Kentucky Sample Founder Stock Purchase Agreement Machinene Communications, Inc. and Peter D. Olson This Kentucky Sample Founder Stock Purchase Agreement is a legally binding contract between Machine Communications, Inc. (referred to as the "Company") and Peter D. Olson (referred to as the "Founder") for the purchase of founder stock in the Company. The agreement outlines the terms and conditions under which the Founder will sell and the Company will purchase the founder stock. The Founder Stock Purchase Agreement includes various key provisions to protect the interests of both parties involved. It addresses important aspects such as purchase price, stock transfer restrictions, representations and warranties, vesting schedule, and stockholder rights. By outlining these terms, the agreement helps ensure transparency and clarity, avoiding potential disputes in the future. The purchase price for the founder stock is agreed upon by both parties and is typically based on the fair market value of the shares at the time of the agreement. The agreement may include clauses for cash payment, stock or a combination of both as consideration for the purchase. To safeguard the Company's interests, the agreement may impose transfer restrictions on the founder stock. These restrictions may include limitations on the transferability of the shares to third parties without consent from the Company or other stockholders. These provisions help protect the stability and control of the Company, ensuring that important decisions regarding the stock are made with the Company's best interests in mind. The Founder Stock Purchase Agreement also includes representations and warranties made by the Founder. These statements ensure that the Founder possesses the legal right to sell the stock and that there are no legal disputes or encumbrances on the shares being sold. This provides the Company with confidence in the legality and authenticity of the transaction. Additionally, the agreement may contain a vesting schedule outlining the conditions under which the Founder will gain full ownership of the shares. Vesting periods are commonly used to incentivize founders to remain with the Company for a specific duration, promoting long-term commitment and alignment. Lastly, the agreement delineates the stockholder rights of the Founder. This includes voting rights, dividend entitlements, and the ability to participate in future equity offerings or stock repurchases. These rights ensure that the Founder has a stake in the Company's growth and can actively participate in major decisions affecting their shareholdings. Different types of Kentucky Sample Founder Stock Purchase Agreements between Machine Communications, Inc. and Peter D. Olson may exist based on specific factors such as the number of shares being purchased, the agreed-upon purchase price, the vesting schedule, and any additional terms negotiated. It is essential to customize the agreement to suit the specific requirements and circumstances of the Company and the Founder. Disclaimer: This content is meant for informational purposes only and should not be considered legal advice. It is advisable to consult with a qualified legal professional when drafting or entering into any legal agreements.

Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Kentucky Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Are you in a position that you require paperwork for sometimes company or person functions just about every time? There are a lot of legitimate file web templates accessible on the Internet, but finding ones you can depend on is not effortless. US Legal Forms provides a huge number of form web templates, such as the Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, that are written in order to meet federal and state demands.

When you are already informed about US Legal Forms web site and possess a merchant account, basically log in. Next, you may obtain the Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson template.

Should you not come with an profile and would like to start using US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for the right town/state.

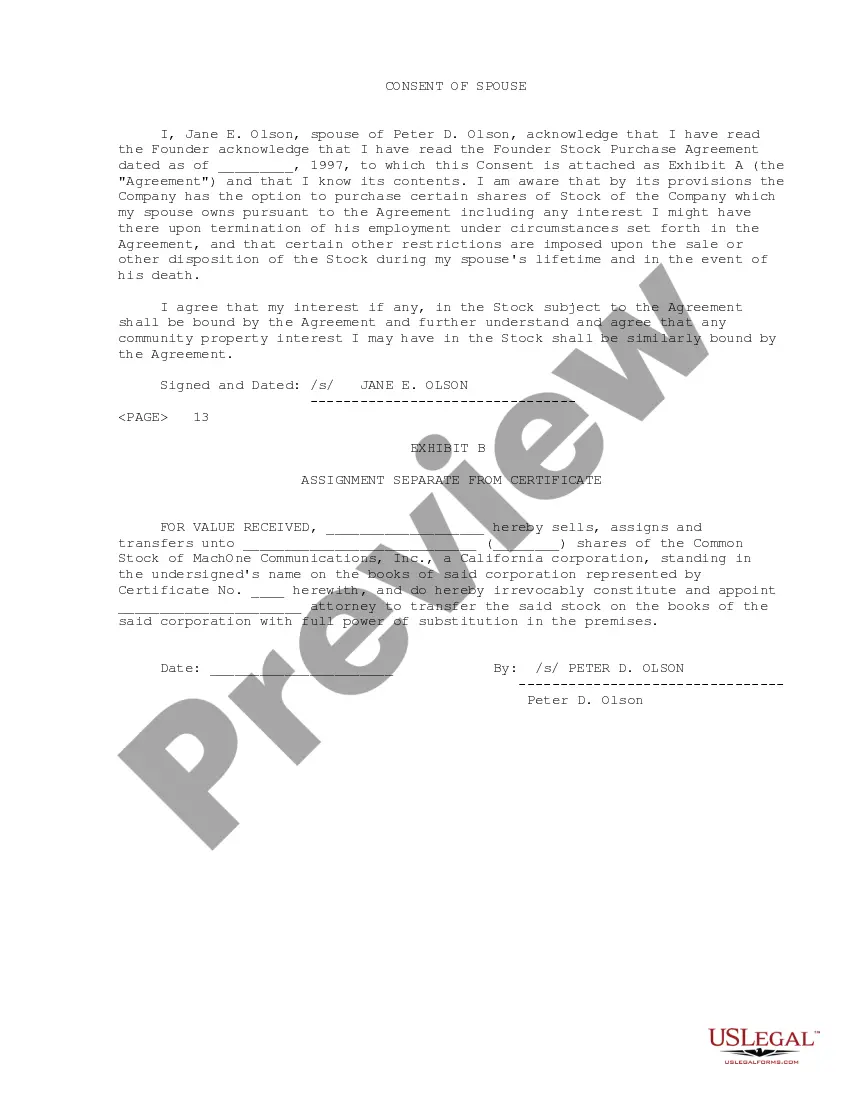

- Utilize the Review key to examine the form.

- Read the information to ensure that you have selected the proper form.

- When the form is not what you are trying to find, use the Search discipline to get the form that fits your needs and demands.

- If you get the right form, simply click Acquire now.

- Opt for the pricing strategy you would like, complete the desired info to create your bank account, and pay for your order using your PayPal or bank card.

- Pick a convenient data file file format and obtain your backup.

Get all the file web templates you might have bought in the My Forms menu. You can aquire a additional backup of Kentucky Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson any time, if required. Just go through the necessary form to obtain or print out the file template.

Use US Legal Forms, one of the most extensive variety of legitimate kinds, to save some time and stay away from mistakes. The services provides skillfully manufactured legitimate file web templates which you can use for a range of functions. Produce a merchant account on US Legal Forms and begin making your lifestyle a little easier.