townhouses. It addresses the specific needs and requirements associated with residential mortgages. 2. Commercial servicing agreement: This type of agreement focuses on servicing commercial mortgages, which involve loans secured by properties intended for business or investment purposes. It may include provisions catering to the complexities associated with commercial real estate financing. 3. Investors servicing agreement: In cases where a mortgage service provides services on behalf of institutional investors, this agreement governs the relationship between the service and the investor. It outlines the terms related to loan handling, reporting, remittance, and other investor-specific requirements. In conclusion, a Kentucky Servicing Agreement is a legal contract that establishes the terms, conditions, and obligations between a mortgage service and the borrower or investor within the state of Kentucky. It ensures compliance with state regulations while facilitating efficient and transparent loan servicing operations.

Kentucky Servicing Agreement

Description

How to fill out Kentucky Servicing Agreement?

US Legal Forms - one of many largest libraries of legitimate forms in the States - provides a wide range of legitimate file layouts you can acquire or print. Utilizing the site, you can get a large number of forms for company and personal purposes, sorted by classes, suggests, or key phrases.You can find the most up-to-date variations of forms like the Kentucky Servicing Agreement in seconds.

If you already have a subscription, log in and acquire Kentucky Servicing Agreement through the US Legal Forms library. The Download key will show up on every single kind you look at. You gain access to all previously saved forms within the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, listed below are straightforward guidelines to obtain started:

- Be sure you have picked out the proper kind for your metropolis/county. Click on the Preview key to check the form`s content. Look at the kind explanation to ensure that you have selected the right kind.

- If the kind doesn`t satisfy your specifications, utilize the Lookup industry at the top of the display to obtain the the one that does.

- When you are content with the shape, affirm your option by clicking on the Acquire now key. Then, opt for the pricing prepare you prefer and offer your qualifications to register for the profile.

- Method the deal. Make use of credit card or PayPal profile to complete the deal.

- Choose the formatting and acquire the shape in your product.

- Make modifications. Complete, edit and print and signal the saved Kentucky Servicing Agreement.

Every template you put into your money lacks an expiry day which is yours for a long time. So, if you would like acquire or print yet another duplicate, just go to the My Forms section and click on about the kind you require.

Gain access to the Kentucky Servicing Agreement with US Legal Forms, probably the most considerable library of legitimate file layouts. Use a large number of expert and condition-certain layouts that meet your business or personal needs and specifications.