Kentucky Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.

Description

How to fill out Escrow Agreement Between The TriZetto Group, Inc., The Finserv Securityholders, Stuart Schloss And Bankers Trust Co.?

Are you currently in a situation where you will need documents for either business or specific purposes just about every day time? There are a lot of lawful document themes available on the net, but locating ones you can depend on is not simple. US Legal Forms gives a large number of form themes, such as the Kentucky Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co., which are composed to fulfill state and federal demands.

If you are presently knowledgeable about US Legal Forms internet site and also have an account, just log in. After that, you are able to down load the Kentucky Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co. template.

Unless you have an account and wish to start using US Legal Forms, adopt these measures:

- Discover the form you need and ensure it is to the correct town/county.

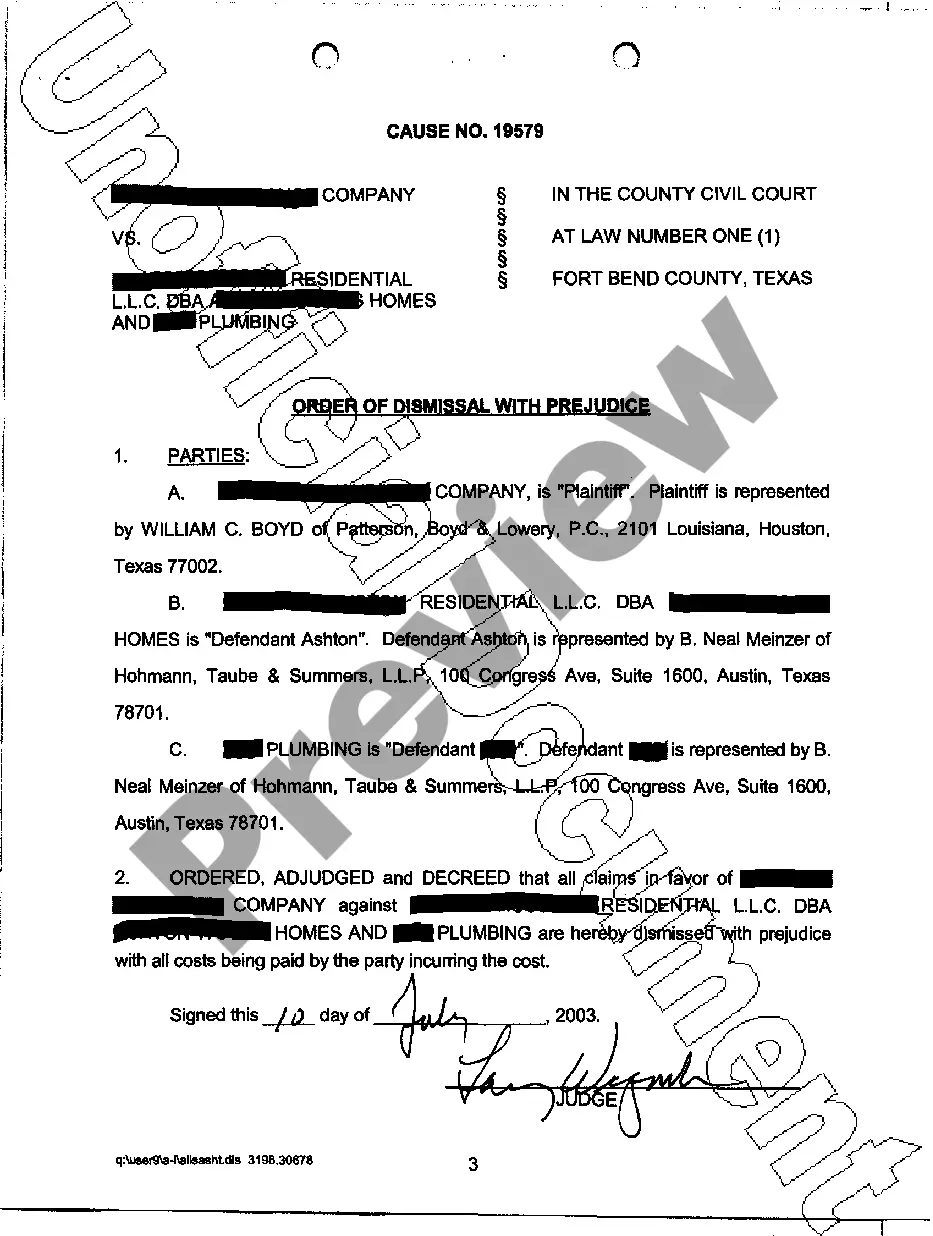

- Use the Preview key to review the shape.

- Look at the information to actually have chosen the proper form.

- In the event the form is not what you are searching for, use the Search field to get the form that fits your needs and demands.

- When you find the correct form, click Purchase now.

- Opt for the rates strategy you need, fill out the necessary info to produce your bank account, and pay for an order with your PayPal or Visa or Mastercard.

- Pick a handy paper format and down load your backup.

Locate each of the document themes you have purchased in the My Forms food list. You can obtain a extra backup of Kentucky Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co. at any time, if required. Just click the necessary form to down load or print out the document template.

Use US Legal Forms, probably the most substantial assortment of lawful kinds, in order to save some time and avoid faults. The service gives skillfully produced lawful document themes that you can use for a range of purposes. Generate an account on US Legal Forms and start making your lifestyle easier.