The Kentucky Plan of Merger between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. encompasses a comprehensive agreement designed to merge and integrate the operations, services, and resources of the three entities. This strategic merger aims to combine their expertise, market presence, and technological capabilities to create a stronger and more competitive healthcare software and services provider. Keywords: Kentucky Plan of Merger, The Trident Group, Finger Acquisition Corp., Finger Health Care Says., healthcare software, services provider, integration, operations, resources, market presence, technological capabilities. The Kentucky Plan of Merger between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. can be further categorized into three main types based on the key entities involved: 1. The Trident Group, Inc. and Finger Acquisition Corp. Merger: This type of merger focuses on combining the operations and resources of The Trident Group, Inc., a leading healthcare software and technology solutions provider, and Finger Acquisition Corp., a specialized acquisition firm. By merging, these companies aim to leverage their respective strengths and market positions to enhance their product offerings and expand their reach in the healthcare industry. 2. The Trident Group, Inc. and Finger Health Care Says., Inc. Merger: In this type of merger, The Trident Group, Inc. intends to merge with Finger Health Care Says., Inc., a healthcare systems and services provider. By joining forces, these organizations seek to combine their expertise in software development and healthcare operations, enabling them to offer comprehensive solutions to healthcare providers, payers, and other stakeholders. 3. Comprehensive Three-Way Merger: The Kentucky Plan of Merger also includes a comprehensive three-way merger involving The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. This type of merger aims to fully integrate the operations, services, and technologies of all three entities, resulting in a unified and synergistic healthcare software and services provider. By merging at all levels, the companies can maximize their resources, streamline operations, and enhance their overall market competitiveness. In conclusion, the Kentucky Plan of Merger between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. aims to create a unified and formidable healthcare software and services provider through strategic integration and collaboration. This merger can unlock synergies, combine expertise, and enhance services to better cater to the dynamic needs of the healthcare industry.

Kentucky Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

How to fill out Kentucky Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

Have you been in a situation where you require documents for either business or specific purposes nearly every day? There are a lot of authorized record web templates accessible on the Internet, but discovering kinds you can rely isn`t effortless. US Legal Forms gives a huge number of type web templates, much like the Kentucky Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc, that are written to satisfy state and federal demands.

When you are previously familiar with US Legal Forms website and also have an account, just log in. After that, it is possible to download the Kentucky Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc design.

If you do not come with an bank account and want to start using US Legal Forms, follow these steps:

- Obtain the type you will need and make sure it is for the correct city/area.

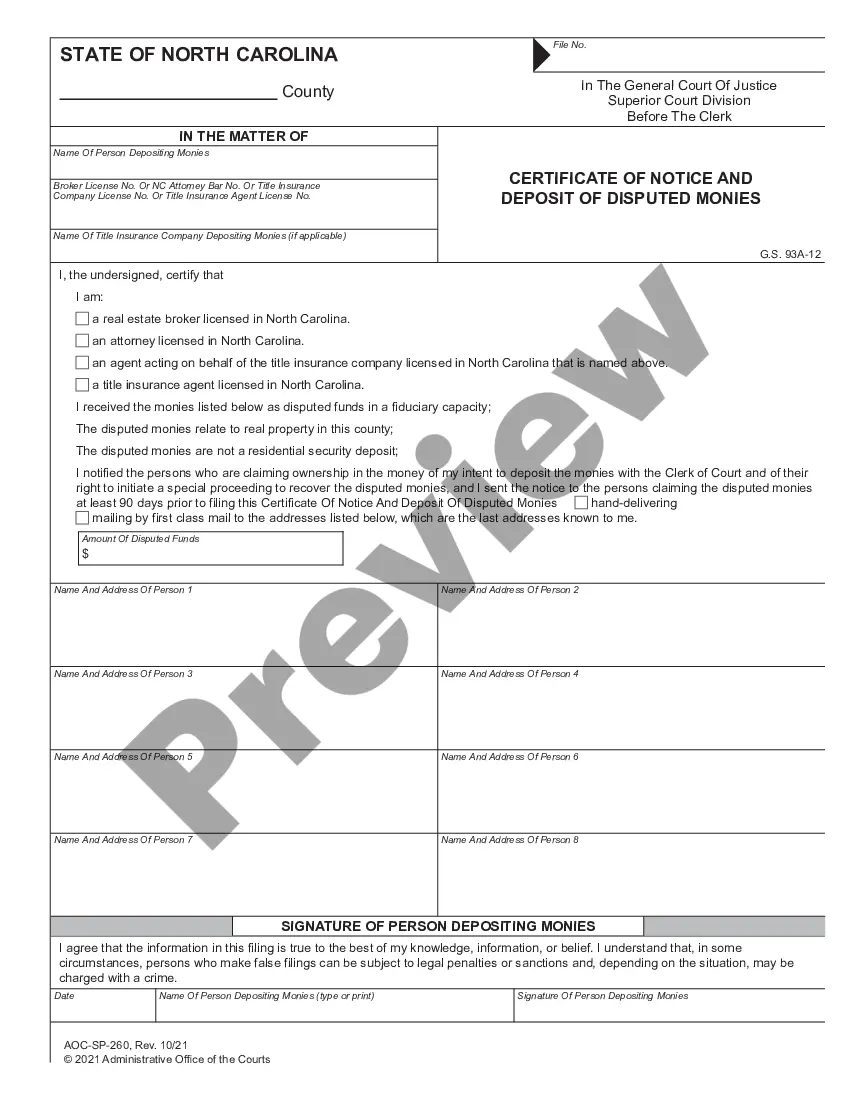

- Utilize the Preview button to analyze the form.

- See the explanation to actually have chosen the appropriate type.

- If the type isn`t what you`re looking for, make use of the Search industry to discover the type that meets your requirements and demands.

- Whenever you discover the correct type, click Purchase now.

- Pick the rates prepare you need, fill out the necessary information to produce your money, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient document structure and download your duplicate.

Discover all of the record web templates you might have purchased in the My Forms menu. You can get a extra duplicate of Kentucky Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc any time, if required. Just select the required type to download or produce the record design.

Use US Legal Forms, probably the most considerable variety of authorized varieties, to save lots of some time and steer clear of faults. The services gives expertly made authorized record web templates that can be used for a selection of purposes. Create an account on US Legal Forms and commence creating your way of life easier.