The Kentucky Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds is a comprehensive agreement that lays out the restructuring process and financial terms for the merging or acquisition of assets between these two entities. It aims to facilitate a smooth transition and ensure the best possible outcome for both parties involved. Keywords: Kentucky Plan of Reorganization, Ingenuity Capital Trust, Firsthand Funds, restructuring process, financial terms, merging, acquisition, assets, smooth transition, the best possible outcome. There are various types of Kentucky Plan of Reorganization, depending on the specific nature of the merger or acquisition. Some common types include: 1. Merger Reorganization: In this type, Ingenuity Capital Trust and Firsthand Funds agree to combine their businesses, assets, and operations, forming a new entity. The Kentucky Plan of Reorganization outlines the steps and legal procedures needed to merge the two entities seamlessly. 2. Asset Acquisition Reorganization: This type involves Ingenuity Capital Trust acquiring specific assets or business divisions from Firsthand Funds. The plan outlines the terms, conditions, and financial obligations related to the transfer of these assets, ensuring a fair and equitable agreement for both parties. 3. Stock Acquisition Reorganization: Here, Ingenuity Capital Trust purchases a controlling interest in Firsthand Funds by acquiring a majority of its outstanding shares. The Kentucky Plan of Reorganization highlights the details of the stock acquisition, such as the price per share, voting rights, and any adjustments needed to safeguard the interests of both parties. 4. Spin-Off Reorganization: In this type, Ingenuity Capital Trust separates a particular division or subsidiary from Firsthand Funds, creating a completely independent entity. The plan outlines the process of the spin-off, including the distribution of shares and assets to the shareholders of both companies. Regardless of the specific type, the Kentucky Plan of Reorganization serves as a legal roadmap, guiding Ingenuity Capital Trust and Firsthand Funds throughout the negotiation, evaluation, and finalization of the reorganization process. It aims to ensure fair treatment, protect the interests of shareholders, and support a successful transition, ultimately creating a stronger, more competitive entity.

Kentucky Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

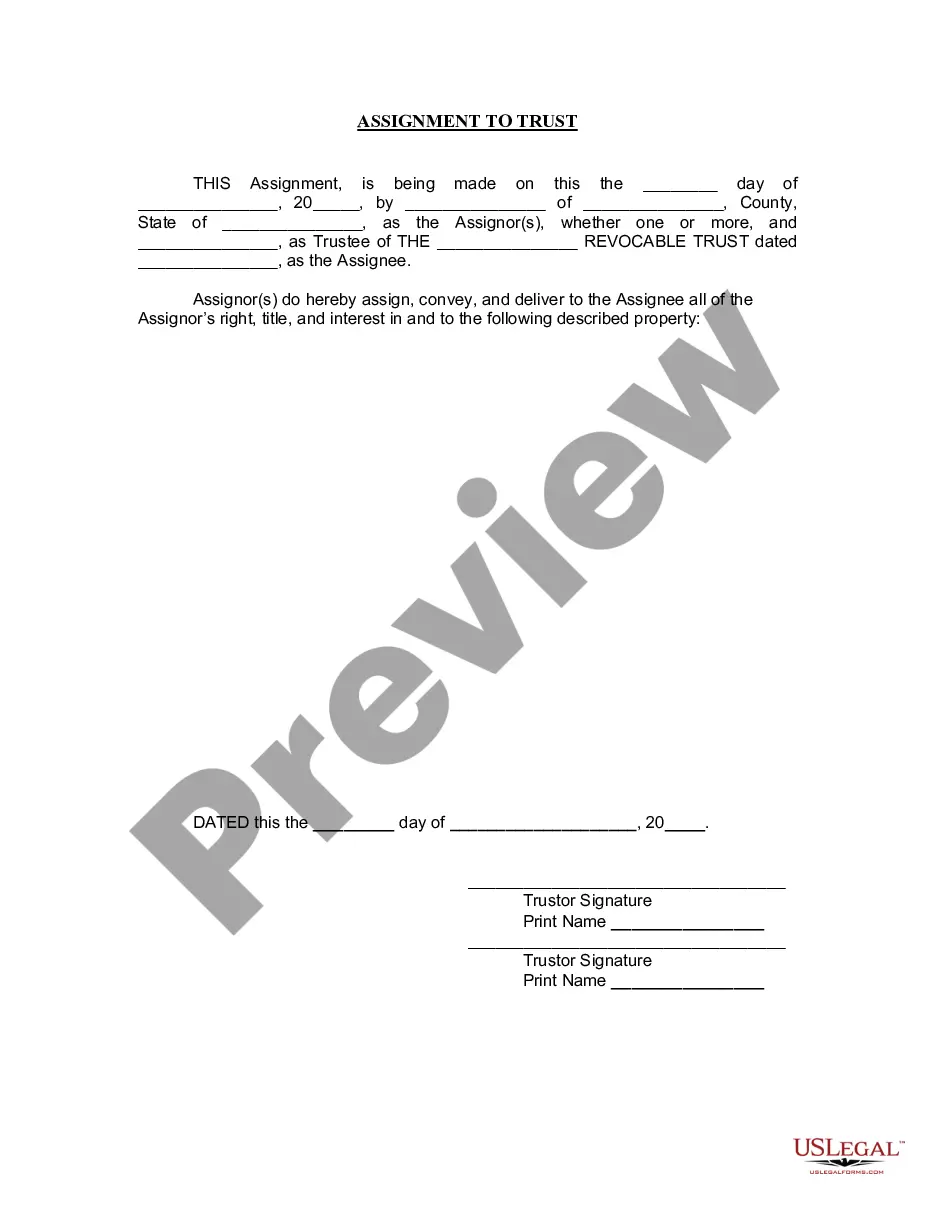

How to fill out Kentucky Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

US Legal Forms - one of many biggest libraries of lawful types in the USA - provides a wide array of lawful file web templates you can download or print. Using the internet site, you can find a huge number of types for company and person purposes, sorted by groups, claims, or keywords and phrases.You can find the latest models of types such as the Kentucky Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds in seconds.

If you have a subscription, log in and download Kentucky Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds from your US Legal Forms local library. The Acquire key will appear on every single develop you view. You have access to all earlier downloaded types inside the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, listed here are easy guidelines to obtain began:

- Make sure you have picked out the right develop for your city/county. Click the Review key to review the form`s content. Browse the develop description to actually have chosen the proper develop.

- In case the develop doesn`t match your demands, utilize the Research industry on top of the screen to find the the one that does.

- In case you are satisfied with the form, confirm your selection by clicking the Acquire now key. Then, opt for the costs program you favor and give your credentials to sign up on an profile.

- Process the transaction. Make use of charge card or PayPal profile to complete the transaction.

- Pick the format and download the form on the system.

- Make modifications. Fill up, revise and print and indicator the downloaded Kentucky Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Each template you included in your money lacks an expiration date and it is the one you have eternally. So, if you would like download or print an additional duplicate, just proceed to the My Forms area and then click on the develop you will need.

Get access to the Kentucky Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with US Legal Forms, by far the most substantial local library of lawful file web templates. Use a huge number of professional and status-particular web templates that satisfy your company or person requirements and demands.