The Kentucky Plan of Acquisition refers to a strategic approach adopted by organizations in the state of Kentucky to expand their business operations or acquire other businesses or assets. This plan outlines the detailed steps and procedures involved in successfully acquiring another company or asset in Kentucky. It primarily aims to outline the goals, strategies, and potential risks associated with the proposed acquisition. Under the Kentucky Plan of Acquisition, there are several types, each catering to specific objectives and industries. Some of these include: 1. Corporate Acquisition: This involves one company purchasing another, either through a merger or by buying a controlling interest in the target company. The plan outlines the financial and legal aspects of the acquisition, such as valuation, due diligence, negotiation, and integration. 2. Asset Acquisition: This refers to buying specific assets or divisions of a company rather than the entire entity. The Kentucky Plan of Acquisition for asset acquisitions focuses on determining the value of the assets, conducting due diligence, negotiating purchase agreements, and planning for the post-acquisition integration of the assets into the acquiring company's operations. 3. Merger: A merger is a type of acquisition where two companies combine to form a new entity. The Kentucky Plan of Acquisition for a merger provides guidelines on valuation, legal compliance, financial restructuring, cultural integration, and synergy realization. 4. Joint Ventures: This is a strategic collaboration where two or more companies pool their resources, expertise, and risks pursuing a specific business opportunity. The Kentucky Plan of Acquisition for joint ventures outlines the terms, responsibilities, and governance structure of the collaboration, as well as strategies for risk management and sharing. 5. Management-Led Buyout: In this type of acquisition, the existing management team of a company, often with the support of external investors, purchases the company they manage. The Kentucky Plan of Acquisition for management-led buyouts focuses on the financial aspects, including debt financing, negotiating terms with the current owners, and developing a transition plan. The Kentucky Plan of Acquisition enables businesses to plan and execute effective strategies for growth and expansion, while considering the unique legal, financial, and market aspects specific to Kentucky. By following this plan, organizations can navigate the complexities of acquiring businesses or assets in the state, mitigate potential risks, and maximize the chances of a successful acquisition.

Kentucky Plan of Acquisition

Description

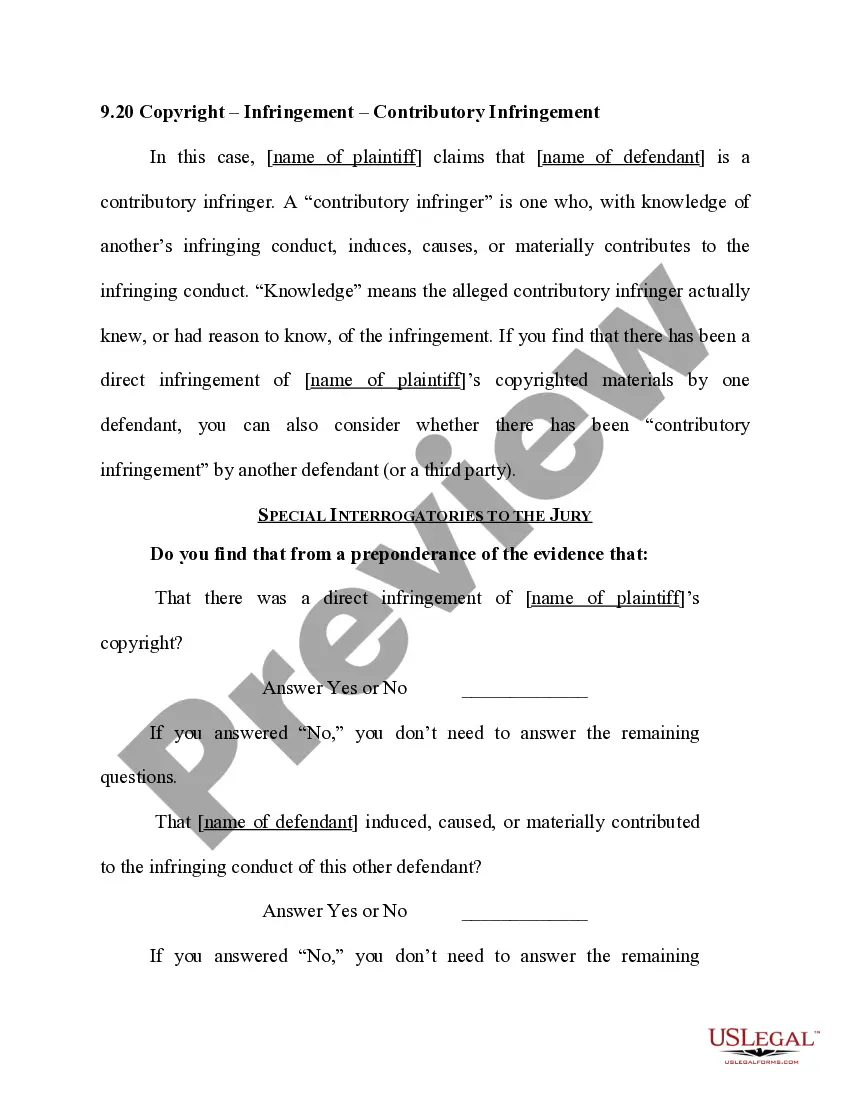

How to fill out Kentucky Plan Of Acquisition?

Finding the right lawful file format can be a struggle. Obviously, there are a variety of themes available on the net, but how do you get the lawful form you need? Utilize the US Legal Forms website. The assistance provides a large number of themes, such as the Kentucky Plan of Acquisition, which you can use for enterprise and private requires. All the forms are inspected by experts and fulfill federal and state needs.

In case you are previously signed up, log in in your profile and click on the Obtain option to have the Kentucky Plan of Acquisition. Make use of your profile to appear throughout the lawful forms you possess bought in the past. Visit the My Forms tab of your respective profile and have an additional backup in the file you need.

In case you are a whole new customer of US Legal Forms, here are easy directions for you to stick to:

- Initial, be sure you have selected the correct form for the city/region. It is possible to look over the form while using Review option and browse the form explanation to guarantee it is the best for you.

- When the form will not fulfill your expectations, take advantage of the Seach discipline to find the proper form.

- When you are certain the form is acceptable, go through the Buy now option to have the form.

- Select the pricing prepare you want and type in the needed info. Make your profile and purchase an order with your PayPal profile or credit card.

- Select the file format and acquire the lawful file format in your gadget.

- Full, modify and produce and indicator the attained Kentucky Plan of Acquisition.

US Legal Forms is definitely the greatest catalogue of lawful forms for which you can find different file themes. Utilize the company to acquire expertly-created papers that stick to express needs.

Form popularity

FAQ

Strategy development. An M&A strategy can help set clear expectations for all involved. ... Target identification. ... Valuation analysis. ... Negotiations. ... Conduct due diligence. ... Deal closure. ... Financing and restructuring. ... Integration and back-office planning.

How To Prepare Your Business For A Successful Acquisition Consider your options for an acquisition. ... Average offers in today's M&A market. ... Get your financial system in order before starting the acquisition process. ... Navigate the LOI process. ... Don't stop ordering inventory after acquisition. ... Implement good advertising systems.

Assuming the potential target companies have been identified, a typical deal includes the following steps: Make an Acquisition Plan. ... Build an Acquisition Team. ... Valuation Analysis. ... Research and Due Diligence. ... Preparation of Documents. ... First Offer and Negotiations. ... Contract Signing. ... Financial Strategy and Integration. Acquisition Planning, Practices, and Strategies | Synario Blog synario.com ? acquisition-planning synario.com ? acquisition-planning

Acquisition plan approval is obtained using a five-phase preparation process. The phases are drafting, consultation, resolution, local signature, and external approval, as required. The process and the estimated time required to accomplish each phase depends on the complexity of each acquisition.

15 to 30 feet Depending on the highway, state right-of-way extends from 15 to 30 feet from the edge of the pavement. The fence line along nearby fields provides an indication to the location of property lines. In the case of most 4-Lane highways, right-of-way extends to the fence line, and includes the roadway side of fences. KYTC Crews to Remove Illegal Signs on State Right-of-Way govdelivery.com ? KYTC ? bulletins govdelivery.com ? KYTC ? bulletins

8 tips for an effective acquisition strategy Define your investment thesis. ... Create the financial model. ... Be realistic about price and terms. ... Plan integration now. ... Have a good story. ... Find proprietary deal flow. ... Thorough due diligence is critical. ... Be prepared to move crisply.