Kentucky Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock

Description

How to fill out Promissory Note And Pledge Agreement Regarding Loan And Grant Of Security Interest In Shares Of The Company's Common Stock?

You are able to spend hours on-line trying to find the authorized file design which fits the federal and state needs you need. US Legal Forms offers 1000s of authorized varieties which can be reviewed by experts. It is possible to down load or printing the Kentucky Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock from our services.

If you currently have a US Legal Forms account, you may log in and then click the Down load button. Following that, you may comprehensive, change, printing, or signal the Kentucky Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock. Every authorized file design you get is your own eternally. To acquire another duplicate of any obtained form, visit the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site the very first time, stick to the basic instructions listed below:

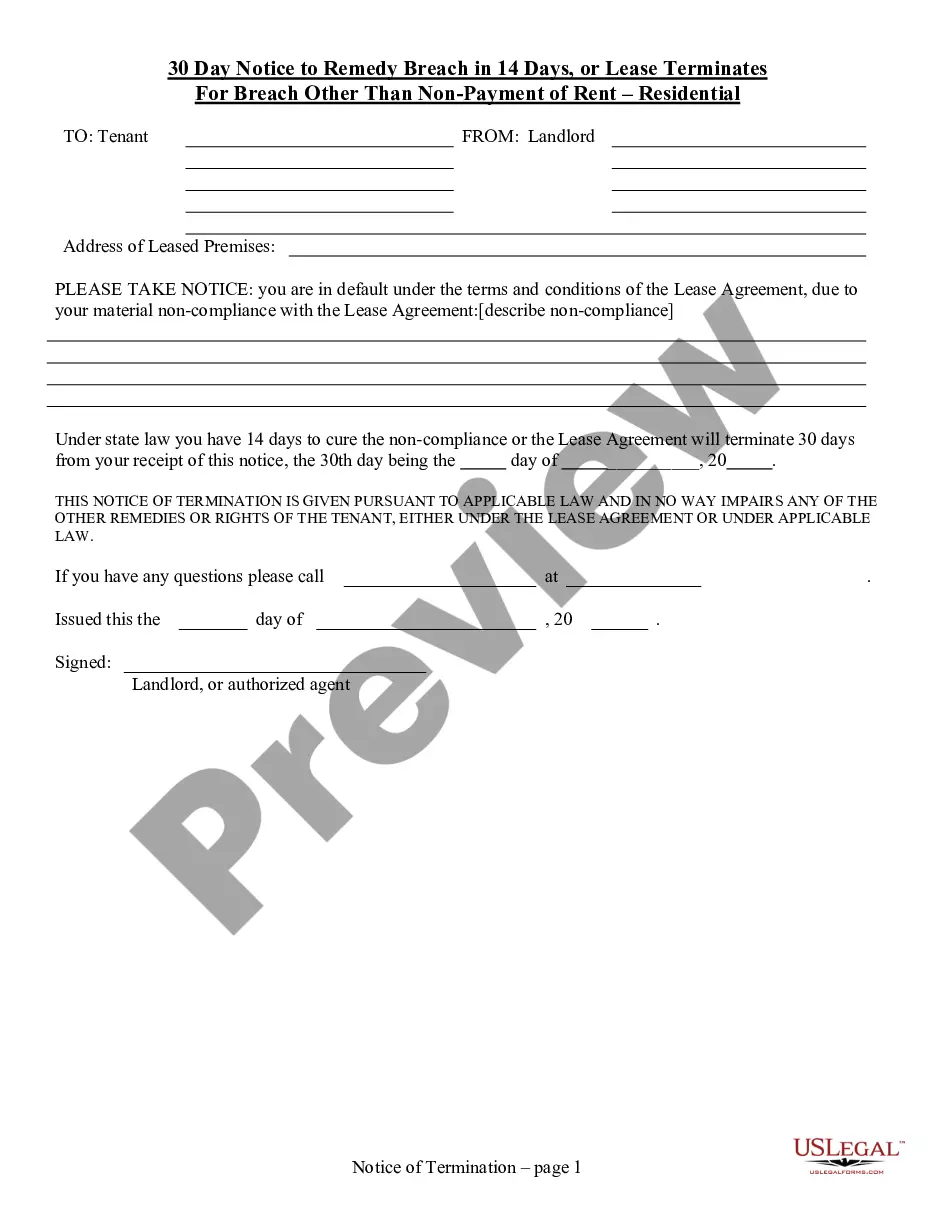

- First, make certain you have selected the best file design for your county/city of your liking. Browse the form explanation to make sure you have selected the correct form. If offered, utilize the Preview button to search from the file design too.

- In order to locate another variation of the form, utilize the Look for field to discover the design that suits you and needs.

- Upon having discovered the design you need, click on Purchase now to continue.

- Select the costs strategy you need, key in your references, and sign up for your account on US Legal Forms.

- Total the deal. You should use your Visa or Mastercard or PayPal account to cover the authorized form.

- Select the format of the file and down load it in your system.

- Make adjustments in your file if necessary. You are able to comprehensive, change and signal and printing Kentucky Promissory Note and Pledge Agreement regarding loan and grant of security interest in shares of the company's common stock.

Down load and printing 1000s of file themes using the US Legal Forms website, that provides the greatest collection of authorized varieties. Use expert and status-particular themes to tackle your small business or specific needs.

Form popularity

FAQ

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

A pledge contract is an agreement between two or more parties outlining the specific actions that each party will take in order to achieve a common objective. Contract terms are typically decided upon by the parties concerned and may be revised or updated as needed.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

Pledged Note means any promissory note (as that term is defined in the Code) issued in favor of any of the Grantors.

The security agreement can be contained in the promissory note, the deed of trust, or a loan agreement. It must, however, include language granting a security interest.

A pledge agreement is just another name for a security agreement which creates a security interest in equity and promissory notes. The term "pledge" predates the UCC, when a pledge involved the creation of a security interest by physical possession of the property.

Sample promissory note for loans to family, friends PROMISSORY NOTE. FOR VALUE RECEIVED, the undersigned, (the "Maker"), hereby promises to pay to the order of ____________________ (LENDER NAME) ("Payee"), the principal sum of $ ____________ pursuant to the terms and conditions set forth herein. PAYMENT OF PRINCIPAL.