Kentucky Registration Rights Agreement between Turnstone Systems, Inc. and purchaser

Description

How to fill out Registration Rights Agreement Between Turnstone Systems, Inc. And Purchaser?

Are you in the position in which you need papers for either organization or person functions almost every day time? There are a lot of legitimate record templates available online, but discovering versions you can trust is not effortless. US Legal Forms gives thousands of develop templates, just like the Kentucky Registration Rights Agreement between Turnstone Systems, Inc. and purchaser, which are composed to satisfy federal and state requirements.

In case you are presently knowledgeable about US Legal Forms web site and possess a merchant account, merely log in. After that, you may obtain the Kentucky Registration Rights Agreement between Turnstone Systems, Inc. and purchaser design.

Should you not offer an bank account and would like to begin to use US Legal Forms, follow these steps:

- Discover the develop you need and make sure it is for the appropriate metropolis/state.

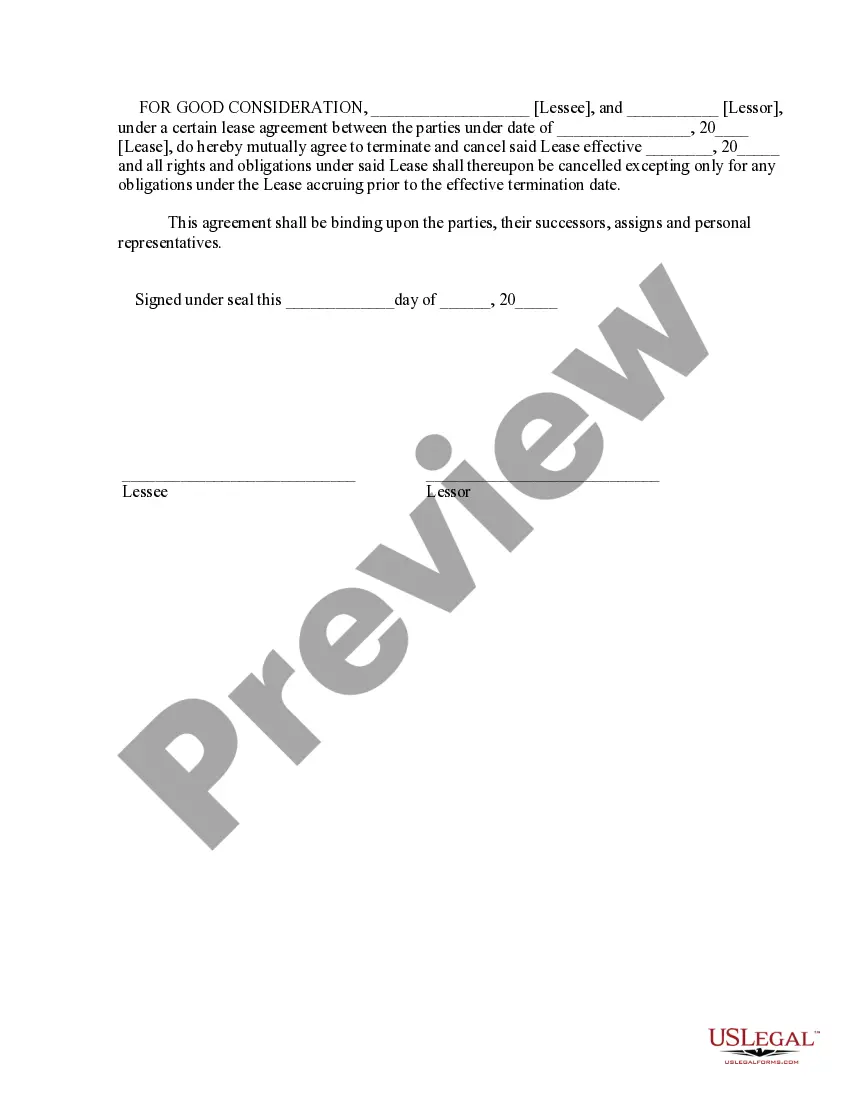

- Use the Preview switch to check the form.

- See the description to actually have chosen the proper develop.

- When the develop is not what you are searching for, utilize the Look for industry to find the develop that meets your requirements and requirements.

- Once you find the appropriate develop, simply click Buy now.

- Choose the rates plan you need, fill out the required information to make your bank account, and buy the order making use of your PayPal or bank card.

- Decide on a convenient document format and obtain your copy.

Discover all of the record templates you possess purchased in the My Forms menus. You can get a more copy of Kentucky Registration Rights Agreement between Turnstone Systems, Inc. and purchaser whenever, if required. Just select the necessary develop to obtain or printing the record design.

Use US Legal Forms, one of the most considerable selection of legitimate varieties, to save lots of time as well as stay away from faults. The support gives appropriately produced legitimate record templates which can be used for a selection of functions. Produce a merchant account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.

Shelf registration, shelf offering, or shelf prospectus is a type of public offering where certain issuers are allowed to offer and sell securities to the public without a separate prospectus for each act of offering and without the issue of further prospectus.

What Is Registration? Registration is the process by which a company files required documents with the Securities and Exchange Commission (SEC), detailing the particulars of a proposed public offering. The registration typically has two parts: the prospectus and private filings.

3 registration gives investors the right to demand that a company registers their shares using Form 3. Form 3 is a shorter registration form than Form 1, which is used in an initial stock launch or IPO. Form 3 can be used by a company one year after an IPO.

If the seller complies with Rule 144, the sale will not violate the registration requirements of the Securities Act. Rule 144 imposes certain holding period, informational, volume, manner of sale and notice obligations in certain situations and for certain stockholders.