Kentucky Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

How to fill out Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

Have you been within a situation the place you require files for either company or specific purposes just about every working day? There are a lot of lawful papers layouts accessible on the Internet, but finding kinds you can trust isn`t straightforward. US Legal Forms provides 1000s of develop layouts, such as the Kentucky Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc., which can be created in order to meet federal and state specifications.

In case you are previously informed about US Legal Forms web site and possess a free account, basically log in. After that, you are able to acquire the Kentucky Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. web template.

If you do not come with an account and need to begin using US Legal Forms, abide by these steps:

- Get the develop you require and make sure it is for the appropriate city/area.

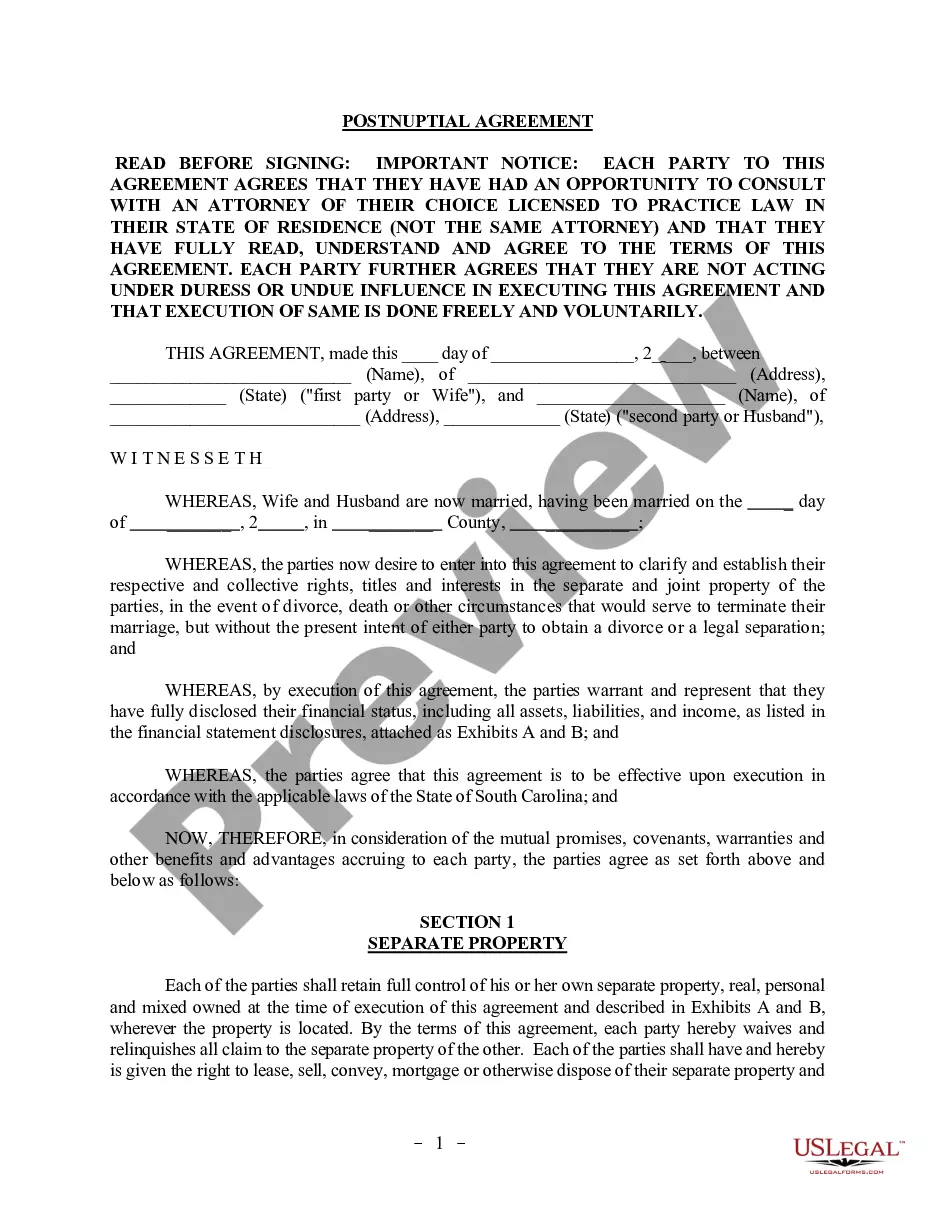

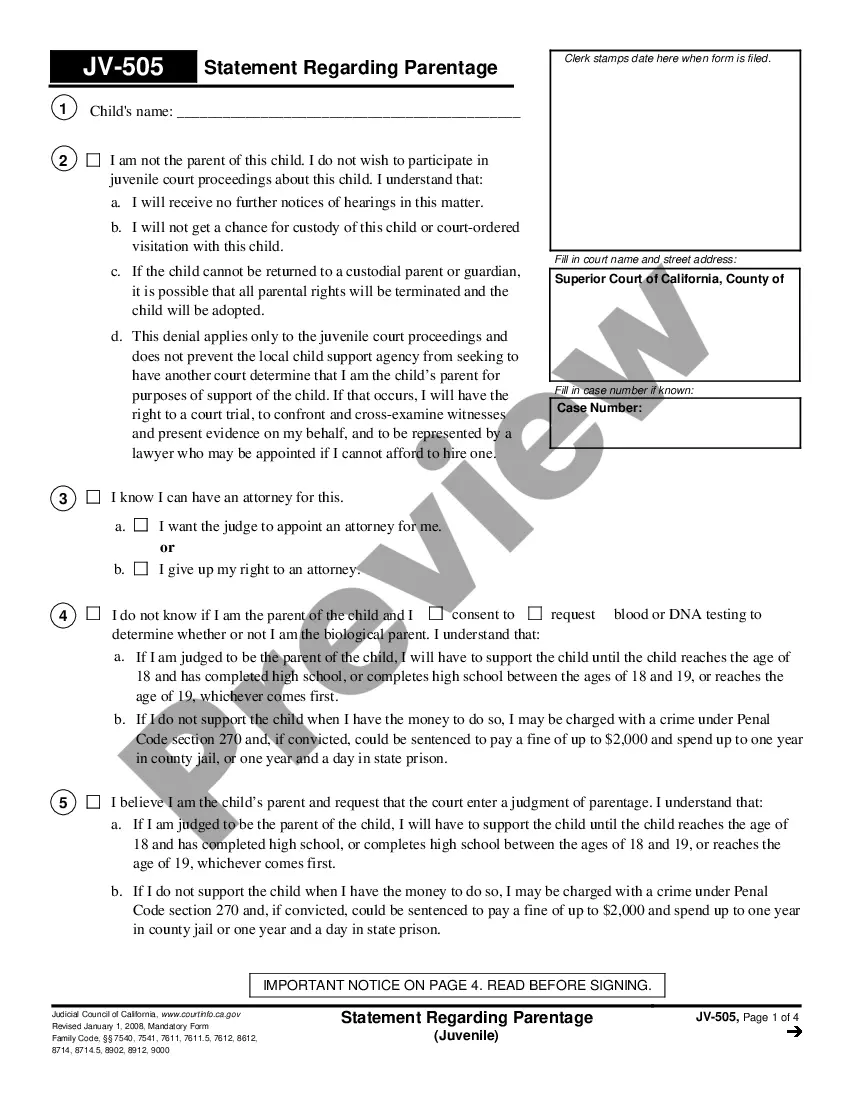

- Take advantage of the Review key to analyze the shape.

- See the description to ensure that you have selected the proper develop.

- In the event the develop isn`t what you`re looking for, use the Search discipline to find the develop that meets your requirements and specifications.

- If you get the appropriate develop, simply click Buy now.

- Pick the costs plan you need, fill in the specified info to make your money, and buy the transaction with your PayPal or Visa or Mastercard.

- Choose a handy data file file format and acquire your copy.

Get all of the papers layouts you may have purchased in the My Forms food selection. You may get a extra copy of Kentucky Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. anytime, if necessary. Just click on the needed develop to acquire or printing the papers web template.

Use US Legal Forms, probably the most considerable selection of lawful varieties, to save lots of time and steer clear of errors. The service provides appropriately created lawful papers layouts that you can use for a range of purposes. Produce a free account on US Legal Forms and start producing your life a little easier.